10465 N State Route 48 Covington, OH 45318

Estimated Value: $675,000 - $814,750

4

Beds

4

Baths

2,708

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 10465 N State Route 48, Covington, OH 45318 and is currently estimated at $732,438, approximately $270 per square foot. 10465 N State Route 48 is a home located in Miami County with nearby schools including Covington Elementary/Junior High School, Covington Junior High School, and Covington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2020

Sold by

Cozad Adam L and Cozad Amber S

Bought by

Rose Michael D and Rose Monica M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$428,000

Outstanding Balance

$380,519

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$351,919

Purchase Details

Closed on

Oct 13, 2016

Sold by

Rieman Duane D and Rieman Hali L

Bought by

Cozad Adam and Cozad Amber

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 10, 2014

Sold by

Bruns Construction Enterprises Inc

Bought by

Rieman Duane D and Rieman Hali L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,964

Interest Rate

4.54%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rose Michael D | $560,000 | None Available | |

| Cozad Adam | $460,000 | Jb Title Company | |

| Rieman Duane D | $422,500 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rose Michael D | $428,000 | |

| Previous Owner | Cozad Adam | $360,000 | |

| Previous Owner | Rieman Duane D | $337,964 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,571 | $225,830 | $43,720 | $182,110 |

| 2023 | $7,571 | $225,830 | $43,720 | $182,110 |

| 2022 | $7,669 | $225,830 | $43,720 | $182,110 |

| 2021 | $6,317 | $149,020 | $8,950 | $140,070 |

| 2020 | $5,416 | $149,020 | $8,950 | $140,070 |

| 2019 | $5,400 | $149,020 | $8,950 | $140,070 |

| 2018 | $4,417 | $123,840 | $9,880 | $113,960 |

| 2017 | $4,505 | $123,840 | $9,880 | $113,960 |

| 2016 | $3,991 | $114,500 | $9,880 | $104,620 |

| 2015 | $4,125 | $108,530 | $9,830 | $98,700 |

| 2014 | $4,125 | $108,530 | $9,830 | $98,700 |

| 2013 | $134 | $3,710 | $3,710 | $0 |

Source: Public Records

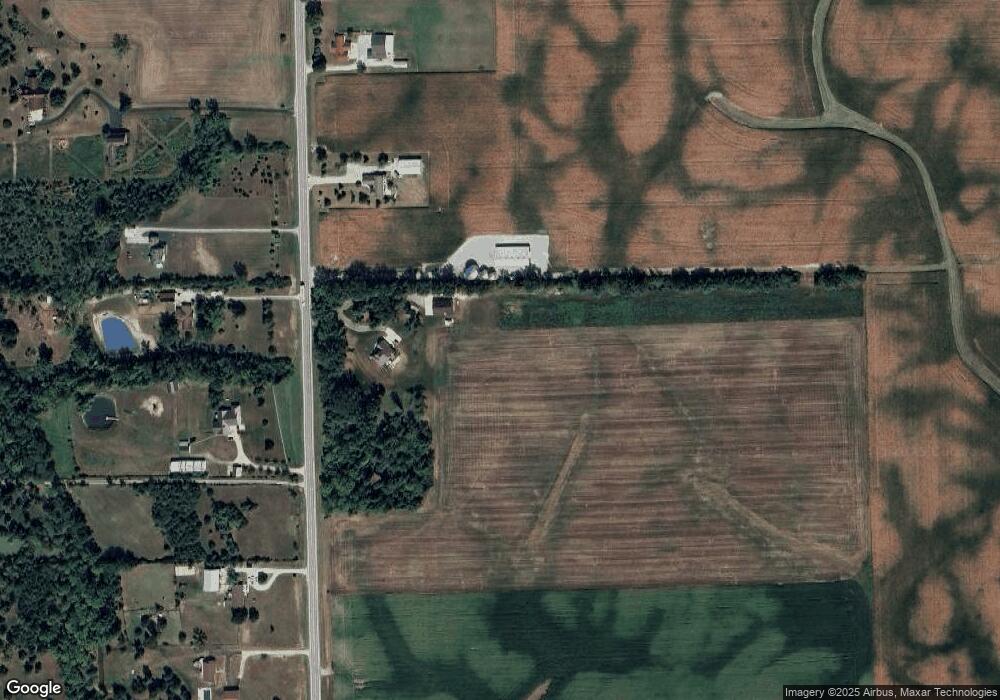

Map

Nearby Homes

- 5882 W Versailles Rd

- 6110 Ohio 185

- 2165 Stillwater Rd

- Russia-Versailles Rd

- 7648 Piqua-Clayton Rd

- 4528 W State Route 185

- 4510 W State Route 185

- 731 N Pearl St

- 520 N Pearl St

- 501 N Main St Unit C1

- 8490 Bennett Dr

- 698 E Broadway St

- 513 Spotted Doe Trail

- 1337 Stratford Dr

- 133 W Broadway St

- 271 N Ludlow St

- 124 N Main St

- 9145 W US Route 36

- 3 Lake Ridge Dr

- 1821 Wilshire Dr

- 10465 Ohio 48

- 10525 N State Route 48

- 10380 N State Route 48

- 10581 N State Route 48

- 10470 N State Route 48

- 10488 N State Route 48

- 10605 Ohio 48

- 10605 N State Route 48

- 10300 N State Route 48

- 10488 Ohio 48

- 10380 Ohio 48

- 10665 N State Route 48

- 10260 N State Route 48

- 10564 Ohio 48

- 10564 Ohio 48

- 10564 N State Route 48

- 10210 N State Route 48

- 10775 N State Route 48

- 10610 N State Route 48

- 10330 N State Route 48