10589 E Canyon Oaks Way Claremore, OK 74017

Estimated Value: $361,251 - $394,000

3

Beds

3

Baths

2,619

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 10589 E Canyon Oaks Way, Claremore, OK 74017 and is currently estimated at $378,813, approximately $144 per square foot. 10589 E Canyon Oaks Way is a home located in Rogers County with nearby schools including Oologah-Talala Lower Elementary School, Oologah-Talala Upper Elementary School, and Oologah-Talala Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2020

Sold by

Cochran Raymond Eugene and Cochran Mary Karen

Bought by

Cochran Raymond Eugene and Cochran Mary Karen

Current Estimated Value

Purchase Details

Closed on

Apr 16, 2010

Sold by

Cambell Chris W

Bought by

Campbell Rebecca

Purchase Details

Closed on

Mar 8, 2010

Sold by

Campbell Rebecca

Bought by

Cartus Financial Corporation

Purchase Details

Closed on

May 16, 2008

Sold by

Cartusfinancial Corp

Bought by

Cochran Raymond Eugene and Cochran Mary Karen

Purchase Details

Closed on

Oct 24, 1996

Sold by

Hinson John Construction

Purchase Details

Closed on

Jul 18, 1996

Sold by

Hinson John Rentals Inc

Purchase Details

Closed on

May 8, 1996

Sold by

J Bar J Land & Cattle Ltd

Purchase Details

Closed on

Jan 20, 1994

Sold by

Hisaw Jack E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cochran Raymond Eugene | -- | None Available | |

| Campbell Rebecca | -- | None Available | |

| Cartus Financial Corporation | $200,000 | None Available | |

| Cochran Raymond Eugene | $200,000 | None Available | |

| -- | $127,000 | -- | |

| -- | -- | -- | |

| -- | $12,000 | -- | |

| -- | $196,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,983 | $28,445 | $2,729 | $25,716 |

| 2024 | $2,802 | $27,616 | $2,649 | $24,967 |

| 2023 | $2,802 | $26,812 | $2,090 | $24,722 |

| 2022 | $2,605 | $26,031 | $2,016 | $24,015 |

| 2021 | $2,544 | $25,915 | $2,200 | $23,715 |

| 2020 | $2,504 | $25,162 | $1,650 | $23,512 |

| 2019 | $2,316 | $23,183 | $1,650 | $21,533 |

| 2018 | $2,478 | $23,939 | $1,650 | $22,289 |

| 2017 | $2,592 | $23,682 | $1,650 | $22,032 |

| 2016 | $2,299 | $23,070 | $1,650 | $21,420 |

| 2015 | $2,318 | $24,696 | $1,650 | $23,046 |

| 2014 | $2,168 | $23,046 | $1,650 | $21,396 |

Source: Public Records

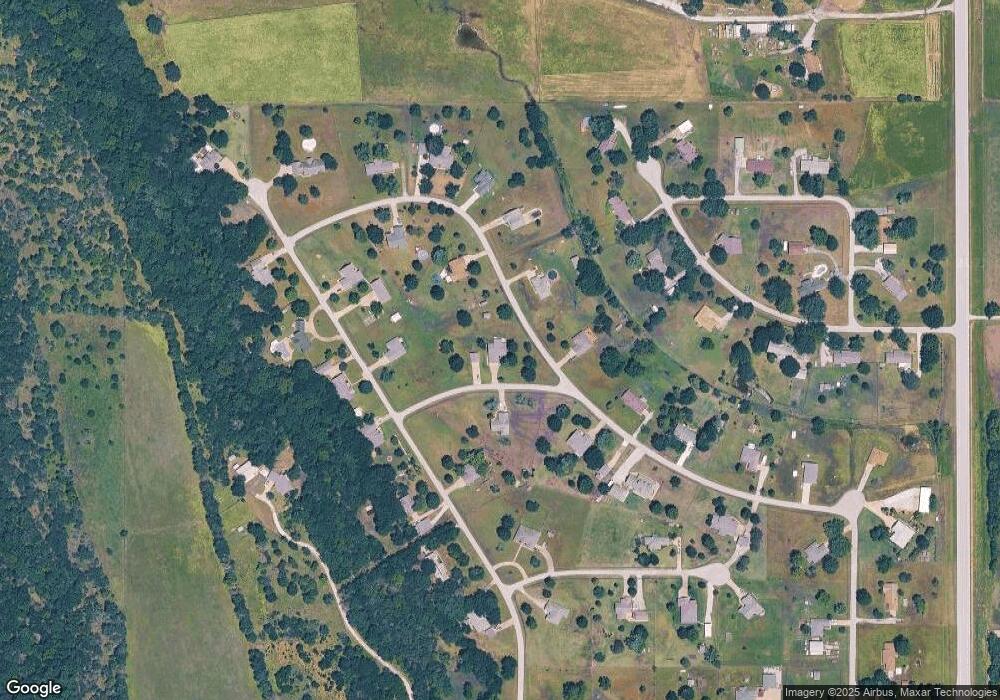

Map

Nearby Homes

- 10922 E Canyon Oaks Blvd

- 0 S 4130 Rd

- 10308 E 445 Rd

- 10192 E 445 Rd

- 9462 E Yorkshire Ave

- 10520 E 450 Rd

- 10860 E 450 Rd

- 15750 S Old Highway 88

- 11971 Stonehedge Dr

- 11901 Laurel Ln

- 13525 S Grande Pointe Pkwy

- 9885 E Mesa Dr

- 13266 S Spruce Ln

- 13192 S Hickory St

- 9666 E Sycamore St

- 17811 S 4150 Rd

- 18182 S Ratliff Ct

- 10036 S Ratliff Ct

- 9910 E Shadowlake Ln

- 9452 E 460 Rd

- 10600 Canyon Oaks Way

- 10589 E Canyon Oaks Way

- 10588 E Canyon Oaks Way

- 10595 E Canyon Oaks Blvd

- 10566 E Canyon Oaks Blvd

- 15777 S Canyon Oaks Ln

- 10655 E Canyon Oaks Blvd

- 0 S Canyon Oaks Ln

- 10700 E Canyon Oaks Blvd

- 15805 S Canyon Oaks Ln

- 10585 E Canyon Oaks Blvd

- 10494 E Canyon Oaks Blvd

- 15750 S Canyon Oaks Ln

- 15730 S Canyon Oaks Ln

- 10711 E Canyon Oaks Blvd

- 15707 S Canyon Oaks Ln

- 10842 E Canyon Oaks Place

- 10601 E Canyon Oaks Ct

- 10533 E Canyon Oaks Blvd

- 10533 E Canyon Oaks Blvd