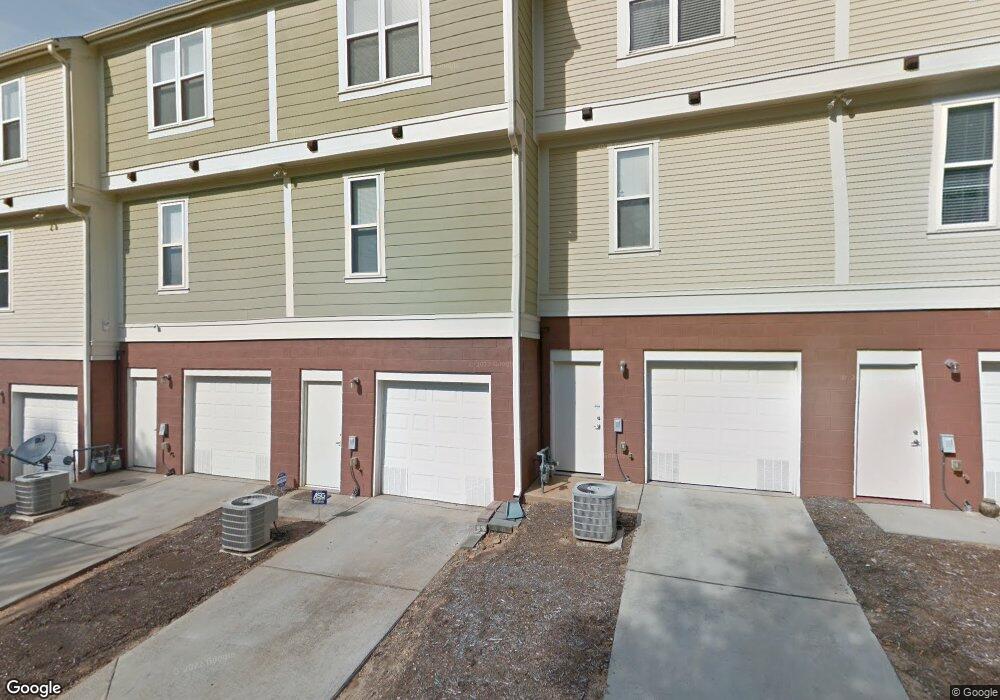

1035 Sycamore Green Place Unit 17 Charlotte, NC 28202

Third Ward NeighborhoodEstimated Value: $427,000 - $542,000

2

Beds

3

Baths

1,200

Sq Ft

$393/Sq Ft

Est. Value

About This Home

This home is located at 1035 Sycamore Green Place Unit 17, Charlotte, NC 28202 and is currently estimated at $472,112, approximately $393 per square foot. 1035 Sycamore Green Place Unit 17 is a home located in Mecklenburg County with nearby schools including First Ward Arts Elementary, Sedgefield Middle School, and Myers Park High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2011

Sold by

Tuite Nicholas and Tuite Erin

Bought by

Vick Charles Taylor

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,500

Outstanding Balance

$130,622

Interest Rate

4.17%

Mortgage Type

New Conventional

Estimated Equity

$341,490

Purchase Details

Closed on

Feb 28, 2006

Sold by

Constantinides Andrea and Brothers John

Bought by

Stringfellow Erin Britt

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.08%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Nov 21, 2003

Sold by

Sycamore Green Condominium Llc

Bought by

Constantinides Andrea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,295

Interest Rate

5.93%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vick Charles Taylor | $190,000 | Meridian Title | |

| Stringfellow Erin Britt | $290,000 | Colonial | |

| Constantinides Andrea | $201,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vick Charles Taylor | $189,500 | |

| Previous Owner | Stringfellow Erin Britt | $180,000 | |

| Previous Owner | Constantinides Andrea | $201,295 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,915 | $358,615 | -- | $358,615 |

| 2024 | $2,915 | $358,615 | -- | $358,615 |

| 2023 | $2,815 | $358,615 | $0 | $358,615 |

| 2022 | $2,913 | $284,800 | $0 | $284,800 |

| 2021 | $2,902 | $284,800 | $0 | $284,800 |

| 2020 | $2,894 | $284,800 | $0 | $284,800 |

| 2019 | $2,879 | $284,800 | $0 | $284,800 |

| 2018 | $2,744 | $200,400 | $56,300 | $144,100 |

| 2017 | $2,691 | $200,400 | $56,300 | $144,100 |

| 2016 | $2,681 | $200,400 | $56,300 | $144,100 |

| 2015 | $2,670 | $200,400 | $56,300 | $144,100 |

| 2014 | $2,647 | $200,400 | $56,300 | $144,100 |

Source: Public Records

Map

Nearby Homes

- 151 S Sycamore St

- 216 S Clarkson St Unit E

- 916 Westbrook Dr

- 241 N Irwin Ave

- 915 Westbrook Dr Unit A

- 214 S Cedar St

- 1115 Greenleaf Ave Unit B

- 718 W Trade St

- 718 W Trade St Unit 314

- 718 W Trade St Unit 105

- 306 S Cedar St Unit 10

- 320 S Cedar St Unit E

- 1101 W 1st St Unit 302

- 1101 W 1st St Unit 409

- 710 W Trade St Unit 701

- 1509 Montgomery St

- 201 Grandin Rd Unit 13

- 1326 W 6th St

- 203 Grandin Rd Unit 2

- 209 Grandin Rd

- 1031 Sycamore Green Place Unit 18

- 1039 Sycamore Green Place Unit 16

- 1027 Sycamore Green Place Unit 19

- 1043 Sycamore Green Place Unit 15

- 1023 Sycamore Green Place Unit 1023

- 135 S Sycamore St Unit 6

- 127 S Sycamore St

- 119 S Sycamore St Unit 2B

- 115 S Sycamore St

- 1015 Sycamore Green Place

- 1049 Sycamore Green Place

- 1053 Sycamore Green Place Unit 13

- 1019 Sycamore Green Place

- 1019 S Sycamore Green Place

- 1057 Sycamore Green Place

- 1004 Margaret Brown St Unit D

- 1004 Margaret Brown St Unit D

- 1004 Margaret Brown St Unit C

- 1061 Sycamore Green Place Unit 11

- 1006 Margaret Brown St Unit B