1040 Wesley Ln Union Point, GA 30669

Estimated Value: $182,983 - $261,000

--

Bed

--

Bath

1,288

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 1040 Wesley Ln, Union Point, GA 30669 and is currently estimated at $228,996, approximately $177 per square foot. 1040 Wesley Ln is a home with nearby schools including Greene County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2021

Sold by

Slt Holdings Llc

Bought by

Lumpkin Derrick and Lumpkin Elisa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,467

Outstanding Balance

$130,417

Interest Rate

2.88%

Mortgage Type

FHA

Estimated Equity

$98,579

Purchase Details

Closed on

Apr 15, 2014

Sold by

Smith Louis

Bought by

Slt Holdings Llc

Purchase Details

Closed on

Jul 16, 2004

Sold by

Bryan Charles Earl

Bought by

Smith Louis--Sale Incl

Purchase Details

Closed on

Jan 1, 1987

Sold by

Smith W L

Bought by

Bryan Charles Earl

Purchase Details

Closed on

Jan 1, 1986

Sold by

Moon Moon W and Moon Evelyn

Bought by

Smith W L

Purchase Details

Closed on

Jan 1, 1973

Bought by

Moon Moon W and Moon Evelyn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lumpkin Derrick | $157,000 | -- | |

| Slt Holdings Llc | $40,000 | -- | |

| Smith Louis--Sale Incl | -- | -- | |

| Bryan Charles Earl | -- | -- | |

| Smith W L | -- | -- | |

| Moon Moon W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lumpkin Derrick | $143,467 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,388 | $72,560 | $4,160 | $68,400 |

| 2023 | $1,303 | $67,800 | $3,480 | $64,320 |

| 2022 | $1,225 | $58,880 | $2,680 | $56,200 |

| 2021 | $76 | $2,720 | $2,680 | $40 |

| 2020 | $61 | $1,760 | $1,720 | $40 |

| 2019 | $65 | $1,760 | $1,720 | $40 |

| 2018 | $65 | $1,760 | $1,720 | $40 |

| 2017 | $63 | $1,792 | $1,752 | $40 |

| 2016 | $63 | $1,792 | $1,752 | $40 |

| 2015 | $16 | $1,792 | $1,752 | $40 |

| 2014 | $19 | $916 | $876 | $40 |

Source: Public Records

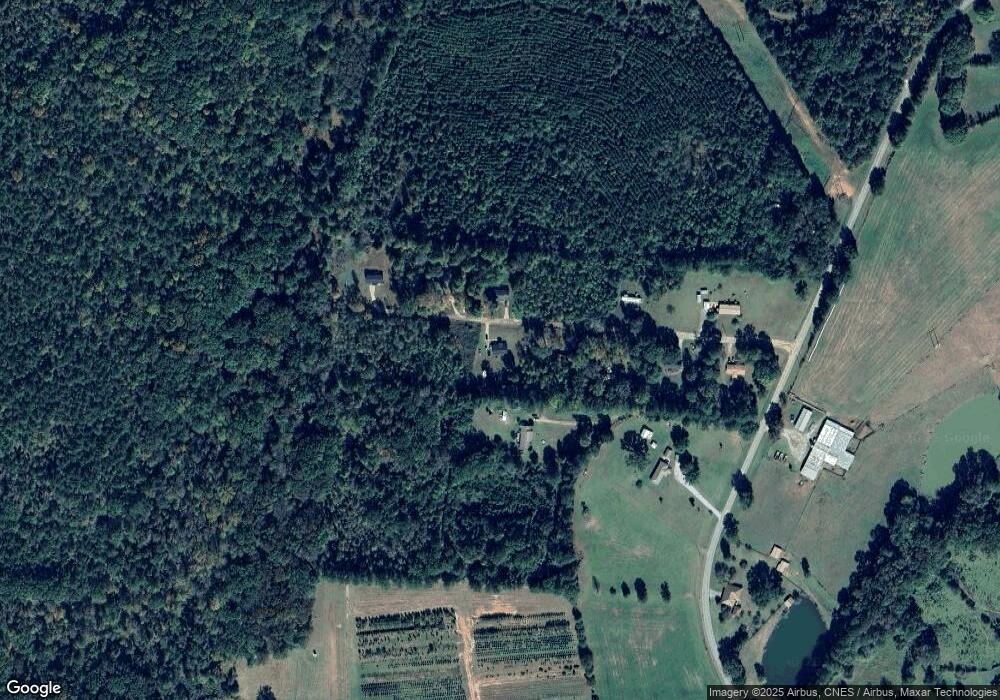

Map

Nearby Homes

- 1860 Washington Hwy

- 0 Woodland Ct Unit 10543600

- 215 Hunter St

- 324 N Rhodes St

- 202 Veazey St

- 0 Washington Hwy Unit 7276060

- 112 Hendry St

- 0 S Rhodes St Unit 10618488

- 1041 Hillcrest Dr

- 1241 Old Siloam Rd

- 1251 Adams Rd

- 5401 Union Point Hwy

- 1201 Buffalo Lick Rd

- 0 Buffalo Lick Rd Unit 10551234

- 0 Buffalo Lick Rd Unit 10551325

- 1581 Highway 77 S Hwy

- 1581 Highway 77 S

- 0 Old Union Point Rd Unit 1 10557753

- 1110 Woodland Ln

- 1110 Woodland Way

- 1030 Wesley Ln

- 1041 Wesley Rd

- 1041 Wesley Ln

- 2783 Temperance Bell Rd

- 1051 Wesley Ln

- 1020 Wesley Ln

- 1061 Wesley Ln

- 1010 Wesley Ln

- 2781 Temperance Bell Rd

- 2781 Temperence Bell Rd

- 2751 Temperence Bell Rd

- 2771 Temperence Bell Rd

- 2840 Temperance Bell Rd

- 2891 Temperence Bell Rd

- 2960 Temperance Bell Rd

- 1610 Washington Hwy

- 2980 Temperence Bell Rd

- 2590 Temperance Bell Rd

- 1491 Washington Hwy

- 1531 Washington Hwy