105 Running Bear Trail Decatur, TX 76234

Estimated Value: $706,000 - $798,000

4

Beds

4

Baths

3,795

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 105 Running Bear Trail, Decatur, TX 76234 and is currently estimated at $743,560, approximately $195 per square foot. 105 Running Bear Trail is a home located in Wise County with nearby schools including Decatur High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 3, 2019

Sold by

Muehlstein Aaron and Muehlstein Julie

Bought by

Hensarling Curtis E and Hensarling Melody A

Current Estimated Value

Purchase Details

Closed on

Aug 7, 2017

Sold by

Chambers Landon and Chambers Britney B

Bought by

Hensarling Curtis E and Hensarling Melody

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$415,437

Interest Rate

3.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 27, 2012

Sold by

Dailey Gary L and Dailey Tracy B

Bought by

Chambers Landon and Chambers Britny B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,742

Interest Rate

3.61%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 4, 2010

Sold by

H -2 Development Inc

Bought by

Dailey Gary L and Dailey Tracy B

Purchase Details

Closed on

Dec 1, 2003

Sold by

H2 Development Inc

Bought by

Chambers Landon and Chambers Britney

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hensarling Curtis E | -- | Guardian Title Co | |

| Hensarling Curtis E | -- | Guardian Title Co | |

| Chambers Landon | -- | Guardian Title Co | |

| Dailey Gary L | -- | -- | |

| Chambers Landon | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hensarling Curtis E | $415,437 | |

| Previous Owner | Chambers Landon | $275,742 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,139 | $685,693 | $43,111 | $642,582 |

| 2024 | $7,139 | $688,712 | $43,111 | $645,601 |

| 2023 | $7,564 | $626,116 | $0 | $0 |

| 2022 | $8,421 | $548,773 | $0 | $0 |

| 2021 | $7,997 | $498,880 | $61,840 | $437,040 |

| 2020 | $8,180 | $507,030 | $87,520 | $419,510 |

| 2019 | $8,293 | $482,630 | $81,680 | $400,950 |

| 2018 | $8,115 | $457,170 | $66,130 | $391,040 |

| 2017 | $6,374 | $359,080 | $52,880 | $306,200 |

| 2016 | $5,954 | $335,420 | $52,880 | $282,540 |

| 2015 | -- | $335,420 | $52,880 | $282,540 |

| 2014 | -- | $313,480 | $46,700 | $266,780 |

Source: Public Records

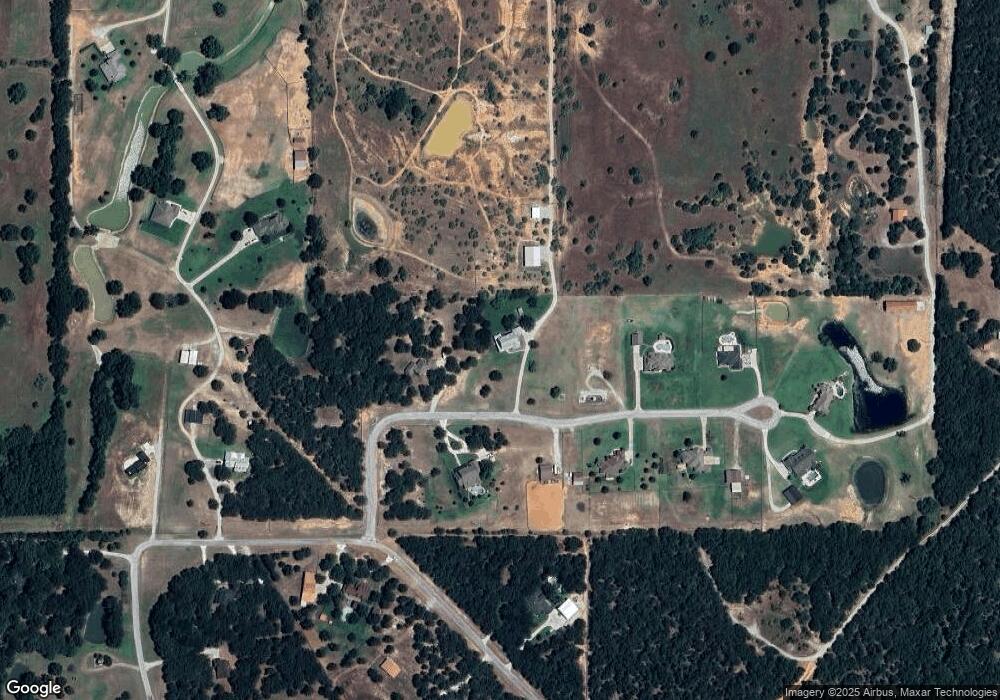

Map

Nearby Homes

- 258 W Ridge St

- 286 W Ridge St

- 159 Rio Rancho Dr

- 189 Rio Rancho Dr

- 0 Hlavek Rd

- 263 Eastridge Rd

- 209 Rio Rancho Dr

- 206 Rio Rancho Dr

- 112 La Paloma Way

- 141 Mission Oak Trail

- 131 San Miguel Dr

- 996 Hlavek Rd

- 1674 Cuba Rd

- 516 Wild Wood Dr

- 0000 Hlavek Rd

- 2012 Cuba Rd

- 1802 Hlavek Rd

- 910 County Road 1111

- 1117 Acorn Dr

- 1121 Acorn Dr

- 101 Running Bear Trail

- 104 Running Bear Trail

- 113 Running Bear Trail

- 150 Rain Dance Trail

- 121 Rain Dance Trail

- 150 Rain Dance Trail

- 172 Rain Dance Tr

- 300 Little Wolf Trail

- 4473 Us Highway 380

- 4473 E Highway 380

- 708 Indian Trail

- 112 Running Bear Trail

- 1156 Honeybear Ln

- 696 Indian Trail

- 301 Little Wolf Trail

- 116 Running Bear Trail

- 121 Running Bear Trail

- 120 Running Bear Trail

- 628 Indian Trail

- 201 Little Wolf Trail