103 Heather Way Unit A Yorktown, VA 23693

Tabb NeighborhoodEstimated Value: $265,000 - $303,000

3

Beds

3

Baths

1,500

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 103 Heather Way Unit A, Yorktown, VA 23693 and is currently estimated at $287,349, approximately $191 per square foot. 103 Heather Way Unit A is a home located in York County with nearby schools including Mt. Vernon Elementary School, Tabb Middle School, and Tabb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 17, 2017

Sold by

Stokes Dennie Joe and Stokes Tonya Rae

Bought by

Leatherbee William and Leatherbee Erin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,192

Outstanding Balance

$166,203

Interest Rate

3.78%

Mortgage Type

VA

Estimated Equity

$121,146

Purchase Details

Closed on

Oct 23, 2006

Sold by

Emmons David S

Bought by

Stokes Donnie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,850

Interest Rate

6.48%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leatherbee William | $195,000 | Stewart Title & Settlement | |

| Stokes Donnie J | $190,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Leatherbee William | $199,192 | |

| Previous Owner | Stokes Donnie J | $192,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,825 | $246,600 | $75,000 | $171,600 |

| 2024 | $1,825 | $246,600 | $75,000 | $171,600 |

| 2023 | $1,612 | $209,400 | $60,000 | $149,400 |

| 2022 | $1,633 | $209,400 | $60,000 | $149,400 |

| 2021 | $1,445 | $181,700 | $60,000 | $121,700 |

| 2020 | $1,445 | $181,700 | $60,000 | $121,700 |

| 2019 | $2,062 | $180,900 | $58,000 | $122,900 |

| 2018 | $2,062 | $180,900 | $58,000 | $122,900 |

| 2017 | $1,268 | $168,700 | $51,000 | $117,700 |

| 2016 | -- | $168,700 | $51,000 | $117,700 |

| 2015 | -- | $167,300 | $51,000 | $116,300 |

| 2014 | -- | $167,300 | $51,000 | $116,300 |

Source: Public Records

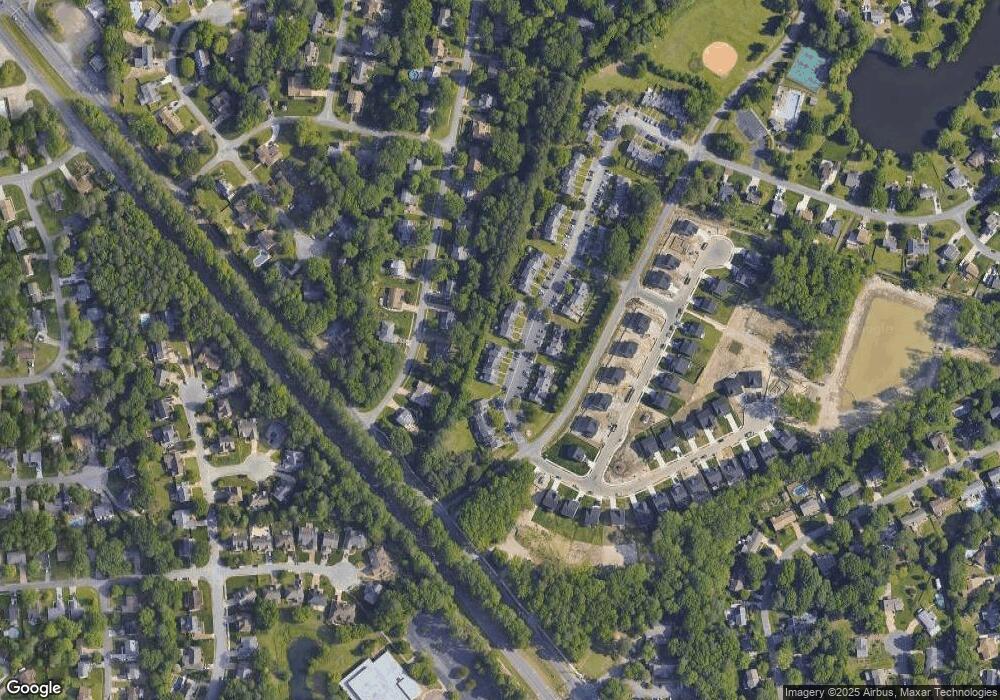

Map

Nearby Homes

- 108 Freemans Trace

- 107 Freemans Trace

- 109 Carys Trace

- Lot 81 Smith Farm Estates

- 306 Meadowlake Rd

- 410 Richter Ln

- 107 Sheldon Ct

- 2019 George Washington Memorial Hwy

- 309 Gardenville Dr

- 102 Octavia Dr

- 305 Peachtree Ln

- 103 William Storrs Rd

- 107 William Storrs Rd

- 105 Richard Run

- 149 Seekright Dr

- 115 Seekright Dr

- 203 William Storrs Rd

- 210 Orion Ct

- 101 Goffigans Trace

- 213 Orion Ct

- 103-B Heather Way

- 103 Heather Way

- 103 Heather Way Unit E

- 103 Heather Way Unit D

- 103 Heather Way Unit C

- 103 Heather Way Unit B

- 103 Heather Way Unit F

- 103-C Heather Way

- 103 Heather Way

- 103-F Heather Way

- 101-G Heather Way

- 101-F Heather Way

- 105 Heather Way Unit F

- 105 Heather Way Unit E

- 105 Heather Way Unit D

- 105 Heather Way Unit C

- 105 Heather Way Unit B

- 105 Heather Way Unit A

- 105 Heather Way

- 104 Autumn Way