10537 Wash Palm Way Unit 4113 Fort Myers, FL 33966

Heritage Palms NeighborhoodEstimated Value: $340,262 - $404,000

2

Beds

2

Baths

1,333

Sq Ft

$279/Sq Ft

Est. Value

About This Home

This home is located at 10537 Wash Palm Way Unit 4113, Fort Myers, FL 33966 and is currently estimated at $372,066, approximately $279 per square foot. 10537 Wash Palm Way Unit 4113 is a home located in Lee County with nearby schools including Orangewood Elementary School, Allen Park Elementary School, and Edison Park Creative & Expressive Arts School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2021

Sold by

Doyle Joanne and Doyle Stephen J

Bought by

Tooley Thomas P and Tooley Joan W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$178,501

Interest Rate

2.71%

Mortgage Type

New Conventional

Estimated Equity

$193,565

Purchase Details

Closed on

Apr 28, 2015

Sold by

Evans Mark C and Evans Michelle

Bought by

Joanne Doyle Revocable Trust

Purchase Details

Closed on

Apr 28, 2011

Sold by

Evans Mark C and Evans Michelle

Bought by

Evans Mark C and Evans Michelle

Purchase Details

Closed on

Apr 29, 2005

Sold by

U S Home Corp

Bought by

Evans Mark C and Evans Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,250

Interest Rate

5.75%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tooley Thomas P | $250,000 | Jewel Stone Title | |

| Tooley Thomas P | $250,000 | Jewel Stone Ttl Ins Agcy Inc | |

| Joanne Doyle Revocable Trust | $217,000 | Jewel Stone Title Insurance | |

| Evans Mark C | -- | Attorney | |

| Evans Mark C | $226,700 | North American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tooley Thomas P | $200,000 | |

| Closed | Tooley Thomas P | $200,000 | |

| Previous Owner | Evans Mark C | $181,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,078 | $259,167 | -- | -- |

| 2024 | $4,078 | $251,863 | -- | -- |

| 2023 | $4,015 | $244,527 | $0 | $0 |

| 2022 | $3,991 | $237,405 | $0 | $237,405 |

| 2021 | $4,067 | $189,986 | $0 | $189,986 |

| 2020 | $3,916 | $180,073 | $0 | $180,073 |

| 2019 | $4,322 | $201,068 | $0 | $201,068 |

| 2018 | $4,435 | $201,875 | $0 | $201,875 |

| 2017 | $4,340 | $192,185 | $0 | $192,185 |

| 2016 | $4,041 | $173,507 | $0 | $173,507 |

| 2015 | $3,696 | $155,500 | $0 | $155,500 |

| 2014 | -- | $158,200 | $0 | $158,200 |

| 2013 | -- | $135,200 | $0 | $135,200 |

Source: Public Records

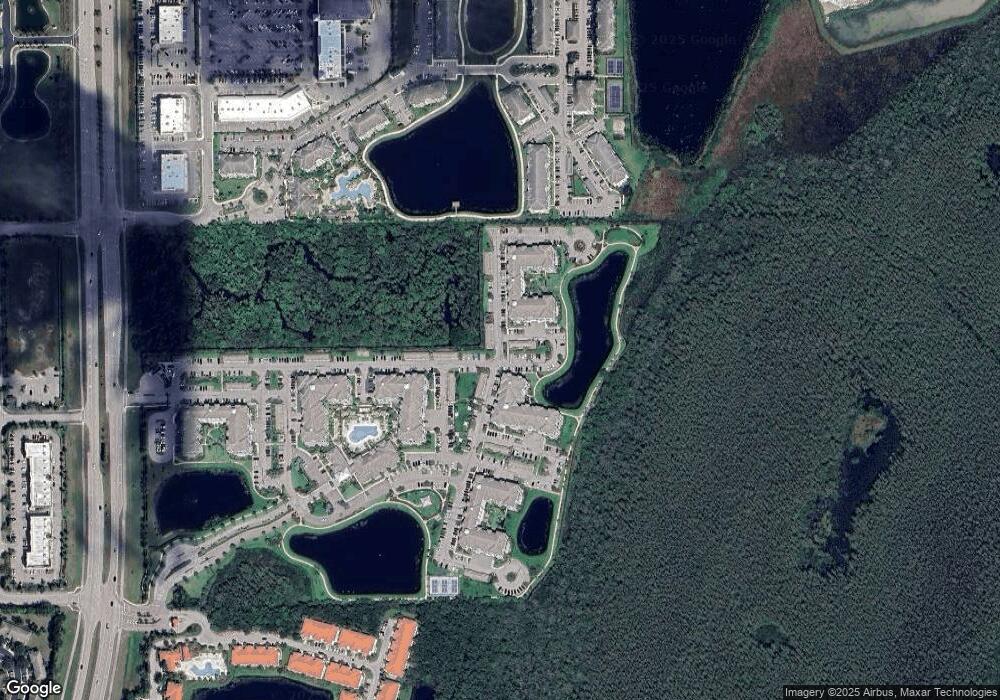

Map

Nearby Homes

- 7951 Gator Palm Dr

- 10391 Butterfly Palm Dr Unit 1014

- 10480 Washingtonia Palm Way Unit 1112

- 10480 Washingtonia Palm Way Unit 1126

- 10480 Washingtonia Palm Way Unit 1144

- 10519 Wine Palm Rd

- 10470 Washingtonia Palm Way Unit 1217

- 4729 Imperial Eagle Dr

- 10460 Washingtonia Palm Way Unit 1313

- 10371 Butterfly Palm Dr Unit 828

- 4756 Crested Eagle Ln

- 4752 Crested Eagle Ln

- 10490 Curry Palm Ln

- 10449 Washingtonia Palm Way Unit 3235

- 10361 Butterfly Palm Dr Unit 727

- 7200 Carousel Ln

- 8056 Queen Palm Ln Unit 635

- 8076 Queen Palm Ln Unit 436

- 8076 Queen Palm Ln Unit 432

- 8076 Queen Palm Ln Unit 412

- 10537 Washingtonia Palm Way Unit 4114

- 10537 Washingtonia Palm Way Unit 4116

- 10537 Washingtonia Palm Way Unit 4115

- 10537 Washingtonia Palm Way Unit 4112

- 10537 Washingtonia Palm Way Unit 4124

- 10537 Washingtonia Palm Way Unit 4122

- 10537 Washingtonia Palm Way Unit 4126

- 10537 Washingtonia Palm Way Unit 4113

- 10537 Washingtonia Palm Way Unit 4125

- 10537 Wash Palm Way Unit 4116

- 10537 Wash Palm Way Unit 4111

- 10537 Wash Palm Way Unit 4126

- 10537 Wash Palm Way Unit 4122

- 10537 Wash Palm Way Unit 4125

- 10537 Wash Palm Way Unit 4123

- 10537 Wash Palm Way Unit 4121

- 10537 Wash Palm Way Unit 4112

- 10537 Wash Palm Way Unit 4124

- 10537 Wash Palm Way Unit 4115

- 10537 Wash Palm Way Unit 4114