10331 Longmont Dr Unit 35 Houston, TX 77042

Briar Forest NeighborhoodEstimated Value: $212,169 - $236,000

2

Beds

3

Baths

1,292

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 10331 Longmont Dr Unit 35, Houston, TX 77042 and is currently estimated at $225,042, approximately $174 per square foot. 10331 Longmont Dr Unit 35 is a home located in Harris County with nearby schools including Walnut Bend Elementary School, Paul Revere Middle School, and Westside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 26, 2016

Sold by

Salinas Karol P and Salinas Karol Patricia

Bought by

Ajin Michael

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,250

Outstanding Balance

$116,990

Interest Rate

4.01%

Mortgage Type

New Conventional

Estimated Equity

$108,052

Purchase Details

Closed on

Aug 10, 2009

Sold by

Gillmor Betty L

Bought by

Salinas Karol Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,821

Interest Rate

5.19%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 25, 2000

Sold by

Donovan John W and Donovan Diane

Bought by

Gillmor Betty L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,800

Interest Rate

8.15%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 1, 1999

Sold by

Watkins Kathleen A

Bought by

Donovan John W and Donovan Diane

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ajin Michael | -- | Stewart Title Houston Div | |

| Salinas Karol Patricia | -- | Alamo Title Company | |

| Gillmor Betty L | -- | Charter Title Company | |

| Donovan John W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ajin Michael | $147,250 | |

| Previous Owner | Salinas Karol Patricia | $108,821 | |

| Previous Owner | Gillmor Betty L | $60,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,645 | $180,736 | $65,000 | $115,736 |

| 2024 | $3,645 | $174,185 | $65,000 | $109,185 |

| 2023 | $3,645 | $180,298 | $65,000 | $115,298 |

| 2022 | $3,560 | $161,959 | $65,000 | $96,959 |

| 2021 | $3,426 | $146,997 | $65,000 | $81,997 |

| 2020 | $3,920 | $161,893 | $65,000 | $96,893 |

| 2019 | $4,097 | $161,893 | $65,000 | $96,893 |

| 2018 | $2,913 | $158,018 | $65,000 | $93,018 |

| 2017 | $3,831 | $151,513 | $65,000 | $86,513 |

| 2016 | $3,643 | $144,079 | $65,000 | $79,079 |

| 2015 | $2,998 | $138,546 | $65,000 | $73,546 |

| 2014 | $2,998 | $116,643 | $37,500 | $79,143 |

Source: Public Records

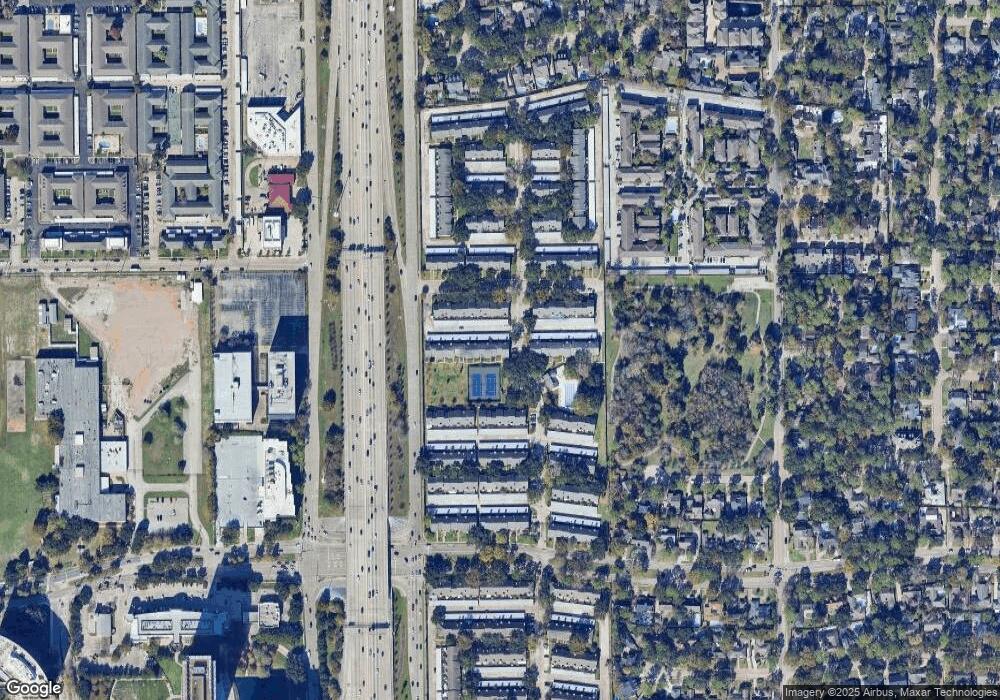

Map

Nearby Homes

- 10212 Longmont Dr Unit 44/7

- 10378 Briar Forest Dr Unit 32/5

- 10324 Briar Forest Dr Unit 28

- 10276 Briar Forest Dr Unit 25

- 10121 Valley Forge Dr

- 10317 Briar Forest Dr Unit 214

- 10118 Briar Rose Dr

- 1537 W Sam Houston Pkwy S

- 10034 Bordley Dr

- 10042 Briar Forest Dr

- 10034 Briar Forest Dr

- 1691 W Sam Houston Pkwy S

- 10323 Pine Forest Rd

- 10010 Bordley Dr

- 1003 Blue Willow Dr

- 10303 Chevy Chase Dr

- 10031 Inwood Dr

- 10614 Lynbrook Dr

- 10211 Olympia Dr

- 10615 Briar Forest Dr Unit 104

- 10331 Longmont Dr Unit 352

- 10333 Longmont Dr Unit 35

- 10333 Longmont Dr Unit 35/3

- 10329 Longmont Dr Unit 35

- 10335 Longmont Dr Unit 35

- 10335 Longmont Dr Unit 4

- 10337 Longmont Dr Unit 35

- 10339 Longmont Dr Unit 35

- 10339 Longmont Dr Unit 6

- 10341 Longmont Dr Unit 35

- 10247 Longmont Dr Unit 34

- 10343 Longmont Dr Unit 35

- 10245 Longmont Dr Unit 34

- 10305 Longmont Dr Unit 37

- 10303 Longmont Dr Unit 37

- 10303 Longmont Dr Unit 1

- 10307 Longmont Dr Unit 37

- 10307 Longmont Dr Unit 37/3

- 10345 Longmont Dr Unit 35/9

- 10309 Longmont Dr Unit 37