10335 Aileen Ave Unit 5 Mokena, IL 60448

Estimated Value: $510,000 - $576,000

3

Beds

4

Baths

3,074

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 10335 Aileen Ave Unit 5, Mokena, IL 60448 and is currently estimated at $534,000, approximately $173 per square foot. 10335 Aileen Ave Unit 5 is a home located in Will County with nearby schools including Mokena Elementary School, Mokena Intermediate School, and Mokena Jr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 8, 2024

Sold by

Burke Mary E and Burke Daniel J

Bought by

Mary Eifilice Revocable Living Trust and Burke

Current Estimated Value

Purchase Details

Closed on

Dec 8, 1997

Sold by

State Bank Of Countryside

Bought by

Burke Daniel J and Burke Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,500

Interest Rate

7.35%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mary Eifilice Revocable Living Trust | -- | None Listed On Document | |

| Burke Daniel J | $251,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Burke Daniel J | $225,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,115 | $162,523 | $23,790 | $138,733 |

| 2023 | $11,115 | $145,149 | $21,247 | $123,902 |

| 2022 | $10,257 | $132,206 | $19,352 | $112,854 |

| 2021 | $9,663 | $123,685 | $18,105 | $105,580 |

| 2020 | $9,467 | $120,199 | $17,595 | $102,604 |

| 2019 | $9,176 | $116,982 | $17,124 | $99,858 |

| 2018 | $8,874 | $113,619 | $16,632 | $96,987 |

| 2017 | $8,714 | $110,967 | $16,244 | $94,723 |

| 2016 | $8,475 | $107,163 | $15,687 | $91,476 |

| 2015 | $8,252 | $103,390 | $15,135 | $88,255 |

| 2014 | $8,252 | $102,672 | $15,030 | $87,642 |

| 2013 | $8,252 | $104,003 | $15,225 | $88,778 |

Source: Public Records

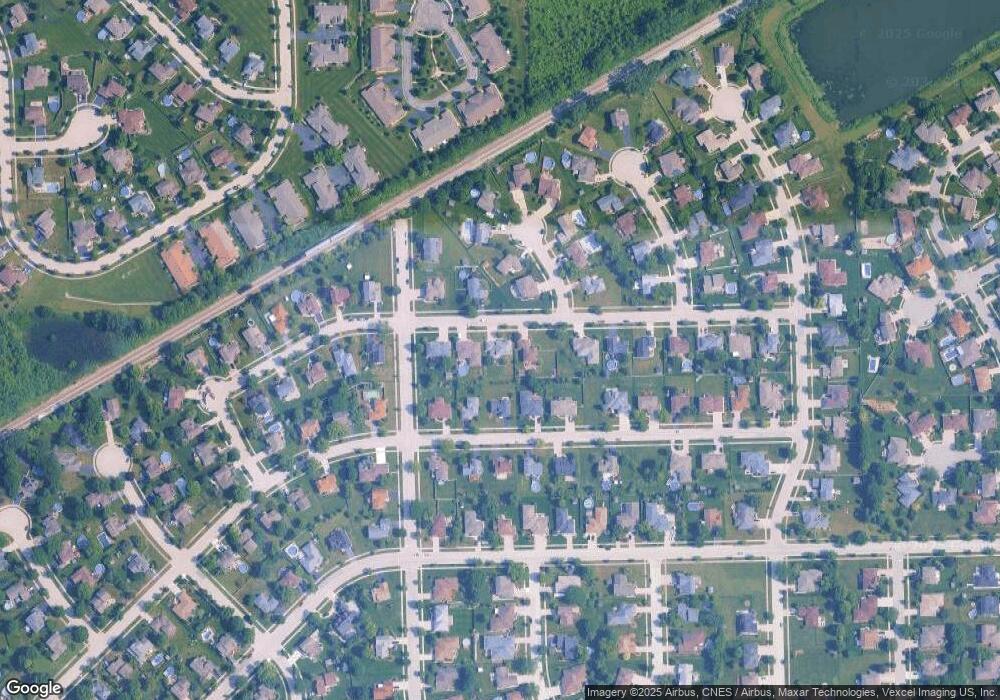

Map

Nearby Homes

- 19242 104th Ave

- 10531 Thornham Ln Unit 10531

- 19222 104th Ave

- 19525 Fiona Ave

- 19443 Trenton Way

- Lots 4,5, & 6 191st St

- Vacant 191st St

- 19425 Everett Ln

- 10752 First Ct

- 10119 Cambridge Dr

- 18821 Dickens Dr

- 19725 S Schoolhouse Rd

- 10508 W La Porte Rd

- 10015 Cambridge Dr

- 9860 Stafford Ct

- 10943 1st St

- 11025 Revere Rd

- 20044 S Kohlwood Dr

- 9702 Chelsea Place

- 19300 S La Grange Rd

- 10343 Aileen Ave Unit 5

- 10325 Aileen Ave

- 10334 Oconnell Ave Unit 5

- 10344 Oconnell Ave Unit 5

- 10326 Oconnell Ave

- 10351 Aileen Ave

- 10342 Aileen Ave Unit 5

- 19350 Emerald Ct Unit 5

- 10352 Oconnell Ave

- 10318 Oconnell Ave Unit 5

- 10315 Aileen Ave

- 10352 Aileen Ave

- 19340 Emerald Ct

- 10335 Oconnell Ave Unit 5

- 10306 Oconnell Ave Unit 5

- 10303 Aileen Ave

- 19349 Emerald Ct

- 10401 Aileen Ave

- 10343 Oconnell Ave Unit 5

- 10327 Oconnell Ave