Estimated Value: $667,000 - $806,000

4

Beds

2

Baths

2,278

Sq Ft

$316/Sq Ft

Est. Value

About This Home

This home is located at 10415 SW 136th Ct, Miami, FL 33186 and is currently estimated at $719,513, approximately $315 per square foot. 10415 SW 136th Ct is a home located in Miami-Dade County with nearby schools including Calusa Elementary School, Arvida Middle School, and Miami Killian Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2006

Sold by

Kelley Sean R and Kelley Yvonne Z

Bought by

Monsalve Luis and Monsalve Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,920

Interest Rate

7.55%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 5, 2004

Sold by

Johnson Guy L and Johnson Hildy E

Bought by

Kelley Sean R and Kelley Yvonne Z

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,600

Interest Rate

5.12%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 27, 2000

Sold by

Clifford and Junkins Fernanda

Bought by

Johnson Guy L and Johnson Hildy E

Purchase Details

Closed on

May 27, 1994

Sold by

Gonzalez Juan Gnacio and Gonzlaez Teresa

Bought by

Junkins Clifford and Junkins Fernanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,400

Interest Rate

8.46%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monsalve Luis | $449,900 | Attorney | |

| Kelley Sean R | $349,000 | -- | |

| Johnson Guy L | $182,700 | -- | |

| Junkins Clifford | $158,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Monsalve Luis | $359,920 | |

| Previous Owner | Kelley Sean R | $273,600 | |

| Previous Owner | Junkins Clifford | $126,400 | |

| Closed | Kelley Sean R | $34,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,364 | $264,038 | -- | -- |

| 2024 | $4,110 | $256,597 | -- | -- |

| 2023 | $4,110 | $249,124 | $0 | $0 |

| 2022 | $3,944 | $241,868 | $0 | $0 |

| 2021 | $3,913 | $234,824 | $0 | $0 |

| 2020 | $3,868 | $231,582 | $0 | $0 |

| 2019 | $3,786 | $226,376 | $0 | $0 |

| 2018 | $3,605 | $222,156 | $0 | $0 |

| 2017 | $3,573 | $217,587 | $0 | $0 |

| 2016 | $3,540 | $213,112 | $0 | $0 |

| 2015 | $3,580 | $211,631 | $0 | $0 |

| 2014 | $3,622 | $209,952 | $0 | $0 |

Source: Public Records

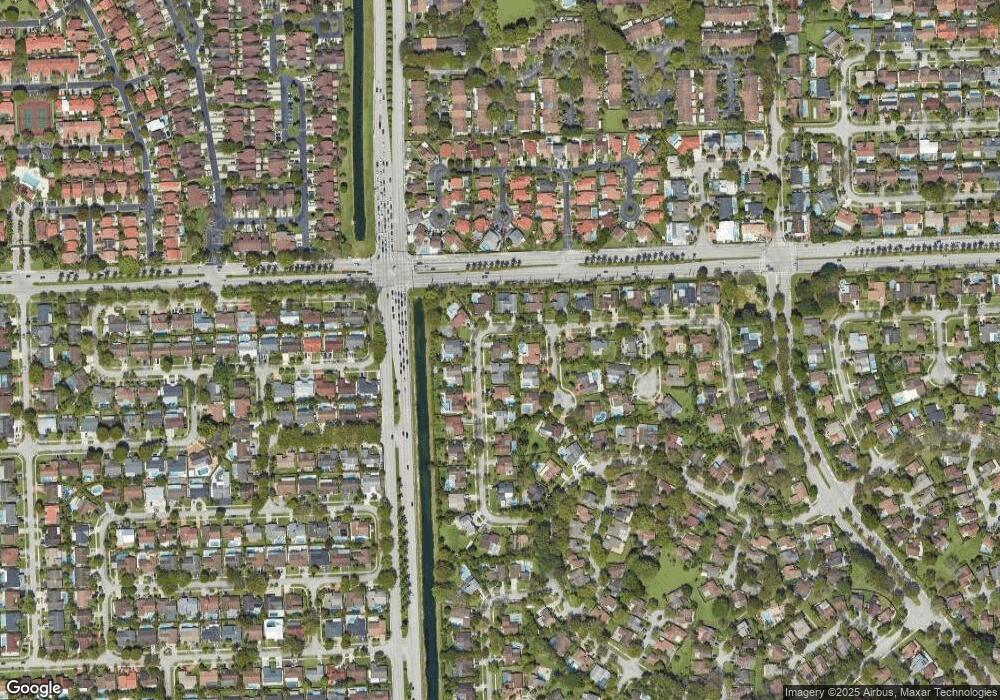

Map

Nearby Homes

- 10331 SW 135th Ct

- 13352 SW 108th Street Cir

- 10110 SW 137th Ct

- 13830 SW 108th St

- 13527 SW 101st Ln

- 13875 SW 102nd Ln

- 10091 SW 137th Place

- 13707 SW 100th Terrace

- 13912 SW 103rd Ln

- 13417 SW 101st Ln

- 10190 SW 138th Ct

- 13284 SW 108th Street Cir

- 10915 SW 134th Ct

- 11031 SW 138th Ave

- 13925 SW 107th Terrace

- 10923 SW 134th Ct

- 10290 SW 139th Ct

- 9922 SW 133rd Place

- 11006 SW 138th Place

- 10605 SW 132nd Ct

- 10505 SW 136th Ct

- 10410 SW 135th Ct

- 10500 SW 135th Ct

- 10515 SW 136th Ct

- 10410 SW 136th Ct

- 13605 SW 104th Terrace

- 13615 SW 104th Terrace

- 10500 SW 136th Ct

- 13525 SW 104th Terrace

- 10510 SW 135th Ct

- 10400 SW 136th Ct

- 10510 SW 136th Ct

- 10525 SW 136th Ct

- 13500 SW 104th Terrace

- 13515 SW 104th Terrace

- 10505 SW 135th Ct

- 10520 SW 136th Ct

- 10605 SW 136th Ct

- 10600 SW 135th Ct

- 13505 SW 104th Terrace Unit 1