10472 Mill St Trimble, OH 45782

Estimated Value: $66,000 - $120,000

2

Beds

1

Bath

1,099

Sq Ft

$81/Sq Ft

Est. Value

About This Home

This home is located at 10472 Mill St, Trimble, OH 45782 and is currently estimated at $88,660, approximately $80 per square foot. 10472 Mill St is a home with nearby schools including Trimble Elementary School, Trimble Middle School, and Trimble High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 1, 2021

Sold by

Riley Joshua

Bought by

Graf Bryon

Current Estimated Value

Purchase Details

Closed on

Oct 2, 2018

Sold by

Graf Bryon and Graf Bryon

Bought by

Riley Joshuha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

3.6%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 19, 2012

Sold by

Brooks William E

Bought by

Hammel Daniel

Purchase Details

Closed on

Dec 5, 2005

Sold by

Bank Of New York

Bought by

Graf Byron and Brooks William E

Purchase Details

Closed on

Jul 25, 2005

Sold by

Smith Phyllis J

Bought by

Bank Of New York

Purchase Details

Closed on

Aug 6, 1993

Sold by

Smith Richard M and Smith Phyllis

Bought by

Smith Phyllis J

Purchase Details

Closed on

Oct 1, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Graf Bryon | -- | None Available | |

| Riley Joshuha | $500,000 | None Available | |

| Hammel Daniel | -- | Attorney | |

| Graf Byron | $4,000 | Resource Title Agency Inc | |

| Bank Of New York | $1,667 | None Available | |

| Smith Phyllis J | -- | -- | |

| -- | $13,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Riley Joshuha | $40,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $144 | $2,960 | $290 | $2,670 |

| 2023 | $141 | $2,960 | $290 | $2,670 |

| 2022 | $139 | $2,800 | $260 | $2,540 |

| 2021 | $527 | $10,410 | $260 | $10,150 |

| 2020 | $509 | $10,410 | $260 | $10,150 |

| 2019 | $491 | $9,600 | $230 | $9,370 |

| 2018 | $535 | $9,600 | $230 | $9,370 |

| 2017 | $733 | $9,600 | $230 | $9,370 |

| 2016 | $511 | $8,930 | $230 | $8,700 |

| 2015 | $677 | $8,930 | $230 | $8,700 |

| 2014 | $677 | $8,930 | $230 | $8,700 |

| 2013 | $528 | $7,810 | $220 | $7,590 |

Source: Public Records

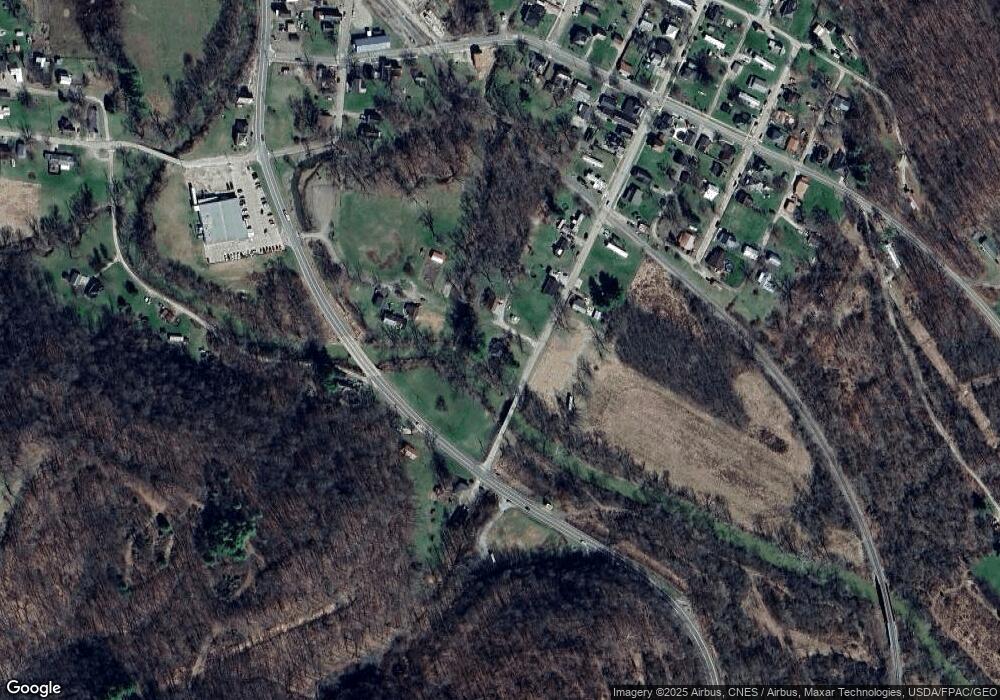

Map

Nearby Homes

- 10473 Mill St

- 10482 Valley St

- 10502 Valley St

- 19397 Lake Dr

- 10605 Sycamore St

- 19415 Lake Dr

- 19438 Walnut St

- 19427 Maple St

- 19448 Walnut St

- 19457 Walnut St

- 19436 Maple St

- 10589 Valley St

- 25 Congress St

- 19467 Walnut St

- 19457 Maple St

- 19468 Walnut St

- 31 Congress St

- 7 Congress St

- 10588 Valley St

- 19509 Congress St