1036 Whitburn Terrace Unit 361 Chesapeake, VA 23322

Great Bridge NeighborhoodEstimated Value: $495,000 - $510,000

3

Beds

3

Baths

2,450

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 1036 Whitburn Terrace Unit 361, Chesapeake, VA 23322 and is currently estimated at $501,441, approximately $204 per square foot. 1036 Whitburn Terrace Unit 361 is a home located in Chesapeake City with nearby schools including Cedar Road Elementary School, Great Bridge Middle School, and Grassfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2024

Sold by

Sutton Venton C

Bought by

Matthews Delphine Antoinette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,175

Outstanding Balance

$362,654

Interest Rate

6.84%

Mortgage Type

New Conventional

Estimated Equity

$138,787

Purchase Details

Closed on

Sep 28, 2017

Sold by

Eagle Construction Of Va Llc A Virginia

Bought by

Sutton Venton C and Sutton Melissa R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$531,334

Interest Rate

3.82%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Matthews Delphine Antoinette | $486,900 | Stewart Title Guaranty Company | |

| Matthews Delphine Antoinette | $486,900 | Stewart Title Guaranty Company | |

| Sutton Venton C | $354,223 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Matthews Delphine Antoinette | $365,175 | |

| Closed | Matthews Delphine Antoinette | $365,175 | |

| Previous Owner | Sutton Venton C | $531,334 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,132 | $449,700 | $125,000 | $324,700 |

| 2024 | $4,132 | $409,100 | $115,000 | $294,100 |

| 2023 | $3,881 | $420,500 | $105,000 | $315,500 |

| 2022 | $4,048 | $400,800 | $90,000 | $310,800 |

| 2021 | $3,605 | $343,300 | $75,000 | $268,300 |

| 2020 | $3,504 | $333,700 | $70,000 | $263,700 |

| 2019 | $3,585 | $341,400 | $70,000 | $271,400 |

| 2018 | $3,449 | $0 | $0 | $0 |

Source: Public Records

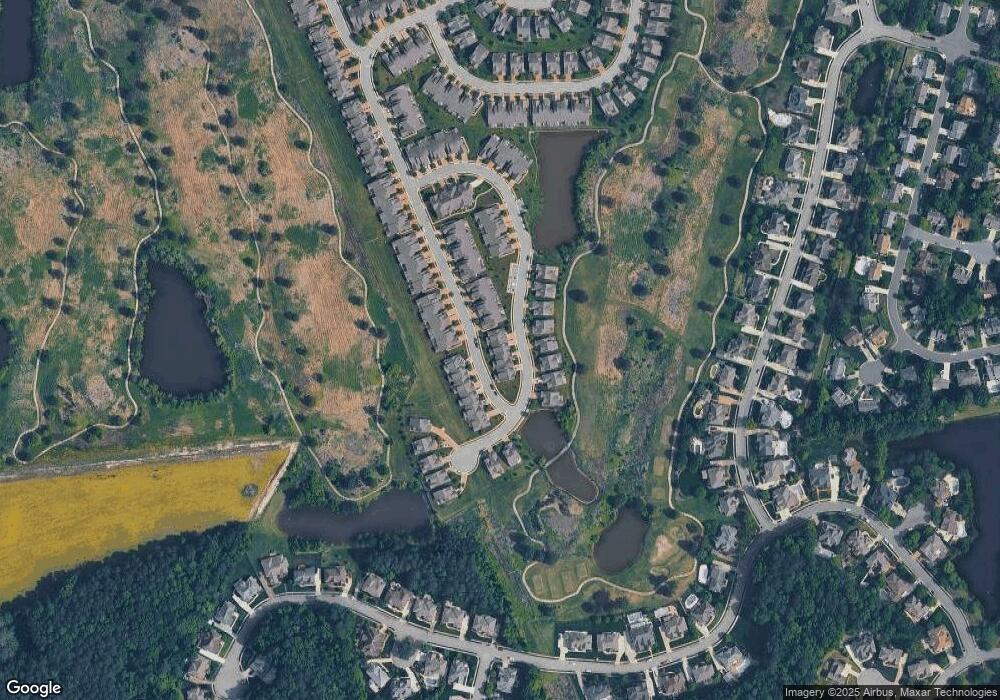

Map

Nearby Homes

- 1030 Eagle Pointe Way

- 1332 Club House Dr

- 1837 Honey Milk Rd

- 1801 Honey Milk Rd

- 405 Asuza St

- 409 Asuza St

- 411 Asuza St

- 704 Brisa Ct

- 1634 Whistling Rd

- 928 Shillelagh Rd

- 1605 Redwing Arcade

- 501 Landmark Ct

- 510 San Pedro Dr

- 340 San Roman Dr

- 732 Washington Dr

- 1008 Fallcreek Run

- 303 Sherwood Forest Rd

- 704 Washington Dr

- 1312 False Creek Way

- 1070 Washington Dr

- 1036 Whitburn Terrace Unit Terrace

- 1034 Whitburn Terrace Unit 362

- 1038 Whitburn Terrace Unit 360

- 1038 Whitburn Terrace

- 1032 Whitburn Terrace Unit 363

- 1032 Whitburn Terrace

- 1026 Eagle Pointe Way Unit 393

- 1026 Eagle Pointe Way

- 1030 Eagle Pointe Way Unit 394

- 1035 Whitburn Terrace Unit 388

- 1035 Whitburn Terrace Unit 389

- 1017 Eagle Pointe Way Unit 367

- 1021 Eagle Pointe Way Unit 366

- 1039 Whitburn Terrace Unit 389

- 1039 Whitburn Terrace

- 1034 Eagle Pointe Way Unit 395

- 1013 Eagle Pointe Way Unit 368

- 1031 Whitburn Terrace Unit 387

- 1025 Eagle Pointe Way Unit 359

- 1009 Eagle Pointe Way Unit 369