Estimated Value: $134,000 - $261,000

1

Bed

1

Bath

736

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 10300 Johns Way, Jones, OK 73049 and is currently estimated at $208,944, approximately $283 per square foot. 10300 Johns Way is a home located in Oklahoma County with nearby schools including Jones Elementary School, Jones Middle School, and Jones High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2014

Sold by

Lattin Brad and Lattin Jessica

Bought by

Drye Shawn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,641

Outstanding Balance

$56,919

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$152,025

Purchase Details

Closed on

May 13, 2011

Sold by

Parkhurst Linda K and Linda K Parkhurst Revocable Li

Bought by

Lattin Brad

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,225

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 21, 2009

Sold by

Parkhurst Linda K

Bought by

Parkhurst Linda K and Linda K Parkhurst Revocable Living Trust

Purchase Details

Closed on

May 4, 2000

Sold by

Sides John Clinton

Bought by

Parkhurst Linda K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Drye Shawn | $75,000 | American Eagle Title Group | |

| Lattin Brad | $70,000 | American Eagle Title Group | |

| Parkhurst Linda K | -- | None Available | |

| Parkhurst Linda K | $4,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Drye Shawn | $73,641 | |

| Previous Owner | Lattin Brad | $68,225 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,433 | $11,811 | $1,638 | $10,173 |

| 2023 | $1,433 | $11,249 | $1,883 | $9,366 |

| 2022 | $1,333 | $10,713 | $1,989 | $8,724 |

| 2021 | $1,285 | $10,202 | $2,135 | $8,067 |

| 2020 | $1,234 | $9,717 | $2,415 | $7,302 |

| 2019 | $1,210 | $9,255 | $2,361 | $6,894 |

| 2018 | $1,161 | $8,814 | $0 | $0 |

| 2017 | $1,135 | $8,688 | $2,624 | $6,064 |

| 2016 | $1,081 | $8,274 | $2,624 | $5,650 |

| 2015 | $1,070 | $8,474 | $2,624 | $5,850 |

| 2014 | $1,077 | $8,430 | $2,442 | $5,988 |

Source: Public Records

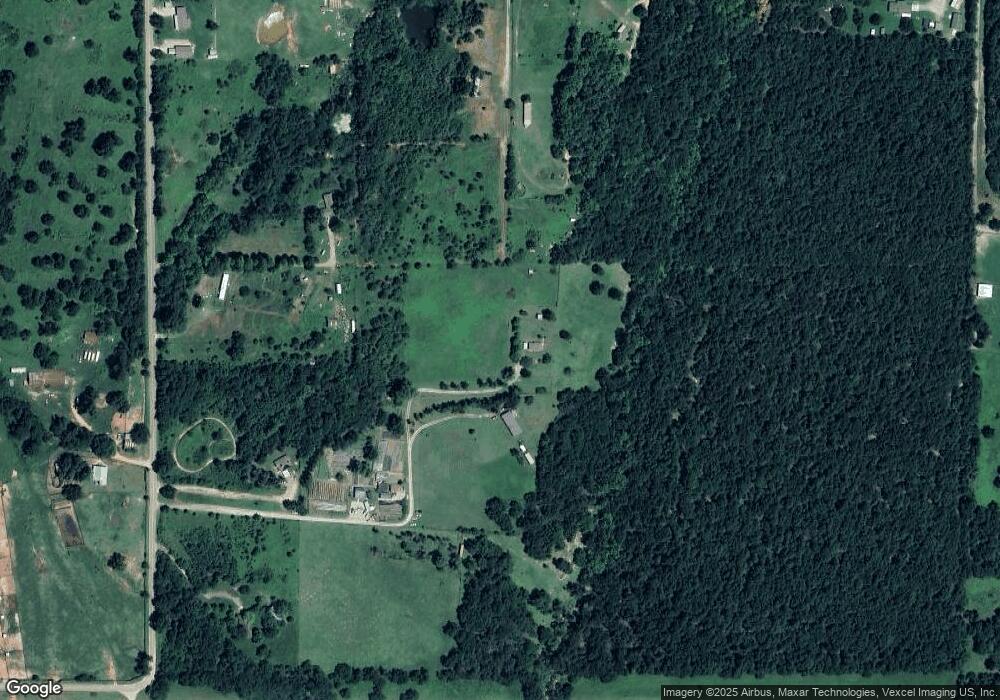

Map

Nearby Homes

- 17200 N Choctaw Rd

- 1 N Choctaw Rd

- 6600 N Choctaw Rd

- 306 W Cherokee St

- 10581 N Triple X Rd

- 137 SW 2nd St

- 11541 N Triple X Rd

- 113 Alabama

- 119 Alabama

- 17134 E Britton Rd

- 14713 Autumn Ridge Ln

- 813 SW 4th St

- 617 Louisiana St

- 0 NE 132nd St Unit 1122492

- 0 NE 132nd St Unit 1121809

- 0 W Wilshire Blvd Unit 1178902

- 613 Montana St

- 635 SW 6th St

- 421 Sweetbough St

- 9290 N Hiwassee Rd

- 10430 N Choctaw Rd

- 10240 N Choctaw Rd

- 10120 N Choctaw Rd

- 10201 N Choctaw Rd

- 10900 N Erin Rd

- 15425 E Hefner Rd

- 15520 NE 108th St

- 15524 E Hefner Rd

- 16539 N Choctaw Rd

- 11100 N Erin Rd

- 15700 E Hefner Rd

- 15500 E Britton Rd

- 10025 N Indian Meridian

- 10201 N Indian Meridian

- 10413 N Indian Meridian

- 10101 N Indian Meridian

- 8850 N Choctaw Rd

- 10301 N Indian Meridian

- 10509 N Indian Meridian

- 10317 N Indian Meridian