Estimated Value: $1,013,642

--

Bed

--

Bath

--

Sq Ft

0.43

Acres

About This Home

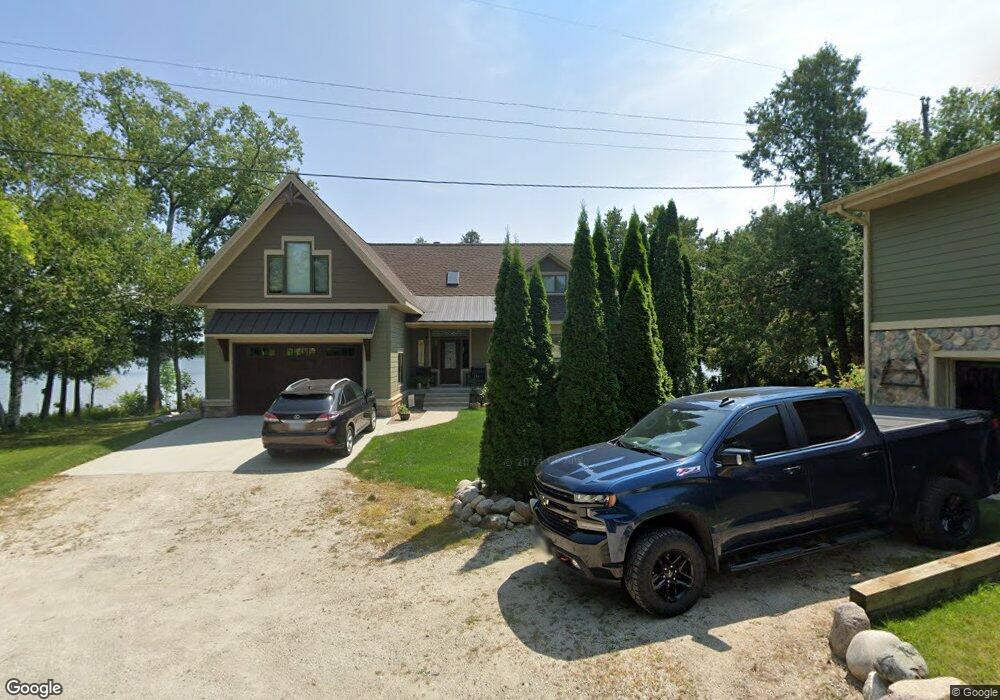

This home is located at 10518 Paradise Ln, Kiel, WI 53042 and is currently estimated at $1,013,642. 10518 Paradise Ln is a home located in Manitowoc County with nearby schools including Zielanis Elementary School, Kiel Middle School, and Kiel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2010

Sold by

Koenigs Nancy J

Bought by

Hadley Robert E and Hadley Betsy A

Current Estimated Value

Purchase Details

Closed on

May 4, 2007

Sold by

Oldenburg Robert K

Bought by

Hadley Robert E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,920

Interest Rate

6.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 3, 2007

Sold by

Oldenburg Robert and Oldenburg Mary

Bought by

Hadley Robet E and Hadley Betsy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,920

Interest Rate

6.21%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hadley Robert E | $66,000 | None Available | |

| Hadley Robert E | $349,900 | -- | |

| Hadley Robet E | $349,900 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hadley Robert E | $279,920 | |

| Previous Owner | Hadley Robet E | $279,920 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,039 | $572,700 | $169,000 | $403,700 |

| 2023 | $11,014 | $572,700 | $169,000 | $403,700 |

| 2022 | $9,906 | $572,700 | $169,000 | $403,700 |

| 2021 | $10,207 | $572,700 | $169,000 | $403,700 |

| 2020 | $9,383 | $535,100 | $169,000 | $366,100 |

| 2019 | $4,866 | $269,800 | $169,000 | $100,800 |

| 2018 | $5,104 | $301,200 | $169,000 | $132,200 |

| 2017 | $5,115 | $301,200 | $169,000 | $132,200 |

| 2016 | $5,112 | $301,200 | $169,000 | $132,200 |

| 2015 | $5,187 | $301,200 | $169,000 | $132,200 |

| 2014 | -- | $301,200 | $169,000 | $132,200 |

| 2013 | $5,662 | $301,200 | $169,000 | $132,200 |

Source: Public Records

Map

Nearby Homes

- 10528 Sunny Vista Ln

- 0 Cedar Lake Rd

- 0 Louis Corners Rd

- 105 Douglas Ct

- 104 S 1st Ave

- 18135 Klemme Rd

- 14595 Louis Corners Rd

- 15816 Lincoln Rd

- 11215 Spring Lake Rd

- 7308 Tompkins Rd

- Lt4 Senn Ln

- 23402 Fish And Game Rd

- N/A W Washington Rd

- 14115 Pigeon River Rd

- 458 Jasper Ct Unit A

- Lt1 Carstens Lake Rd

- Lt2 Carstens Lake Rd

- 6831 Marken Rd

- 24020 Fish And Game Rd

- 15324 Horseshoe Lake Rd

- 10512 Paradise Ln

- 10524 Glen Flora Rd

- 10506 Paradise Ln

- 10531 Glen Flora Rd

- 10611 Glen Flora Rd

- 10434 Paradise Ln

- 10424 Paradise Ln

- 10615 Glen Flora Rd

- 10414 Paradise Ln

- 10622 Glen Flora Rd

- 10627 Glen Flora Rd

- 10408 Paradise Ln

- 10626 Glen Flora Rd

- 10336 Paradise Ln

- 10425 Glen Flora Rd

- 10330 Paradise Ln

- 19802 Kunish Ln

- 10393 Glen Flora Rd

- 19813 Kunish Ln

- 19817 Kunish Ln