10355 Paradise Valley Dr Conroe, TX 77304

Estimated Value: $1,018,000 - $1,065,628

4

Beds

3

Baths

4,512

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 10355 Paradise Valley Dr, Conroe, TX 77304 and is currently estimated at $1,034,157, approximately $229 per square foot. 10355 Paradise Valley Dr is a home located in Montgomery County with nearby schools including Eddie Ruth Lagway Elementary, Robert P. Brabham Middle School, and Willis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2008

Sold by

Reed Gary E

Bought by

Turpin Larry J and Turpin Kim L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,250

Interest Rate

6.19%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Aug 18, 2008

Sold by

Reed Gary E and Reed Deborah G

Bought by

Reed Gary E and Reed Deborah G

Purchase Details

Closed on

Feb 26, 2001

Sold by

Pecos Vaught Custom Homes Inc

Bought by

Reed Gary E and Reed Deborah G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,000

Interest Rate

6.97%

Purchase Details

Closed on

Aug 31, 1999

Sold by

Teaswood Llc

Bought by

Turpin Larry J and Turpin Kim L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Turpin Larry J | -- | Chicago Title Conroe | |

| Reed Gary E | -- | Chicago Title Conroe | |

| Reed Gary E | -- | First American Title | |

| Turpin Larry J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Turpin Larry J | $360,000 | |

| Closed | Turpin Larry J | $400,000 | |

| Closed | Turpin Larry J | $63,250 | |

| Closed | Turpin Larry J | $417,000 | |

| Previous Owner | Reed Gary E | $370,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,961 | $835,215 | $110,022 | $725,193 |

| 2024 | $9,961 | $825,220 | -- | -- |

| 2023 | $9,771 | $750,200 | $110,020 | $774,140 |

| 2022 | $14,417 | $682,000 | $110,020 | $676,700 |

| 2021 | $13,530 | $620,000 | $110,020 | $509,980 |

| 2020 | $14,503 | $624,660 | $110,020 | $514,640 |

| 2019 | $15,445 | $632,500 | $110,020 | $542,300 |

| 2018 | $14,539 | $636,000 | $110,020 | $525,980 |

| 2017 | $15,588 | $636,000 | $110,020 | $525,980 |

| 2016 | $15,191 | $619,800 | $66,220 | $553,580 |

| 2015 | $13,745 | $617,000 | $66,220 | $550,780 |

| 2014 | $13,745 | $565,800 | $66,220 | $499,580 |

Source: Public Records

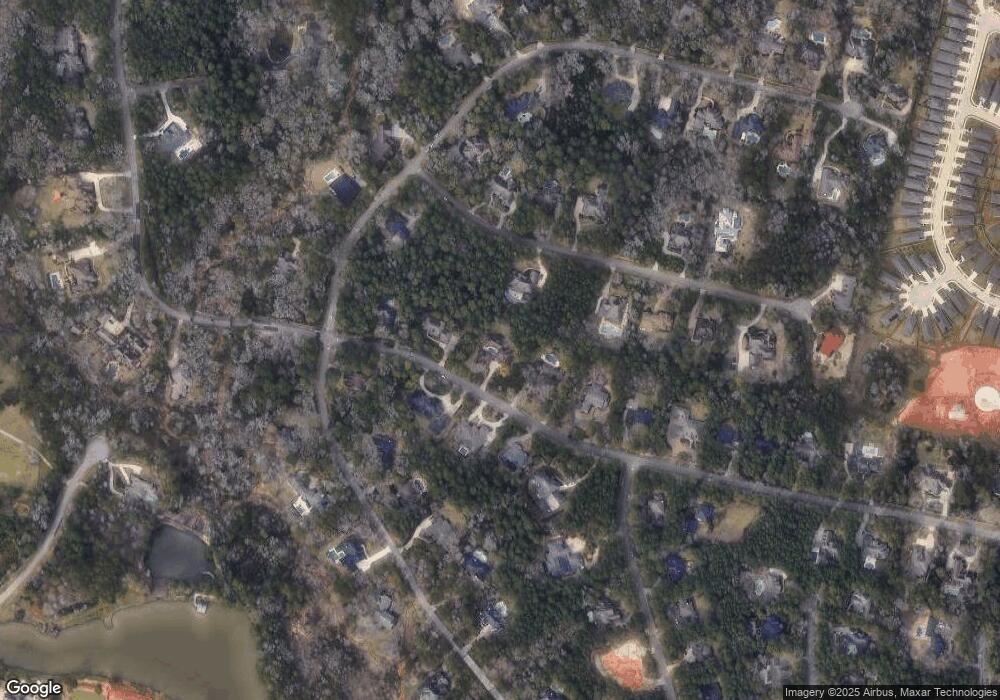

Map

Nearby Homes

- 10362 Hunter Creek Ln

- 10332 Hunter Creek Ln

- 7373 Teaswood Dr

- 10308 Paradise Valley Dr

- 7393 Teaswood Dr

- 7389 Teaswood

- 3 Quinns Cabin Ct

- 2010 Bluff Oak Ct

- 2007 Bluff Oak Ct

- 2051 W Darlington Oak Ct

- 2002 Bluff Oak Ct

- 10265 Paradise Valley

- The Gateway (390) Plan at Montgomery Oaks - Premier

- The Cedar (4012) Plan at Montgomery Oaks - Estate

- The Oleander (C401) Plan at Montgomery Oaks - Estate

- The Henderson (C404) Plan at Montgomery Oaks - Estate

- The Kessler (C454) Plan at Montgomery Oaks - Estate

- The Kendall (C485) Plan at Montgomery Oaks - Estate

- The Bryce (375) Plan at Montgomery Oaks - Premier

- The Cascade (330) Plan at Montgomery Oaks - Premier

- 10349 Paradise Valley Dr

- 10349 Paradise Valley

- 10350 Hunter Creek

- 10350 Hunter Creek Ln

- 10361 Paradise Valley

- 10344 Hunter Creek Ln

- 10360 Paradise Valley

- 10360 Paradise Valley

- 10352 Paradise Valley Dr

- 10346 Paradise Valley Dr

- 10343 Paradise Valley Dr

- 7358 Paradise Valley

- 10346 Paradise Valley

- 10338 Hunter Creek Ln

- 7354 Teaswood Dr

- 7350 Teaswood Dr

- 10356 Hunter Creek Ln

- 10321 Hunter Creek Ln

- 10309 Hunter Creek Ln

- 10337 Paradise Valley