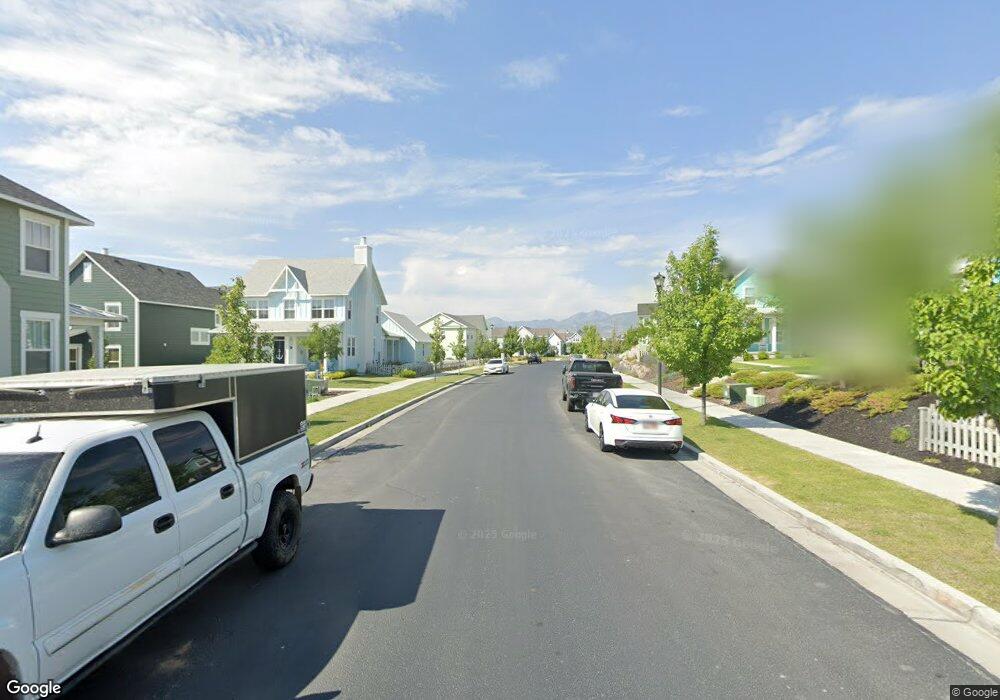

10588 S Beach Comber Way Unit LT107 South Jordan, UT 84009

Daybreak NeighborhoodEstimated Value: $792,792 - $896,000

4

Beds

3

Baths

2,929

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 10588 S Beach Comber Way Unit LT107, South Jordan, UT 84009 and is currently estimated at $848,948, approximately $289 per square foot. 10588 S Beach Comber Way Unit LT107 is a home located in Salt Lake County with nearby schools including Golden Fields Elementary School, Mountain Creek Middle School, and Herriman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2022

Sold by

Christopher Johansen

Bought by

Mark Neal Legrande Living Trust and Mylinda Elizabeth Legrande Living Trust

Current Estimated Value

Purchase Details

Closed on

Jun 6, 2018

Sold by

Johnasen Christopher

Bought by

Johansen Christopher and Johansen Alysha Duffy

Purchase Details

Closed on

Apr 28, 2015

Sold by

Weekley Homes Llc

Bought by

Johansen Christopher

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$408,458

Interest Rate

3.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 30, 2014

Sold by

Daybreak Development Co

Bought by

Weekley Homes Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mark Neal Legrande Living Trust | -- | New Title Company Name | |

| Johansen Christopher | -- | Stewart Title | |

| Johansen Christopher | -- | Bonneville Superior Title | |

| Weekley Homes Llc | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johansen Christopher | $408,458 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13 | $778,600 | $113,800 | $664,800 |

| 2024 | $13 | $771,400 | $110,500 | $660,900 |

| 2023 | $1,380 | $748,900 | $107,300 | $641,600 |

| 2022 | $3,779 | $663,600 | $105,200 | $558,400 |

| 2021 | $3,078 | $495,900 | $81,000 | $414,900 |

| 2020 | $2,927 | $442,000 | $76,300 | $365,700 |

| 2019 | $2,897 | $430,000 | $76,300 | $353,700 |

| 2018 | $2,763 | $408,100 | $75,200 | $332,900 |

| 2017 | $2,640 | $382,200 | $75,200 | $307,000 |

| 2016 | $2,798 | $383,800 | $75,200 | $308,600 |

| 2015 | $2,724 | $363,200 | $91,000 | $272,200 |

| 2014 | -- | $83,000 | $83,000 | $0 |

Source: Public Records

Map

Nearby Homes

- 4821 W Dock St

- 10566 S Lake Ave

- 10617 S Split Rock Dr

- 4966 W Kitsap Way Unit 10-532

- 10762 S Beach Comber Way

- 4881 S Jordan Pkwy W

- 4801 W South Jordan Pkwy

- 5023 S Jordan Pkwy W

- 4712 W South Jordan Pkwy

- 10843 S Lake Ave Unit 257

- 10421 S Split Rock Dr

- 10566 S Oquirrh Lake Rd

- 669 Split Rock Dr Unit 115

- 4722 W Noyo Ln

- 10308 S Rubicon Rd

- 10572 S Kestrel Rise Rd

- 4518 W Cave Run Ln

- 4722 W Vermillion Dr

- 5131 W Split Rock Dr

- 4523 W South Jordan Pkwy

- 10588 S Beach Comber Way

- 10596 S Beach Comber Way Unit 110

- 10596 S Beach Comber Way

- 10578 S Beach Comber Way Unit 106

- 10568 S Beach Comber Way Unit LOT103

- 10568 S Beach Comber Way

- 10587 S Lake Terrace Ave Unit LOT108

- 10579 S Lake Terrace Ave Unit LT105

- 10597 S Lake Terrance Ave W Unit 109

- 10597 S Lake Terrace Ave Unit LT 109

- 10597 S Lake Terrace Ave

- 10618 S Beach Comber Way Unit 136

- 10618 S Beach Comber Way Unit 112

- 10618 S Beach Comber Way

- 10622 S Beach Comber Way Unit 111

- 10622 S Beach Comber Way

- 10616 S Beach Comber Way

- 10616 S Beach Comber Way Unit 137

- 10614 S Beach Comber Way

- 10569 S Lake Terrace Ave Unit LOT104