1035 E E St Rainier, OR 97048

Estimated Value: $310,305 - $432,000

2

Beds

1

Bath

1,193

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 1035 E E St, Rainier, OR 97048 and is currently estimated at $354,826, approximately $297 per square foot. 1035 E E St is a home located in Columbia County with nearby schools including Hudson Park Elementary School and Rainier Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2021

Sold by

Weaver Jenna and Hege Robert

Bought by

Weaver Kenneth A and Weaver Jenna R

Current Estimated Value

Purchase Details

Closed on

Sep 21, 2017

Sold by

Malloy Sharon

Bought by

Benson Martha

Purchase Details

Closed on

Apr 1, 2008

Sold by

Markle Arnold E and Markle Diana L

Bought by

Markle Arnold E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Interest Rate

3.1%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

Dec 1, 2005

Sold by

Davis Gary L

Bought by

Markle Arnold E and Markle Diana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.31%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weaver Kenneth A | -- | None Listed On Document | |

| Weaver Kenneth A | -- | None Available | |

| Benson Martha | $12,000 | Ticor Title Company Of Or | |

| Markle Arnold E | -- | Columbia County Title | |

| Markle Arnold E | $160,000 | Ticor Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Markle Arnold E | $255,000 | |

| Previous Owner | Markle Arnold E | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,340 | $126,670 | $50,630 | $76,040 |

| 2024 | $2,285 | $122,990 | $49,150 | $73,840 |

| 2023 | $2,253 | $119,410 | $42,340 | $77,070 |

| 2022 | $2,152 | $115,940 | $40,800 | $75,140 |

| 2021 | $2,117 | $112,570 | $34,360 | $78,210 |

| 2020 | $2,606 | $138,450 | $60,340 | $78,110 |

| 2019 | $2,565 | $134,420 | $55,910 | $78,510 |

| 2016 | $2,411 | $123,020 | $72,510 | $50,510 |

| 2015 | $2,155 | $119,440 | $60,950 | $58,490 |

| 2014 | $2,210 | $119,100 | $57,490 | $61,610 |

Source: Public Records

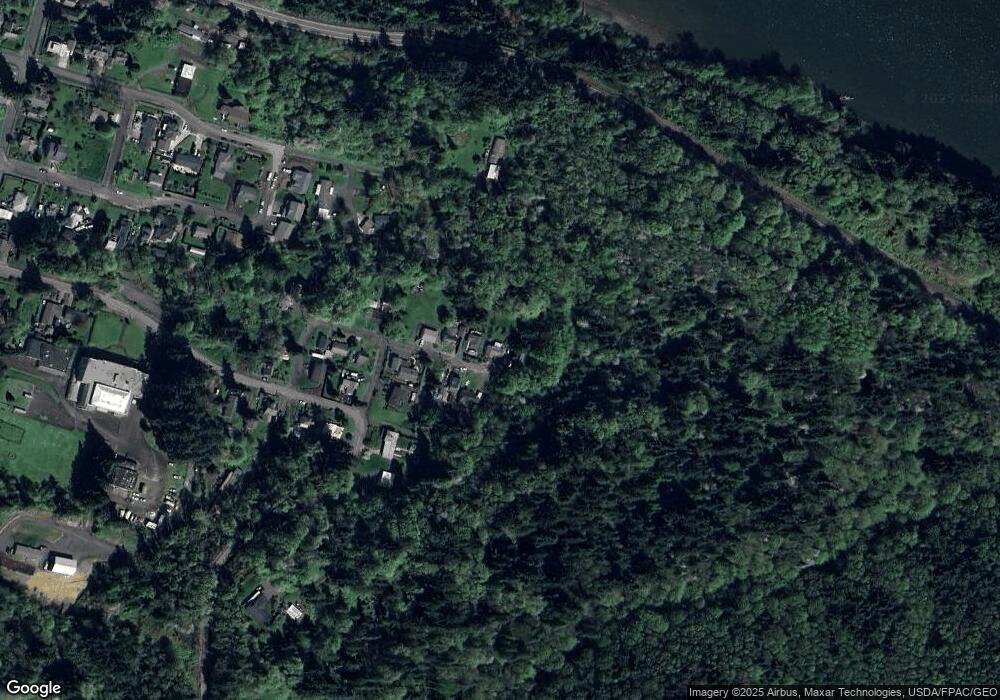

Map

Nearby Homes