Estimated Value: $1,118,000 - $1,364,000

3

Beds

4

Baths

3,696

Sq Ft

$341/Sq Ft

Est. Value

About This Home

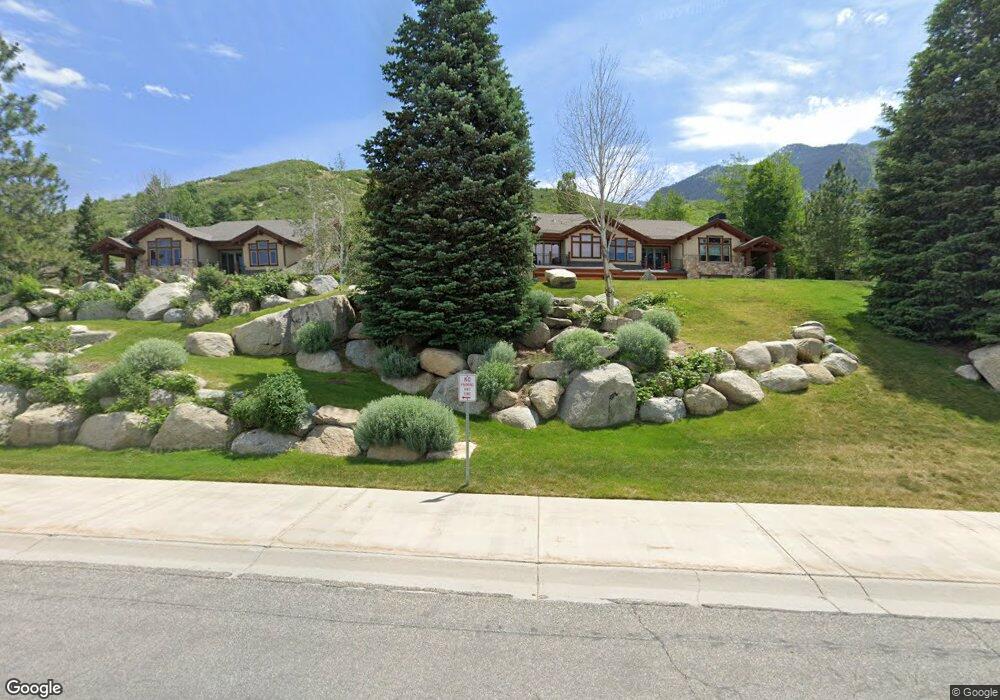

This home is located at 10323 Bedrock Ln, Sandy, UT 84092 and is currently estimated at $1,261,637, approximately $341 per square foot. 10323 Bedrock Ln is a home located in Salt Lake County with nearby schools including Granite Elementary School, Eastmont Middle School, and Beehive Science & Technology Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 12, 2021

Sold by

Chard Allyson A

Bought by

Chard Daniel R and Chard Allyson A

Current Estimated Value

Purchase Details

Closed on

Aug 3, 2018

Sold by

Bert Margaret L and Bert Clement A

Bought by

Chard Allyson A

Purchase Details

Closed on

Jun 19, 2014

Sold by

Bert Margaret L and The Margaret L Bert Living Tru

Bought by

The Margaret L Bert Trust

Purchase Details

Closed on

Mar 21, 2005

Sold by

Bogden Steve P

Bought by

Bert Margaret L and Margaret L Bert Living Trust

Purchase Details

Closed on

Nov 19, 2002

Sold by

Bogden Steve P and Bogden Steven

Bought by

Bogden Steve P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$565,600

Interest Rate

5.37%

Purchase Details

Closed on

Sep 17, 2001

Sold by

Lost Canyon Estates Llc

Bought by

Bogden Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$627,187

Interest Rate

7%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chard Daniel R | -- | None Available | |

| Chard Allyson A | -- | Vanguard Title | |

| The Margaret L Bert Trust | -- | None Available | |

| Bert Margaret L | -- | Title West | |

| Bogden Steve P | -- | Title West | |

| Bogden Steven | -- | Brighton Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bogden Steve P | $565,600 | |

| Previous Owner | Bogden Steven | $627,187 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,479 | $1,179,100 | $353,700 | $825,400 |

| 2024 | $4,479 | $828,400 | $248,500 | $579,900 |

| 2023 | $4,836 | $891,700 | $267,500 | $624,200 |

| 2022 | $6,030 | $1,086,300 | $325,900 | $760,400 |

| 2021 | $5,341 | $819,000 | $245,700 | $573,300 |

| 2020 | $5,966 | $862,700 | $258,800 | $603,900 |

| 2019 | $5,630 | $793,400 | $238,000 | $555,400 |

| 2016 | $5,239 | $709,800 | $212,900 | $496,900 |

Source: Public Records

Map

Nearby Homes

- 10279 S Dimple Dell Rd E Unit 103

- 10471 S Wasatch Blvd

- 10471 S Wasatch Blvd Unit 27

- 10175 S Dimple Dell Rd

- 10480 S Seven Springs Cir Unit 23

- 3149 E 10000 S

- 3316 E Lone Springs Cove

- 10804 S Hiddenwood Dr

- 2724 Mount Jordan Rd

- 8732 Oakwood Ln

- 9862 Granite Slope Dr

- 9673 Chylene Dr

- 1 Pepperwood Pointe

- 9623 Tannenbaum Cove

- 9942 S Altamont Dr

- 3357 Glacier Ln

- 11 Bent Hollow Ln Unit 1141

- 39 Northridge Way

- 15 Bentwood Ln S Unit 1117

- 6 Bent Hollow Ln Unit 1147

- 10323 Bedrock Ln Unit 14

- 10323 S Bedrock Ln Unit 14

- 10323 S Bedrock Ln

- 10327 S Bedrock Ln

- 10327 Bedrock Ln

- 10327 Bedrock Ln Unit 15

- 10327 S Bedrock Ln

- 10311 Bedrock Ln

- 10311 Bedrock Ln Unit 13

- 10311 S Bedrock Ln Unit 13

- 10311 S Bedrock Ln

- 10348 Bedrock Ln Unit 16

- 10299 Bedrock Ln

- 10299 S Bedrock Ln Unit 12

- 10352 S Bedrock Ln Unit 17

- 10352 Bedrock Ln

- 10295 S Bedrock Ln

- 10295 S Bedrock Ln Unit 11

- 10295 Bedrock Ln

- 10295 Bedrock Ln Unit 11