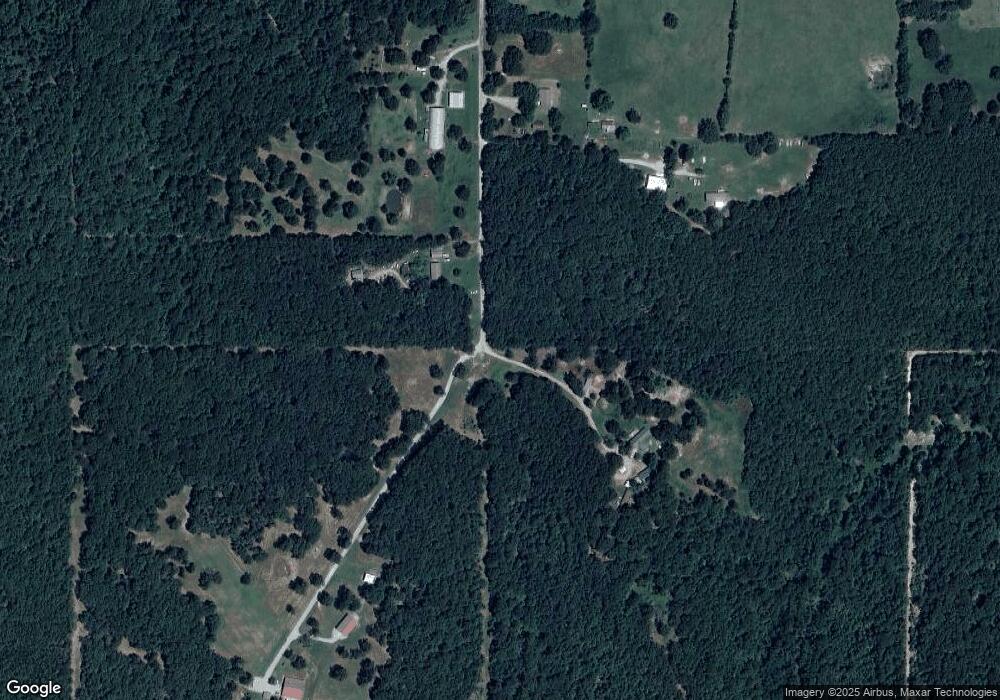

10253 S 4422 Locust Grove, OK 74352

Estimated Value: $226,000 - $317,063

3

Beds

3

Baths

1,848

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 10253 S 4422, Locust Grove, OK 74352 and is currently estimated at $286,516, approximately $155 per square foot. 10253 S 4422 is a home located in Mayes County with nearby schools including Locust Grove Early Lrning Center, Locust Grove Upper Elementary School, and Locust Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 8, 2010

Sold by

Vinson Ronald E and Vinson Pamela Kay

Bought by

Biendl John Edgar and Biendl Claudia D

Current Estimated Value

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Biendl John Edgar | $150,000 | Investors Title & Escrow Com |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,211 | $14,443 | $1,733 | $12,710 |

| 2024 | $1,211 | $14,022 | $1,682 | $12,340 |

| 2023 | $1,211 | $13,615 | $1,404 | $12,211 |

| 2022 | $762 | $9,446 | $498 | $8,948 |

| 2021 | $753 | $9,172 | $333 | $8,839 |

| 2020 | $739 | $8,904 | $332 | $8,572 |

| 2019 | $716 | $8,645 | $332 | $8,313 |

| 2018 | $706 | $8,393 | $332 | $8,061 |

| 2017 | $706 | $8,393 | $332 | $8,061 |

| 2016 | $690 | $8,393 | $332 | $8,061 |

| 2015 | $712 | $8,393 | $332 | $8,061 |

| 2014 | $748 | $8,768 | $313 | $8,455 |

Source: Public Records

Map

Nearby Homes

- 9212 S 443 Rd

- 0 E 610 Rd Unit 2542638

- 6164 E 578

- TBD SE 575

- 12665 S 4429

- 12754 S 442 Rd

- 7167 E 618 Rd

- 0 S 4409 Rd

- 4100 N 430 Rd

- 12293 E 590 Rd

- 10171 U S Highway 412

- 58 Oak

- 0 Hwy 82 S Unit 2503331

- 815 S Cherokee St

- 715 S Cherokee St

- 608 S Cherokee St

- 6959 E 561 Rd

- 00 Hill St

- 301 S Water St

- 10761 E 590 Rd