1047 Grand Oaks Dr Unit 11A Hoover, AL 35022

Estimated Value: $573,000 - $710,000

4

Beds

4

Baths

3,921

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 1047 Grand Oaks Dr Unit 11A, Hoover, AL 35022 and is currently estimated at $654,174, approximately $166 per square foot. 1047 Grand Oaks Dr Unit 11A is a home located in Shelby County with nearby schools including South Shades Crest Elementary School, Brock's Gap Intermediate School, and Robert F. Bumpus Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2020

Sold by

Smith Ernest L and Smith Mistry R

Bought by

Fargason Dedra Denee and Fargason Russell

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$436,056

Outstanding Balance

$385,559

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$268,615

Purchase Details

Closed on

Mar 30, 2018

Sold by

Bliss Sandra L

Bought by

Smith Ernest L and Smith Mistry R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,000

Interest Rate

4.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 8, 2012

Sold by

Bliss Robert B

Bought by

Bliss Sandra L

Purchase Details

Closed on

May 30, 2008

Sold by

Trinity Homes Llc

Bought by

Bliss Robert B and Floyd Sandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 30, 2006

Sold by

Genesis Group Llc

Bought by

Trinity Homes Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fargason Dedra Denee | $460,000 | None Available | |

| Smith Ernest L | $495,000 | None Available | |

| Bliss Sandra L | -- | None Available | |

| Bliss Robert B | $599,900 | None Available | |

| Trinity Homes Llc | $115,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fargason Dedra Denee | $436,056 | |

| Previous Owner | Smith Ernest L | $337,000 | |

| Previous Owner | Bliss Robert B | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,917 | $58,900 | $0 | $0 |

| 2023 | $3,959 | $60,000 | $0 | $0 |

| 2022 | $3,636 | $55,300 | $0 | $0 |

| 2021 | $3,158 | $48,100 | $0 | $0 |

| 2020 | $3,687 | $56,060 | $0 | $0 |

| 2019 | $3,555 | $54,080 | $0 | $0 |

| 2017 | $3,453 | $52,540 | $0 | $0 |

| 2015 | $3,530 | $53,700 | $0 | $0 |

| 2014 | $3,203 | $48,780 | $0 | $0 |

Source: Public Records

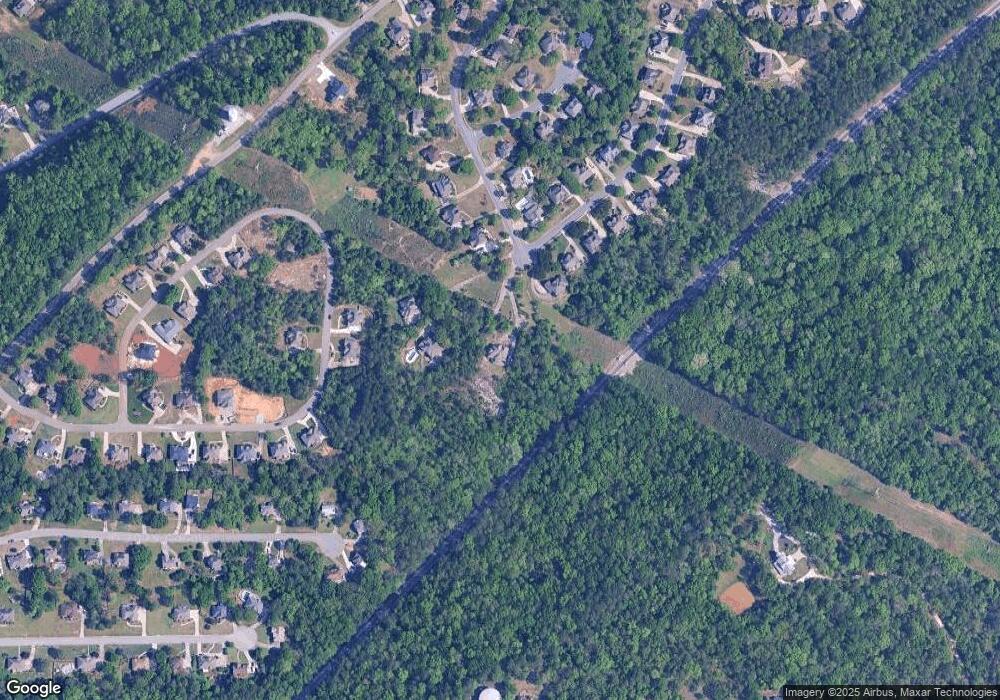

Map

Nearby Homes

- 1056 Asbury Cir

- 1069 Asbury Park Cir Unit 139

- 1079 Asbury Cir

- 4653 S Shades Crest Rd

- 4915 S Shades Crest Rd Unit A

- 1046 Laurel Lakes Dr

- 4586 S Shades Crest Rd

- 205 Chestnut Forest Dr

- 2009 Laurel Lakes Ln

- 3125 Laurel Lakes Cove Unit 321

- 7293 Bayberry Rd

- 2043 Laurel Lakes Ln Unit 115

- 173 Jonagold Rd Unit 30

- 4037 Laurel Lakes Way

- 4045 Laurel Lakes Way

- 4740 S Shades Crest Rd

- 2689 Hawthorne Lake Rd

- 3031 Laurel Lakes Cove Unit 1

- 2559 Highway 93

- 1681 Highway 93

- 1047 Grand Oaks Dr

- 1043 Grand Oaks Dr Unit 10

- 1043 Grand Oaks Dr

- 1051 Grand Oaks Dr

- 1051 Grand Oaks Dr

- 1051 Grand Oaks Dr Unit 12

- 1039 Grand Oaks Dr

- 1039 Grand Oaks Dr

- 1035 Grand Oaks Dr

- 1055 Grand Oaks Dr

- 1032 Grand Oaks Dr

- 1052 Asbury Cir

- 1059 Grand Oaks Dr

- 1031 Grand Oaks Dr

- 1056 Asbury Cir Unit 113

- 1058 Grand Oaks Dr

- 1027 Grand Oaks Dr

- 1063 Grand Oaks Dr

- 1028 Grand Oaks Dr

- 1062 Grand Oaks Dr