10588 N 600 W-90 Markle, IN 46770

Estimated Value: $333,000 - $460,615

3

Beds

3

Baths

1,936

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 10588 N 600 W-90, Markle, IN 46770 and is currently estimated at $409,404, approximately $211 per square foot. 10588 N 600 W-90 is a home with nearby schools including Norwell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2017

Sold by

Bartrom Ryan C

Bought by

Larr Erik J and Larr Heather N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$29,600

Outstanding Balance

$16,085

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$393,319

Purchase Details

Closed on

Sep 25, 2017

Sold by

Bartrom Ryan C

Bought by

Sharp Joshua A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$29,600

Outstanding Balance

$16,085

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$393,319

Purchase Details

Closed on

May 9, 2001

Sold by

3 5A From Dennis Lallah A Estate

Bought by

35A From Dennis Lallah A Estate

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Larr Erik J | $37,000 | -- | |

| Larr Erik J | -- | -- | |

| Sharp Joshua A | $37,000 | -- | |

| 35A From Dennis Lallah A Estate | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Larr Erik J | $29,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,488 | $374,500 | $87,900 | $286,600 |

| 2023 | $2,513 | $383,700 | $74,900 | $308,800 |

| 2022 | $2,496 | $369,500 | $59,300 | $310,200 |

| 2021 | $2,310 | $345,600 | $59,300 | $286,300 |

| 2020 | $1,694 | $298,900 | $59,300 | $239,600 |

| 2019 | $1,625 | $276,800 | $59,300 | $217,500 |

| 2018 | $32 | $3,100 | $3,100 | $0 |

| 2017 | $54 | $3,600 | $3,600 | $0 |

| 2016 | $58 | $3,900 | $3,900 | $0 |

| 2014 | $52 | $4,100 | $4,100 | $0 |

| 2013 | $45 | $3,500 | $3,500 | $0 |

Source: Public Records

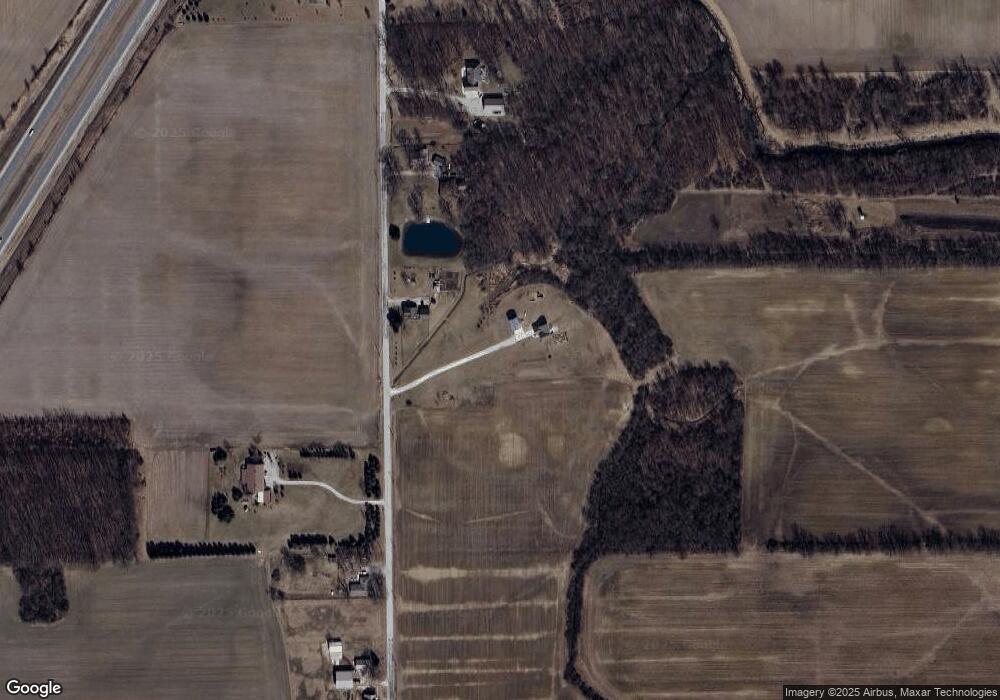

Map

Nearby Homes

- 500 W 800 N-90

- * Ginger Rd

- 11130 N 300 W

- 17820 N Wayne St

- TBD W Yoder Rd

- 2501 W 1100 N

- TBD W 900 N

- 0 Ginger Rd

- 13011 Hamilton Rd

- 10930 Yoder Rd

- 2405 W 900 N

- 11136 N 200 W

- 798 N 500 E

- 4565 E Station Rd

- 16902 Prine Rd

- 15011 Lafayette Center Rd

- 000 Feighner Rd

- 15855 Feighner Rd

- 5110 N US Highway 24 E

- 680 Helms Orange Dr

- 10641 N 600 W-90

- 10719 N 600 W-90 Unit 90

- 10767 N 600 W-90

- 4496 N 600 E

- 4534 N 600 E

- 4496 W 600 N

- 4430 N 600 E

- 10817 N 600 W-90 Unit 90

- 4838 N 600 E

- 4842 N 600 E

- 10859 N 600 W-90 Unit 90

- 4886 N 600 E

- 5734 W 1100 N-90 Unit 90

- 10167 N 600 W-90 Unit 90

- 5845 E 500 N

- 5667 W 1100 N-90 Unit 90

- 4504 E 500 N

- 4522 S 400 E

- 5675 E 500 N

- 5367 W 1100 N-90