104 Creekside Cir Spring Valley, NY 10977

Estimated Value: $438,000 - $449,824

3

Beds

2

Baths

1,380

Sq Ft

$322/Sq Ft

Est. Value

About This Home

This home is located at 104 Creekside Cir, Spring Valley, NY 10977 and is currently estimated at $444,608, approximately $322 per square foot. 104 Creekside Cir is a home located in Rockland County with nearby schools including Grandview Elementary School, Pomona Middle School, and Ramapo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2021

Sold by

Vincent Jean Garry and Vincent Marie

Bought by

Vincent Gary

Current Estimated Value

Purchase Details

Closed on

Jun 24, 2005

Sold by

Louis Nadyne Jean

Bought by

Vincent Jean Garry and Vincent Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,800

Outstanding Balance

$122,078

Interest Rate

5.73%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$322,530

Purchase Details

Closed on

Jul 13, 1995

Sold by

Newhaus Corp

Bought by

Jean Louis Jean Claude

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,600

Interest Rate

7.7%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vincent Gary | -- | None Available | |

| Vincent Gary | -- | None Available | |

| Vincent Jean Garry | $262,000 | First Amer Title Ins Co Ny | |

| Vincent Jean Garry | $262,000 | First Amer Title Ins Co Ny | |

| Vincent Jean Garry | $262,000 | First Amer Title Ins Co Ny | |

| Jean Louis Jean Claude | $136,900 | -- | |

| Jean Louis Jean Claude | $136,900 | -- | |

| Jean Louis Jean Claude | $136,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vincent Jean Garry | $235,800 | |

| Closed | Vincent Jean Garry | $235,800 | |

| Previous Owner | Jean Louis Jean Claude | $102,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,042 | $25,500 | $4,200 | $21,300 |

| 2023 | $12,042 | $25,500 | $4,200 | $21,300 |

| 2022 | $10,846 | $25,500 | $4,200 | $21,300 |

| 2021 | $4,468 | $25,500 | $4,200 | $21,300 |

| 2020 | $7,292 | $25,500 | $4,200 | $21,300 |

| 2019 | $8,104 | $25,500 | $4,200 | $21,300 |

| 2018 | $8,104 | $25,500 | $4,200 | $21,300 |

| 2017 | $6,909 | $25,500 | $4,200 | $21,300 |

| 2016 | $6,774 | $25,500 | $4,200 | $21,300 |

| 2015 | -- | $25,500 | $4,200 | $21,300 |

| 2014 | -- | $25,500 | $4,200 | $21,300 |

Source: Public Records

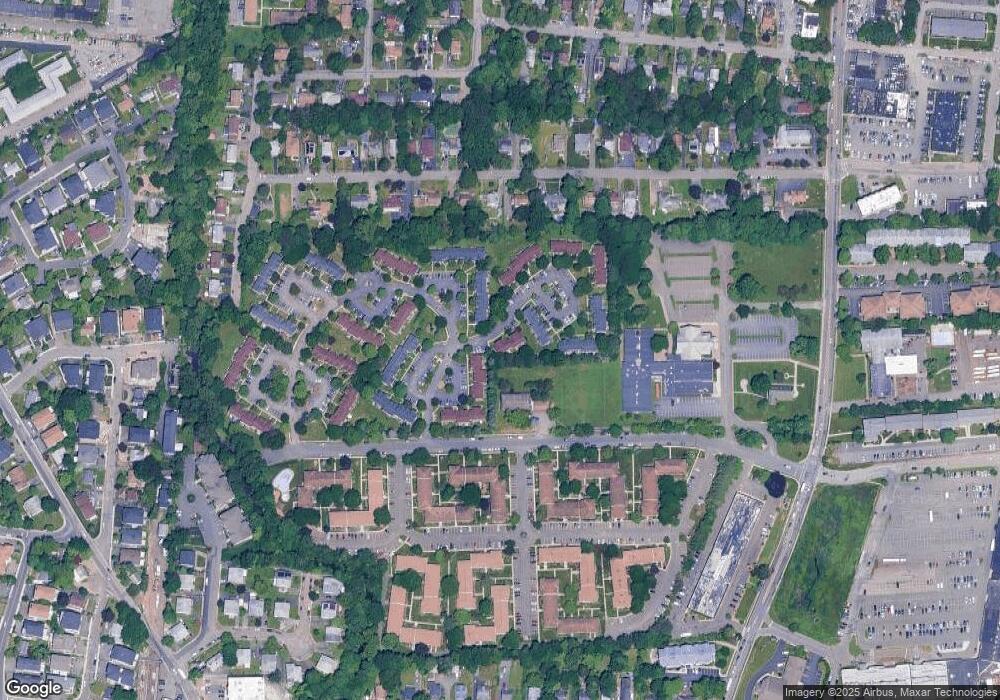

Map

Nearby Homes

- 80 Sneden Place Unit 80

- 196 Sneden Place W Unit 196

- 148 Sneden Place W Unit 148

- 220 Sneden Place W

- 19 Sneden Place W Unit 19

- 96 W Eckerson Rd

- 258 N Main St Unit C19

- 258 N Main St Unit C7

- 258 N Main St Unit C29

- 258 N Main St Unit C3

- 108 Union Rd Unit 2R

- 106 Union Rd Unit 3J

- 112 Union Rd Unit 3L

- 9 E Hickory St

- 35 Ewing Ave

- 37 Ewing Ave Unit 202

- 37 Ewing Ave Unit 201

- 260 N Main St Unit B-28

- 260 N Main St Unit B6

- 260 N Main St Unit B32

- 108 Creekside Cir

- 110 Creekside Cir

- 102 Creekside Cir

- 100 Creekside Cir

- 100 Creekside Cir Unit 100

- 109 Creekside Cir

- 98 Creekside Cir

- 96 Creekside Cir

- 107 Creekside Cir

- 94 Creekside Cir

- 114 Creekside Cir

- 112 Creekside Cir

- 116 Creekside Cir

- 92 Creekside Cir

- 105 Creekside Cir

- 118 Creekside Cir

- 120 Creekside Cir

- 333 Sneden Place W

- 103 Creekside Cir

- 101 Creekside Cir