Estimated Value: $279,948 - $558,000

2

Beds

1

Bath

800

Sq Ft

$502/Sq Ft

Est. Value

About This Home

This home is located at 104 Apple Gap Trail, Tiger, GA 30576 and is currently estimated at $401,649, approximately $502 per square foot. 104 Apple Gap Trail is a home with nearby schools including Rabun County Primary School and Rabun County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 11, 2020

Sold by

Martino James

Bought by

James And Ashley Martino Revocable Tr

Current Estimated Value

Purchase Details

Closed on

May 24, 2012

Sold by

Scbt

Bought by

Martino James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,975

Interest Rate

3.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 7, 2011

Sold by

Fordham Charles Edwards

Bought by

Scbt Na

Purchase Details

Closed on

Feb 19, 2010

Sold by

Fordham Charles Edward

Bought by

Craft Micah

Purchase Details

Closed on

Jan 1, 1997

Purchase Details

Closed on

Feb 1, 1995

Bought by

Fordham Charles Edward

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James And Ashley Martino Revocable Tr | -- | -- | |

| James And Ashley Martino Revocable Tr | -- | -- | |

| Martino James | $127,750 | -- | |

| Scbt Na | -- | -- | |

| Scbt Na | -- | -- | |

| Craft Micah | -- | -- | |

| Craft Micah | -- | -- | |

| Craft Micah | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| Fordham Charles Edward | $26,900 | -- | |

| Fordham Charles Edward | $26,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Martino James | $114,975 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,522 | $94,843 | $17,853 | $76,990 |

| 2023 | $1,597 | $87,248 | $16,803 | $70,445 |

| 2022 | $1,537 | $84,002 | $15,752 | $68,250 |

| 2021 | $1,432 | $76,379 | $14,702 | $61,677 |

| 2020 | $1,477 | $76,153 | $14,702 | $61,451 |

| 2019 | $1,487 | $76,153 | $14,702 | $61,451 |

| 2018 | $1,454 | $76,153 | $14,702 | $61,451 |

Source: Public Records

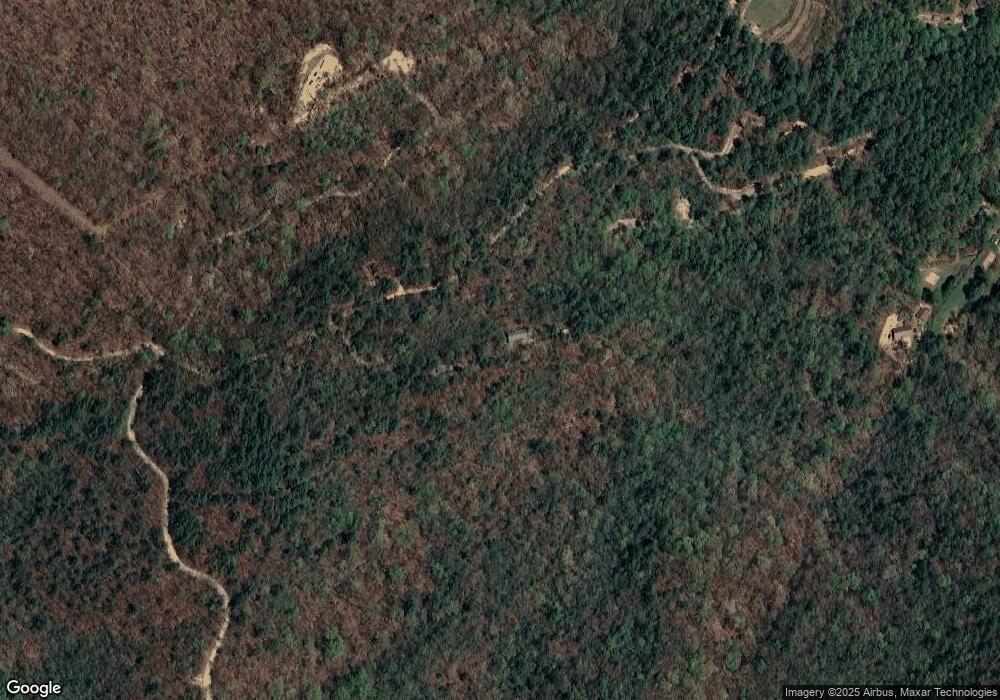

Map

Nearby Homes

- 772 Glassy Mount Rd

- 47 Cripple Creek Ln

- 0 Bridge Creek Rd Unit 7552589

- 0 Bridge Creek Rd Unit 10491627

- 0 Peach Orchard Way

- 59 Ritchie Rd

- 2969 Bridge Creek Rd

- 0 Bonanza Ln Unit 10579703

- 420 Bonanza Ln

- 11 Bonanza Ln

- 0 Rainwater Trail Unit 10532876

- 0 Rainwater Trail Unit 7586703

- 0 Rainwater Trail Unit LOTS 6 & 7 10457238

- 32 Hill Camp Ln

- 767 Covecrest Dr Unit 702

- 0 Highway 76 E Unit 10579447

- 0 Highway 76 E Unit 7628537

- 0 Highway 76 E Unit 10566724

- 0 Brighton Dr Unit LOTS 20 & 21

- 377 Charmont Dr

- 282 Apple Gap Trail

- 109 Apple Gap Trail

- 371 Apple Gap Trail

- 180 Coalley Ln

- 770 Glassy Mountain Rd

- 493 Frontier Rd

- 624 Frontier Rd

- 26 Coalley Ln

- 473 Apple Gap

- 0 Coalley Ln Unit 8338322

- 0 Coalley Ln

- 37 Coalley Ln

- 440 Frontier Rd Unit 14

- 762 Carnes Rd

- 386 Frontier Rd

- 5335 Bridge Creek Rd

- 0 Frontier Rd Unit 8611125

- 0 Frontier Rd Unit 8548281

- 0 Frontier Rd Unit 7074052

- 0 Frontier Rd Unit 7342097