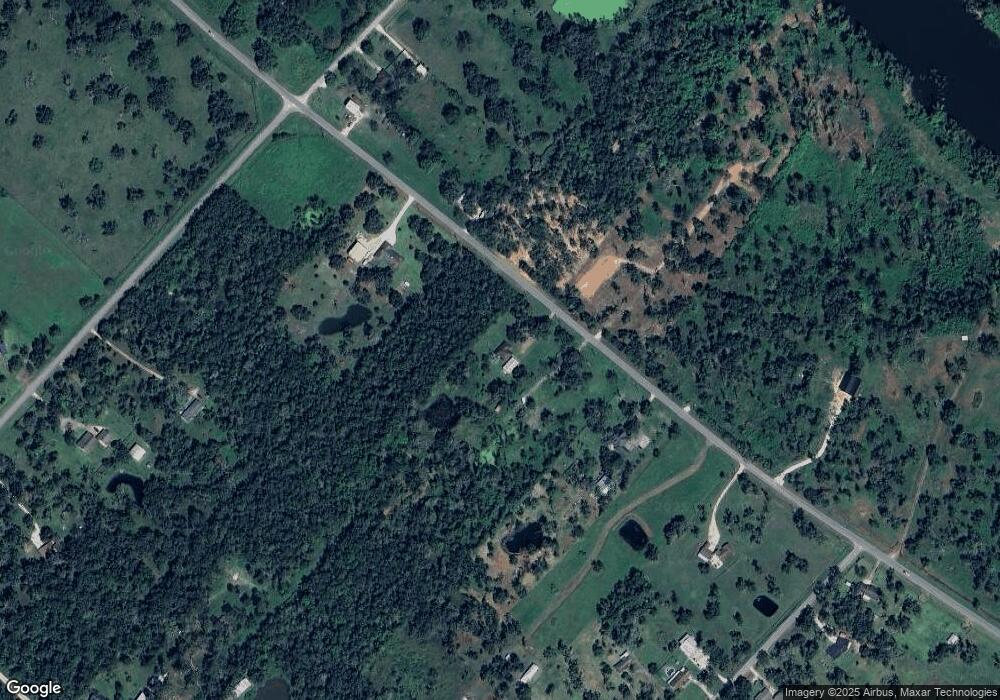

10507 County Road 400 Brazoria, TX 77422

Estimated Value: $431,444

--

Bed

--

Bath

--

Sq Ft

4

Acres

About This Home

This home is located at 10507 County Road 400, Brazoria, TX 77422 and is currently estimated at $431,444. 10507 County Road 400 is a home located in Brazoria County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2013

Sold by

Freedom Mortgage Corp

Bought by

Secretary Of Hud

Current Estimated Value

Purchase Details

Closed on

Mar 23, 2009

Sold by

Gay Wendell K and Gay Shannon

Bought by

Freedom Mortgage Corp

Purchase Details

Closed on

May 23, 2007

Sold by

Veterans Land Board Of The State Of Tx

Bought by

Mcqueen Troy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,557

Interest Rate

6.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 11, 2007

Sold by

Mcqueen Troy and Mcqueen Tina M

Bought by

Gay Wendell K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,557

Interest Rate

6.13%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Secretary Of Hud | -- | None Available | |

| Freedom Mortgage Corp | $192,918 | None Available | |

| Mcqueen Troy | $20,000 | American Title Company | |

| Gay Wendell K | -- | American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gay Wendell K | $182,557 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,048 | $74,800 | $74,800 | -- |

| 2023 | $1,048 | $74,800 | $74,800 | $0 |

| 2022 | $1,042 | $66,000 | $66,000 | $0 |

| 2021 | $1,106 | $66,000 | $66,000 | $0 |

| 2020 | $1,184 | $66,000 | $66,000 | $0 |

| 2019 | $967 | $52,800 | $52,800 | $0 |

| 2018 | $812 | $44,000 | $44,000 | $0 |

| 2017 | $573 | $30,720 | $30,720 | $0 |

| 2016 | $573 | $30,720 | $30,720 | $0 |

| 2015 | $880 | $25,600 | $25,600 | $0 |

| 2014 | $880 | $45,970 | $31,200 | $14,770 |

Source: Public Records

Map

Nearby Homes

- 338 County Road 912a

- 10186 County Road 400

- 549 E New York St

- 706 E New York St

- 441 County Road 849

- 519 County Road 849

- 4773 County Road 652

- 145

- 409 Carlton St

- 0 Travis St

- 411 Travis St

- 0 Pearl St

- 401 E Texas St

- 0 N Market St

- 310 E Texas St

- 307 Avenue G

- 0 Austin St

- 110 Millican St

- 230 E New York St

- 0 Spencer St

- 10507 County Road 400

- 10489 County Road 400

- 10477 County Road 400

- 10553 County Road 400

- 10439 County Road 400

- 4352 County Road 400

- 4338 County Road 400

- 4247 County Road 400

- 4258 County Road 400

- 00 County Road 400

- 244a Old River Rd

- 302 County Road 912

- 226 County Road 912

- 0 County Road 762

- 310 County Road 912

- 324 County Road 912

- 268 County Road 762

- 334 County Road 912

- 213 County Road 912

- 10347 County Road 400