10352 W Whitnall Edge Court West Ct W Unit 203 Franklin, WI 53132

Estimated Value: $171,000 - $181,000

2

Beds

2

Baths

940

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 10352 W Whitnall Edge Court West Ct W Unit 203, Franklin, WI 53132 and is currently estimated at $175,676, approximately $186 per square foot. 10352 W Whitnall Edge Court West Ct W Unit 203 is a home located in Milwaukee County with nearby schools including Hales Corners Elementary School, Whitnall Middle School, and Whitnall High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2024

Sold by

Granados Giselle

Bought by

Dirksen Jonathan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$10,000

Outstanding Balance

$9,851

Interest Rate

6.9%

Mortgage Type

New Conventional

Estimated Equity

$165,825

Purchase Details

Closed on

Jun 8, 2022

Sold by

Esenberg Ross P and Esenberg Rachael

Bought by

Granados Giselle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,681

Interest Rate

5.3%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 7, 2005

Sold by

Randa James P

Bought by

Esenberg Ross P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,900

Interest Rate

6.04%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 31, 2003

Sold by

Prusinski John J and Prusinski Gale A

Bought by

Randa James P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,900

Interest Rate

5.76%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dirksen Jonathan | $164,000 | Prism Title | |

| Granados Giselle | $128,000 | None Listed On Document | |

| Esenberg Ross P | $101,900 | -- | |

| Randa James P | $74,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dirksen Jonathan | $10,000 | |

| Previous Owner | Granados Giselle | $125,681 | |

| Previous Owner | Esenberg Ross P | $101,900 | |

| Previous Owner | Randa James P | $44,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,144 | -- | -- | -- |

| 2023 | $2,073 | $143,500 | $8,900 | $134,600 |

| 2022 | $1,976 | $101,700 | $8,900 | $92,800 |

| 2021 | $1,847 | $86,400 | $6,000 | $80,400 |

| 2020 | $1,614 | $0 | $0 | $0 |

| 2019 | $1,664 | $73,400 | $6,000 | $67,400 |

| 2018 | $1,295 | $0 | $0 | $0 |

| 2017 | $1,520 | $63,300 | $6,000 | $57,300 |

| 2015 | -- | $46,600 | $6,000 | $40,600 |

| 2013 | -- | $46,600 | $6,000 | $40,600 |

Source: Public Records

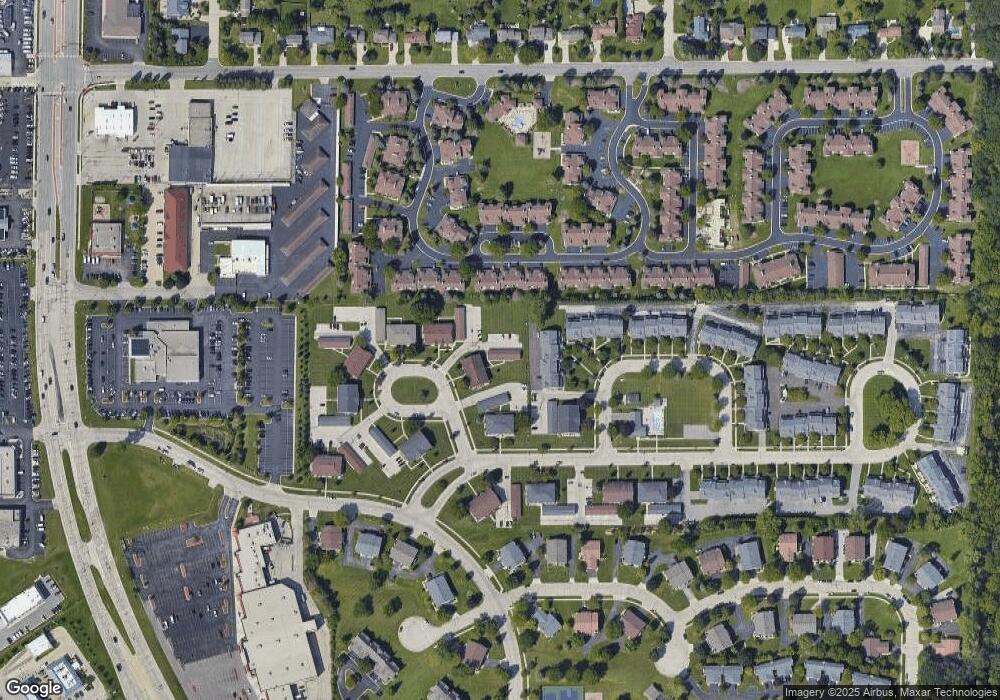

Map

Nearby Homes

- 10464 W Whitnall Edge Dr Unit 203

- 10380 W Whitnall Edge Cir Unit H

- 10320 W Whitnall Edge Cir Unit A

- 6512 S Parkedge Cir Unit 118B

- 6749 S Prairie Wood Ln

- 6741 S Prairie Wood Ln

- 11310 Haleco Ln

- Lt31 S Lory Ln

- 7084 S Fieldstone Ct Unit 43

- 5714 S 107th St

- 10555 W Parnell Ave

- 6433 S 121st St

- 11931 W Janesville Rd

- 5531 S 110th St

- 8866 Greenmeadow Ln

- 10201 Brookside Dr

- 6100 W Stone Hedge Dr Unit 320

- 11470 W Tess Creek St

- 5305 S 110th St

- 9839 Brookside Dr

- 10352 W Whitnall Edge Ct

- 10352 W Whitnall Edge Ct Unit 203

- 10352 W Whitnall Edge Ct Unit 202

- 10352 W Whitnall Edge Ct Unit 201

- 10352 W Whitnall Edge Ct Unit 104

- 10352 W Whitnall Edge Ct Unit 103

- 10352 W Whitnall Edge Ct Unit 102

- 10352 W Whitnall Edge Ct Unit 101

- 10352 W Whitnall Edge Ct Unit 204

- 10352 W Whitnall Edge Ct Unit 10352

- 10352 W Whitnall Edge Ct

- 10352 W Whitnall Edge Ct 103

- 10364 W Whitnall Edge Ct Unit 203

- 10364 W Whitnall Edge Ct Unit 202

- 10364 W Whitnall Edge Ct Unit 201

- 10364 W Whitnall Edge Ct Unit 104

- 10364 W Whitnall Edge Ct Unit 103

- 10364 W Whitnall Edge Ct Unit 102

- 10364 W Whitnall Edge Ct Unit 101

- 10364 W Whitnall Edge Ct Unit 204