10581 Clermont Way Thornton, CO 80233

Wyndemere NeighborhoodEstimated Value: $571,897 - $644,000

5

Beds

4

Baths

3,252

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 10581 Clermont Way, Thornton, CO 80233 and is currently estimated at $603,974, approximately $185 per square foot. 10581 Clermont Way is a home located in Adams County with nearby schools including Riverdale Elementary School, Shadow Ridge Middle School, and Thornton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2014

Sold by

Jones Matt and Jones Daneen

Bought by

Lopez Shawn and Lopez Selena

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,511

Outstanding Balance

$228,525

Interest Rate

4.62%

Mortgage Type

FHA

Estimated Equity

$375,449

Purchase Details

Closed on

May 15, 2000

Sold by

And Bartz Gordon H and Bartz Katherine L

Bought by

Deal Howard K and Deal Christine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

8.19%

Purchase Details

Closed on

Jul 27, 1995

Sold by

Tyler Gerald M and Tyler Mary F

Bought by

Bartz Gordon H and Bartz Katherine L

Purchase Details

Closed on

Jul 2, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Shawn | $303,000 | First American | |

| Deal Howard K | $221,000 | First American Heritage Titl | |

| Bartz Gordon H | $139,990 | Title America | |

| -- | $117,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lopez Shawn | $297,511 | |

| Previous Owner | Deal Howard K | $165,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,494 | $31,690 | $6,630 | $25,060 |

| 2023 | $3,459 | $37,480 | $5,820 | $31,660 |

| 2022 | $3,086 | $28,010 | $5,980 | $22,030 |

| 2021 | $3,188 | $28,010 | $5,980 | $22,030 |

| 2020 | $2,904 | $26,030 | $6,150 | $19,880 |

| 2019 | $2,910 | $26,030 | $6,150 | $19,880 |

| 2018 | $2,775 | $24,120 | $5,760 | $18,360 |

| 2017 | $2,524 | $24,120 | $5,760 | $18,360 |

| 2016 | $2,314 | $21,530 | $3,340 | $18,190 |

| 2015 | $2,310 | $21,530 | $3,340 | $18,190 |

| 2014 | -- | $15,570 | $2,470 | $13,100 |

Source: Public Records

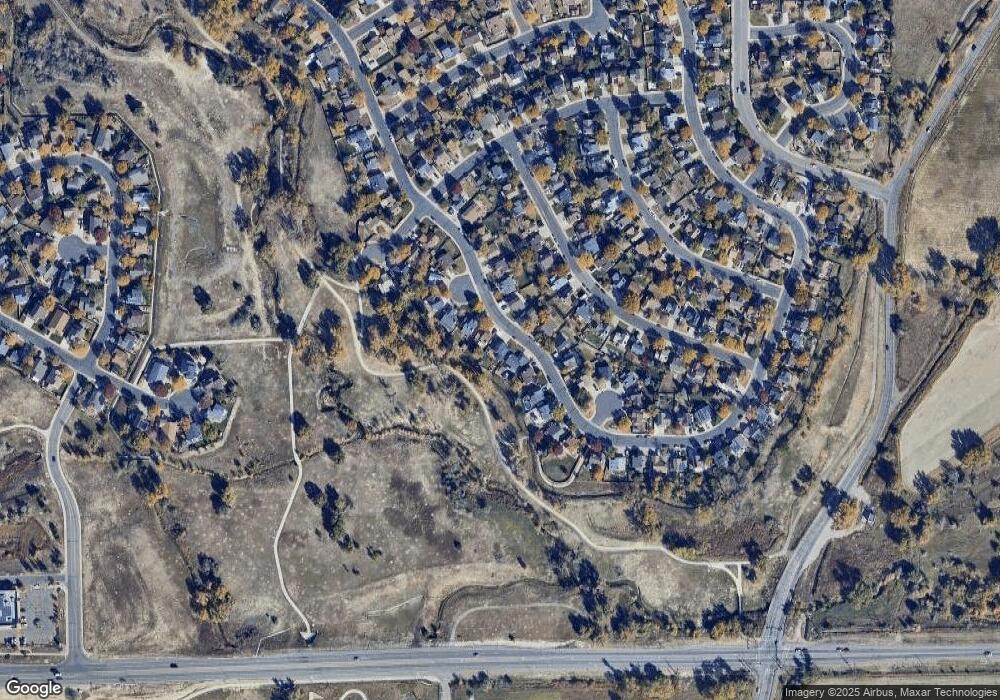

Map

Nearby Homes

- 4645 E 106th Dr

- 4310 E 107th Ct

- 10899 Grange Creek Dr

- 4884 E 101st Ct

- 4897 E 100th Ln

- 10106 Forest Ct

- 4211 E 100th Ave Unit 465

- 10201 Riverdale Rd Unit 90

- 4211 E 100th Ave Unit 463

- 10201 Riverdale Rd Unit 200

- 10201 Riverdale Rd Unit 187

- 10201 Riverdale Rd Unit 174

- 10201 Riverdale Rd Unit 32

- 4211 E 100th Ave Unit 323

- 4211 E 100th Ave Unit 375

- 10985 Glencoe Place

- 10979 Grange Creek Dr

- 4807 E 110th Place

- 11062 Fairfax Cir

- 10513 Madison St

- 10585 Clermont Way

- 10577 Clermont Way

- 10587 Clermont Way

- 10571 Clermont Way

- 10584 Clermont Way

- 10589 Clermont Way

- 10586 Clermont Way

- 10578 Clermont Way

- 10569 Clermont Way

- 10576 Clermont Way

- 10588 Clermont Way

- 10565 Clermont Way

- 10572 Clermont Way

- 10594 Clermont Way

- 10591 Clermont Way

- 10567 Cherry St

- 10562 Clermont Way

- 10563 Cherry St

- 10595 Clermont Way

- 10583 Cherry St