10514 N 44th West Ave Sperry, OK 74073

Estimated Value: $263,000 - $434,000

2

Beds

1

Bath

1,600

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 10514 N 44th West Ave, Sperry, OK 74073 and is currently estimated at $350,534, approximately $219 per square foot. 10514 N 44th West Ave is a home located in Osage County with nearby schools including Sperry Elementary School, Sperry Middle School, and Sperry High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2021

Sold by

Havellana Robert and Richardson Debra Jo

Bought by

Richardon Debra Jo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,962

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 28, 2018

Sold by

Worsham David C and Worsham Sharon S

Bought by

Havellana Robert and Havellana Debta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$257,962

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 24, 2007

Sold by

Rocklin Mare S and Revoc Susan C

Bought by

Smith Joanna Leigh

Purchase Details

Closed on

Nov 5, 2004

Sold by

Rocklin Marc S and Rocklin Susan C

Bought by

Rocklin Marc S and Rev~Living Susan C

Purchase Details

Closed on

Nov 13, 2001

Sold by

Freeman Linda Kay

Bought by

Rocklin Marc S and Rocklin Susan C

Purchase Details

Closed on

Jun 3, 1999

Sold by

Schulte Patrick J and Schulte Michelle R

Bought by

Freeman Paul Wayne and Freeman Rev Liv

Purchase Details

Closed on

Aug 7, 1997

Sold by

Barnett John Ronald

Bought by

Schulte Patrick J and Schulte Michelle R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richardon Debra Jo | $500 | None Available | |

| Richardson Debra Jo | $500 | None Listed On Document | |

| Havellana Robert | $260,000 | -- | |

| Smith Joanna Leigh | $102,500 | -- | |

| Rocklin Marc S | -- | -- | |

| Rocklin Marc S | $150,000 | -- | |

| Freeman Paul Wayne | $135,000 | -- | |

| Schulte Patrick J | $120,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Richardson Debra Jo | $254,962 | |

| Previous Owner | Havellana Robert | $257,962 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,147 | $19,721 | $1,381 | $18,340 |

| 2024 | $2,052 | $18,867 | $1,341 | $17,526 |

| 2023 | $2,052 | $17,124 | $741 | $16,383 |

| 2022 | $1,801 | $16,625 | $741 | $15,884 |

| 2021 | $1,738 | $16,141 | $741 | $15,400 |

| 2020 | $1,690 | $15,671 | $741 | $14,930 |

| 2019 | $1,710 | $15,671 | $741 | $14,930 |

| 2018 | $1,709 | $15,671 | $741 | $14,930 |

| 2017 | $1,663 | $15,671 | $741 | $14,930 |

| 2016 | $1,631 | $15,444 | $741 | $14,703 |

| 2015 | $1,589 | $15,310 | $741 | $14,569 |

| 2014 | $1,561 | $14,970 | $741 | $14,229 |

| 2013 | $1,516 | $14,534 | $741 | $13,793 |

Source: Public Records

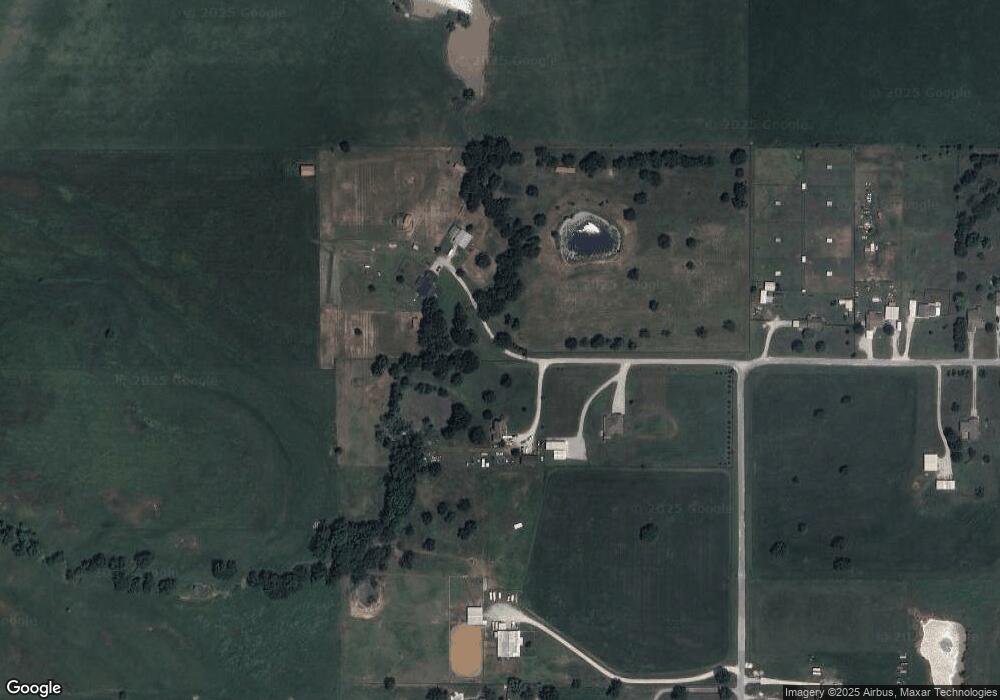

Map

Nearby Homes

- 11375 Forest View Ln

- 11339 Forest View Ln

- 11314 Scissortail Rd

- 9858 N 38 Ave W

- 0 N 36th West Ave

- 10044 N 30th West Ave

- 2744 W 103rd St N

- 0 N 52nd West Ave

- 10 N 52nd West Ave

- 4812 E 76th

- 6146 W 108th St N

- 10739 N 25th West Ave

- 0 W 52nd Ave W Unit 2535302

- 6211 W 91st St N

- 11860 N 68th West Ave

- 2781 W 88th St N

- 9026 Crestwood Dr

- 8222 W 118th St N

- 8306 N 52nd West Ave

- 1819 W Oak Knoll

- 4665 W 103rd St N

- 10662 N 44th West Ave

- 10680 N 44th West Ave

- 10644 N 44th West Ave

- 10644 N 44th West Ave

- 0 N 44th West Ave

- 10662 N 44th Ave W

- 10690 N 44th West Ave

- 14143 N 44th West Ave

- 0 103rd St N Unit 201309

- 0 103rd St N Unit 514878

- 0 103rd St N Unit 918321

- 0 103rd St N Unit 1547578

- 0 103rd St N Unit 1814459

- 0 103rd St N Unit 1839634

- 0 103rd St N Unit 2038606

- 0 W 107th St N

- 4381 N 107th Ave W

- 4381 W 107th St N