105 Flatrock Pastures Unit 1C Cramerton, NC 28032

Estimated Value: $490,000 - $514,000

4

Beds

4

Baths

2,641

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 105 Flatrock Pastures Unit 1C, Cramerton, NC 28032 and is currently estimated at $504,943, approximately $191 per square foot. 105 Flatrock Pastures Unit 1C is a home located in Gaston County with nearby schools including New Hope Elementary School, Cramerton Middle School, and Forestview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2018

Sold by

Seabrook William B and Seabrook Elizabeth C

Bought by

Maclaren Kristina Caidwell

Current Estimated Value

Purchase Details

Closed on

Jun 26, 2014

Sold by

Hawkins Theo H

Bought by

Seabrook William B and Seabrook Elizabeth C

Purchase Details

Closed on

Nov 5, 2007

Sold by

Kircus Clifford and Kircus Marjorie H

Bought by

Hawkins Frank M and Hawkins Theo H

Purchase Details

Closed on

Sep 6, 2005

Sold by

Sumner Jacqueline D and Sumner Michael D

Bought by

Kircus Clifford and Kircus Marjorie H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.64%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maclaren Kristina Caidwell | $310,000 | None Available | |

| Seabrook William B | $229,000 | Chicago Title Insurance Co | |

| Hawkins Frank M | $330,000 | None Available | |

| Kircus Clifford | $243,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kircus Clifford | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,587 | $445,740 | $0 | $445,740 |

| 2024 | $4,609 | $445,740 | $0 | $445,740 |

| 2023 | $4,703 | $445,740 | $0 | $445,740 |

| 2022 | $3,616 | $281,430 | $0 | $281,430 |

| 2021 | $3,673 | $281,430 | $0 | $281,430 |

| 2019 | $3,701 | $281,430 | $0 | $281,430 |

| 2018 | $3,216 | $239,118 | $20,000 | $219,118 |

| 2017 | $3,216 | $239,118 | $20,000 | $219,118 |

| 2016 | $3,216 | $239,118 | $0 | $0 |

| 2014 | $3,401 | $252,887 | $20,000 | $232,887 |

Source: Public Records

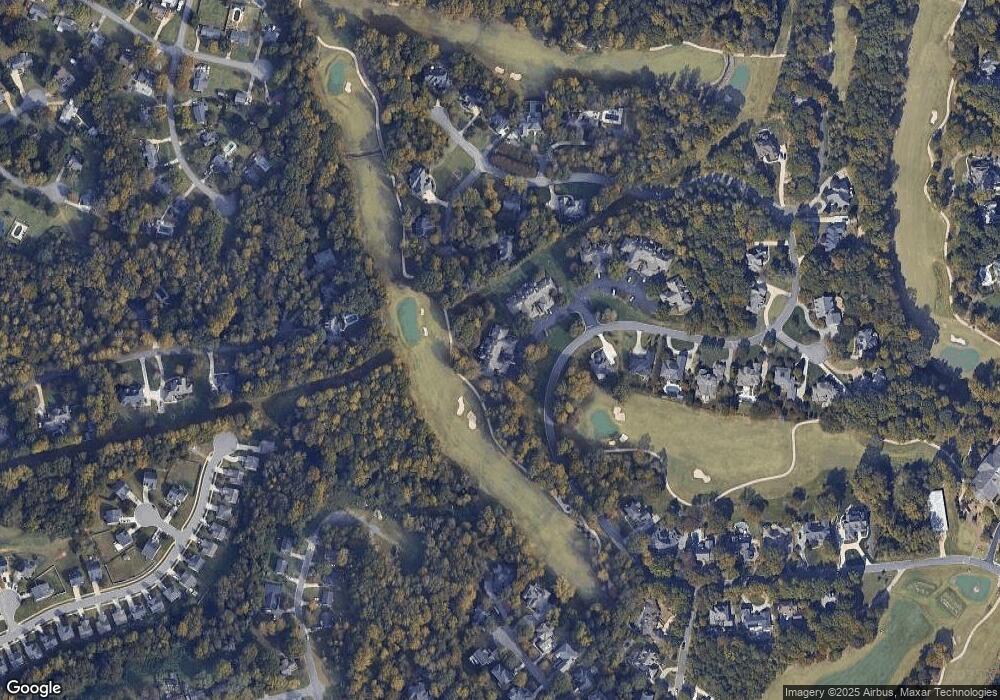

Map

Nearby Homes

- 501 Maymont Dr

- 4700 Misty Hill Ln

- 506 King Arthur Dr

- 3536 Canyon Live Oak Ct

- 204 Keyhole Ct

- 223 Mays Mills Dr Unit 28

- 214 Mays Mills Dr

- 221 Mays Mills Dr Unit 27

- 415 Newstyle Way

- 413 Newstyle Way

- 411 Newstyle Way

- 409 Newstyle Way

- 407 Newstyle Way

- 2909 Dodsworth Dr

- 405 Newstyle Way

- 3338 Cord Oak Ct

- 203 Vanguard Ln Unit 14

- 201 Vanguard Ln Unit 13

- Melton Plan at Cramerton Mills - The Terraces

- Melton Basement Plan at Cramerton Mills - The Terraces

- 103 Flatrock Pastures Unit 1B

- 107 Flatrock Pastures Unit 1D

- 101 Flatrock Pastures

- 109 Flatrock Pastures Unit 2A

- 109 Flatrock Pastures Unit 1

- 111 Flatrock Pastures

- 113 Flatrock Pastures Unit 2C

- 113 Flatrock Pastures Unit 113

- 115 Flatrock Pastures Unit 2D

- 612 Ellis Ct

- 611 Ellis Ct

- 120 Hidden Pastures Dr

- 201 Flatrock Pastures None Unit A

- 201 Flatrock Pastures Unit 3A

- 610 Ellis Ct

- 1027 Dan Maples Dr

- 122 Hidden Pastures Dr

- 203 Flatrock Pastures Unit 203

- 1023 Dan Maples Dr

- 146 Carrie Elizabeth Ct