1025 Resort Rd Suamico, WI 54173

Estimated Value: $406,000 - $474,000

5

Beds

2

Baths

1,568

Sq Ft

$277/Sq Ft

Est. Value

About This Home

This home is located at 1025 Resort Rd, Suamico, WI 54173 and is currently estimated at $434,452, approximately $277 per square foot. 1025 Resort Rd is a home located in Brown County with nearby schools including Bay Harbor Elementary School, Lineville Intermediate School, and Bay View Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2009

Sold by

Reimer Jonathan and Peot Kristopher M

Bought by

Bartman Thomas D and Bartman Jill L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,278

Outstanding Balance

$87,648

Interest Rate

4.83%

Mortgage Type

FHA

Estimated Equity

$346,804

Purchase Details

Closed on

Aug 29, 2008

Sold by

Mineau Albert P

Bought by

Reimer Jonathan and Peot Kristopher M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,000

Interest Rate

6.52%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bartman Thomas D | $140,900 | Liberty Title | |

| Reimer Jonathan | $107,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bartman Thomas D | $138,278 | |

| Previous Owner | Reimer Jonathan | $122,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,471 | $297,100 | $38,600 | $258,500 |

| 2022 | $5,428 | $297,100 | $38,600 | $258,500 |

Source: Public Records

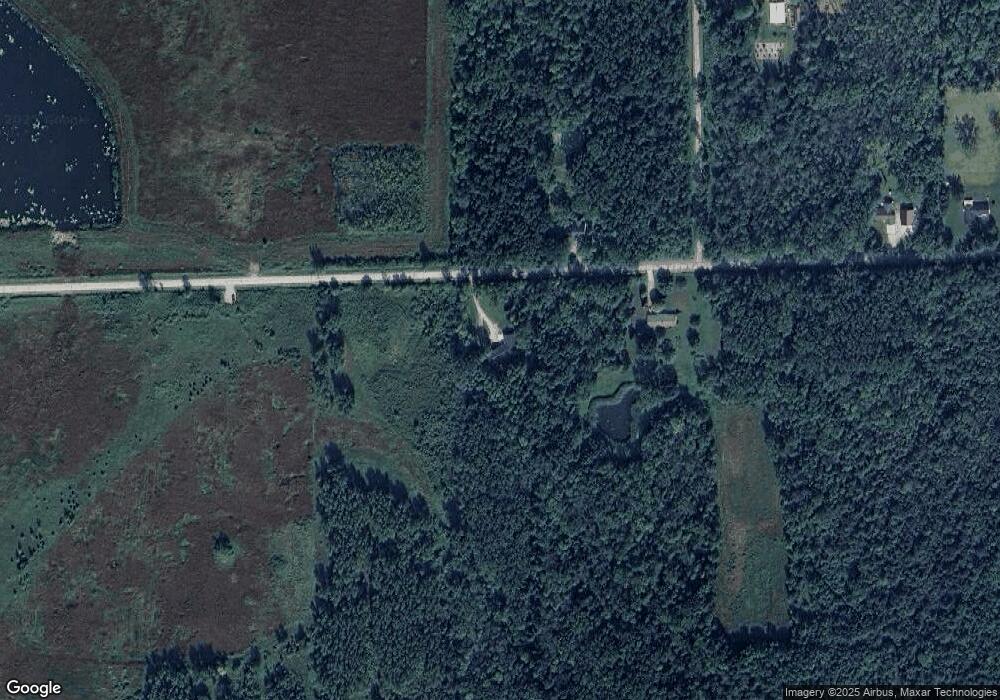

Map

Nearby Homes

- 4132 Bayside Rd

- 0 Sunset Beach Rd

- 1334 Norfield Rd

- 0 Maple Grove Unit 50315677

- 0 Maple Grove Unit 50315674

- 0 Maple Grove Unit 50315676

- 0 Lost Trail Unit 50313993

- 1980 Lost Trail

- 2150 Lost Trail

- 0 Velp Ave Unit 50315411

- 1429 Harbor Lights Rd

- 1926 River Hill Ct

- 2753 Summerset Cir

- 1968 Trenton Ln

- 0 Brown Rd Unit 50320099

- 2055 S Tanager Ln

- 2442 Loxley Ct

- 0 Harbor Cove Ln

- 2664 Chambers Crossing

- 2652 Chambers Crossing

- 800 Resort Rd

- 0 Resort Rd

- 1008 Resort Rd

- 4051 Willow Way

- 989 Resort Rd

- 3982 Willow Way

- 912 Resort Rd

- 4012 Willow Way

- 892 Resort Rd

- 815 Resort Rd

- 3845 Glorysu Ct

- 3838 Glory Sue Ct Unit 3840

- 798 Resort Rd

- 3845 Glory Sue Ct

- 805 Resort Rd

- 788 Resort Rd

- 3808 Glory Sue Ct

- 4002 Lakeview Dr

- 4010 Lakeview Dr

- 0 Lakeview Dr Unit 50117131