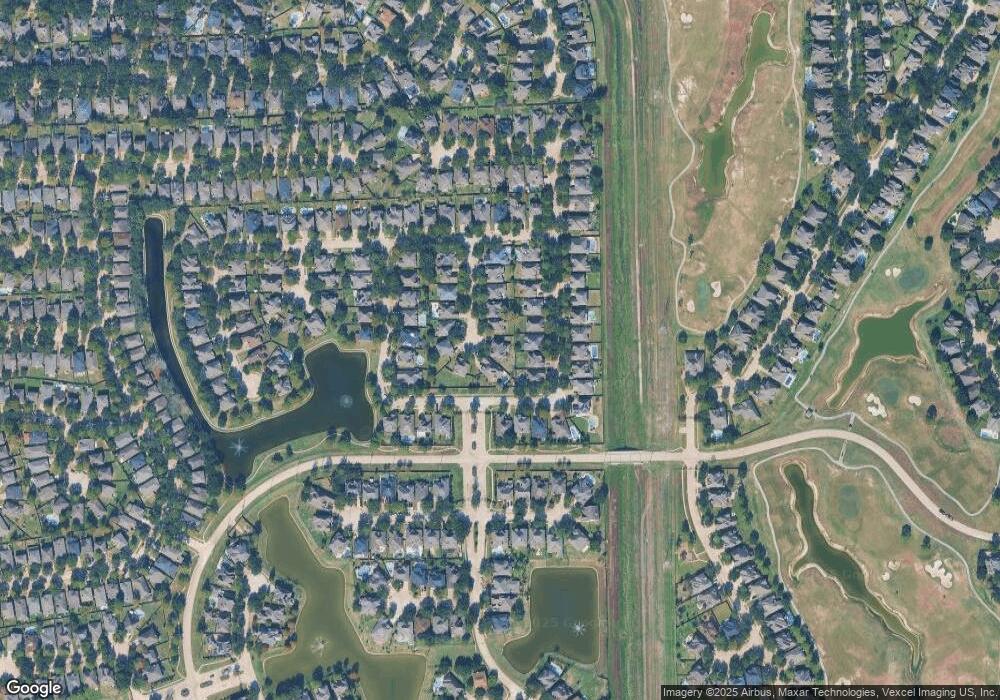

10406 Red Slate Ln Houston, TX 77095

Canyon Lakes at Stonegate NeighborhoodEstimated Value: $438,000 - $480,000

4

Beds

4

Baths

3,733

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 10406 Red Slate Ln, Houston, TX 77095 and is currently estimated at $458,785, approximately $122 per square foot. 10406 Red Slate Ln is a home located in Harris County with nearby schools including Woodard Elementary School, Aragon Middle School, and Langham Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2015

Sold by

Johnson Kirt and Johnson Jessica

Bought by

Spencer Gerald A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,550

Outstanding Balance

$208,326

Interest Rate

2.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$250,459

Purchase Details

Closed on

Dec 22, 2014

Sold by

Charles Ramsey and Charles Martha

Bought by

Johnson Kirt

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,950

Interest Rate

3%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jul 11, 2003

Sold by

First Texas Homes

Bought by

Charles Ramsey and Charles Martha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,777

Interest Rate

5.19%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spencer Gerald A | -- | Providence Title Co | |

| Johnson Kirt | -- | None Available | |

| Charles Ramsey | -- | Ticor Title Services |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Spencer Gerald A | $274,550 | |

| Previous Owner | Johnson Kirt | $247,950 | |

| Previous Owner | Charles Ramsey | $212,777 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,811 | $462,766 | $70,951 | $391,815 |

| 2024 | $6,811 | $464,456 | $70,951 | $393,505 |

| 2023 | $6,811 | $493,640 | $70,951 | $422,689 |

| 2022 | $8,479 | $418,532 | $54,605 | $363,927 |

| 2021 | $8,164 | $318,770 | $54,605 | $264,165 |

| 2020 | $7,859 | $294,437 | $42,084 | $252,353 |

| 2019 | $7,948 | $288,948 | $31,302 | $257,646 |

| 2018 | $2,808 | $275,023 | $31,302 | $243,721 |

| 2017 | $7,470 | $275,023 | $31,302 | $243,721 |

| 2016 | $7,470 | $275,023 | $31,302 | $243,721 |

| 2015 | $5,309 | $269,145 | $31,302 | $237,843 |

| 2014 | $5,309 | $230,890 | $31,302 | $199,588 |

Source: Public Records

Map

Nearby Homes

- 10402 Indian Paintbrush Ln

- 10327 Sablebrook Ln

- 17142 Kiowa River Ln

- 17018 Arrows Peak Ln

- 17219 S Summit Canyon Dr

- 10338 E Summit Canyon Dr

- 16715 Hibiscus Point Dr

- 16815 Morris Hill Ln

- 17219 Desert Maize Ln

- 16707 Vivian Point Ln

- 10615 Indian Paintbrush Ln

- 16726 Mallory Bridge Dr

- 10427 Lyndon Meadows Dr

- 16714 Mallory Bridge Dr

- 17227 Horsetooth Canyon Dr

- 16706 Mallory Bridge Dr

- 10531 Oleander Point Dr

- 10518 Lyndon Meadows Dr

- 17435 Prospect Meadows Dr

- 17438 Prospect Meadows Dr

- 10402 Red Slate Ln

- 10515 Badger Canyon Dr

- 10519 Badger Canyon Dr

- 10511 Badger Canyon Dr

- 10523 Badger Canyon Dr

- 10414 Red Slate Ln

- 10403 Red Slate Ln

- 10527 Badger Canyon Dr

- 10407 Red Slate Ln

- 10418 Red Slate Ln

- 10411 Red Slate Ln

- 10531 Badger Canyon Dr

- 10415 Red Slate Ln

- 17015 Muddy Spring Dr

- 17011 Muddy Spring Dr

- 10422 Red Slate Ln

- 10514 Badger Canyon Dr

- 10419 Red Slate Ln

- 10518 Badger Canyon Dr

- 17007 Muddy Spring Dr