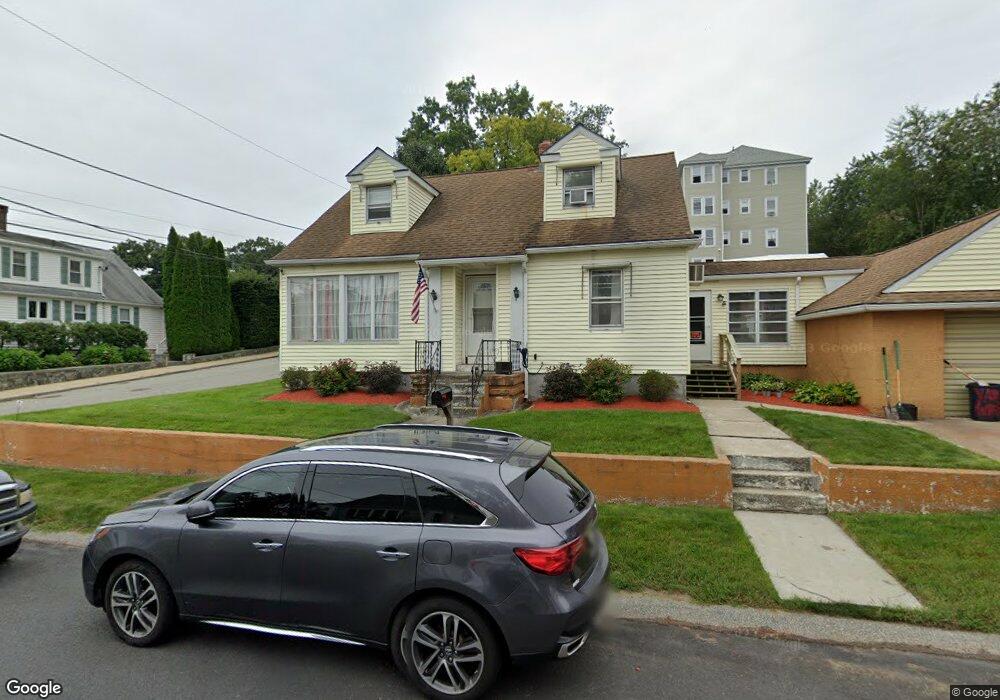

104 8th Ave Woonsocket, RI 02895

Fairmount NeighborhoodEstimated Value: $378,000 - $402,387

3

Beds

2

Baths

2,442

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 104 8th Ave, Woonsocket, RI 02895 and is currently estimated at $391,097, approximately $160 per square foot. 104 8th Ave is a home located in Providence County with nearby schools including Woonsocket High School, Rise Prep Mayoral Academy Middle School, and Rise Prep Mayoral Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2021

Sold by

Lussier Krystal L Est and Carrio

Bought by

Carrio Jason B

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2006

Sold by

Croutear Mark S and Croutear Christine A

Bought by

Lussier Krystal L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,520

Interest Rate

6.67%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 21, 1994

Sold by

Rzewuski Michael J and Rzewuski Thomas P

Bought by

Croutear Mark S and Croutear Christine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carrio Jason B | -- | None Available | |

| Carrio Jason B | -- | None Available | |

| Carrio Jason B | -- | None Available | |

| Lussier Krystal L | $237,000 | -- | |

| Croutear Mark S | $81,500 | -- | |

| Lussier Krystal L | $237,000 | -- | |

| Croutear Mark S | $81,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Croutear Mark S | $189,520 | |

| Previous Owner | Croutear Mark S | $47,380 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,112 | $366,200 | $90,200 | $276,000 |

| 2024 | $3,823 | $262,900 | $91,800 | $171,100 |

| 2023 | $3,675 | $262,900 | $91,800 | $171,100 |

| 2022 | $3,675 | $262,900 | $91,800 | $171,100 |

| 2021 | $3,741 | $157,500 | $37,500 | $120,000 |

| 2020 | $3,780 | $157,500 | $37,500 | $120,000 |

| 2018 | $3,793 | $157,500 | $37,500 | $120,000 |

| 2017 | $3,868 | $128,500 | $41,000 | $87,500 |

| 2016 | $4,091 | $128,500 | $41,000 | $87,500 |

| 2015 | $4,701 | $128,500 | $41,000 | $87,500 |

| 2014 | $3,188 | $126,700 | $45,100 | $81,600 |

Source: Public Records

Map

Nearby Homes

- 0 10th Ave

- 123 4th Ave

- 83 4th Ave

- 168 3rd Ave

- 227 3rd Ave

- 435 S Main St

- 6 Obeline Dr

- 92 Rockland Ave

- 0 Holbrook Ln Unit 1402850

- 36 Fairmount St

- 84 Bernice Ave

- 190 Coe St

- 595 S Main St

- 0 Pound Hill Rd Unit 1403654

- 0 Pound Hill Rd Unit 1403653

- 4 Sharon Pkwy

- 80 Summit St

- 308 Harris Ave

- 34 Smithfield Rd

- 184 Avenue C Unit 2