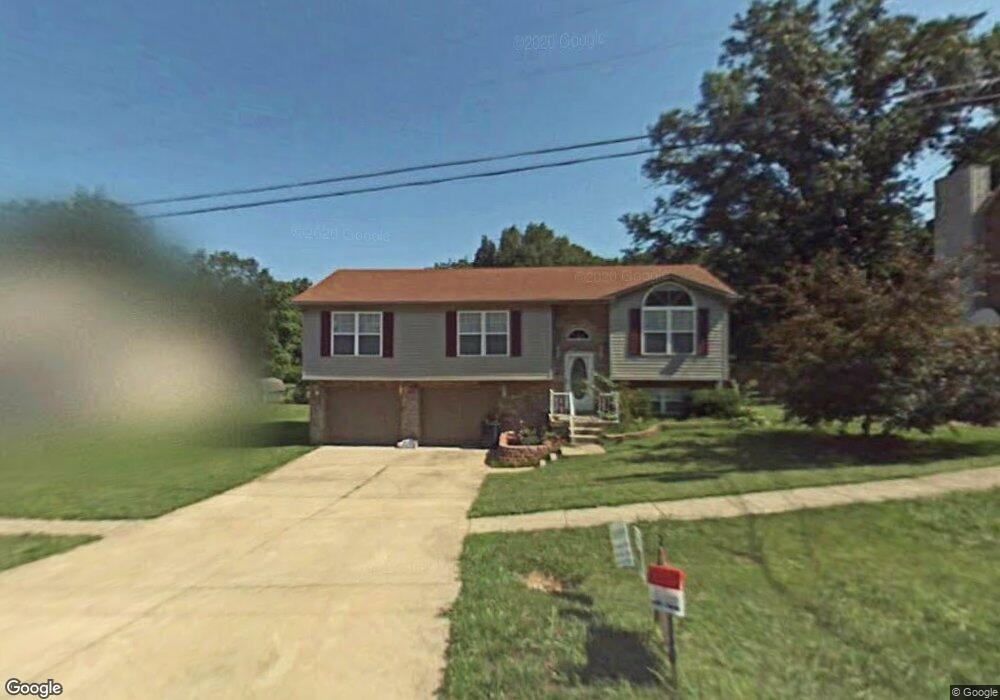

106 Masters St Radcliff, KY 40160

Estimated Value: $242,000 - $260,088

3

Beds

3

Baths

1,891

Sq Ft

$132/Sq Ft

Est. Value

About This Home

This home is located at 106 Masters St, Radcliff, KY 40160 and is currently estimated at $250,522, approximately $132 per square foot. 106 Masters St is a home located in Hardin County with nearby schools including Woodland Elementary School, North Middle School, and John Hardin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2011

Sold by

Monteiro Marie

Bought by

Peterson Samuel C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,900

Outstanding Balance

$99,515

Interest Rate

4.55%

Mortgage Type

VA

Estimated Equity

$151,007

Purchase Details

Closed on

Sep 4, 2009

Sold by

Hsbc Bank Usa Na

Bought by

Monteiro Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,186

Interest Rate

5.11%

Mortgage Type

VA

Purchase Details

Closed on

Apr 26, 2009

Sold by

Rodriguez Jamie and Rodriguez Amanda M

Bought by

Hsbc Bank Usa Na

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peterson Samuel C | $144,900 | Foreman Watson Land Title Ll | |

| Monteiro Marie | $129,900 | Prism Title And Closing Serv | |

| Hsbc Bank Usa Na | $125,550 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peterson Samuel C | $144,900 | |

| Previous Owner | Monteiro Marie | $134,186 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $166,300 | $166,300 | $20,000 | $146,300 |

| 2024 | $1,570 | $166,300 | $20,000 | $146,300 |

| 2023 | $209 | $144,900 | $19,800 | $125,100 |

| 2022 | $1,386 | $144,900 | $19,800 | $125,100 |

| 2021 | $1,569 | $144,900 | $19,800 | $125,100 |

| 2020 | $1,583 | $144,900 | $19,800 | $125,100 |

| 2019 | $226 | $144,900 | $0 | $0 |

| 2018 | $1,551 | $144,900 | $0 | $0 |

| 2017 | $1,544 | $144,900 | $0 | $0 |

| 2016 | $226 | $144,900 | $0 | $0 |

| 2015 | $1,266 | $144,900 | $0 | $0 |

| 2012 | -- | $144,900 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 114 Amanda Ct

- LOT 113 Joshua Ct

- 149 Bivins Ct

- 5013 S Woodland Dr

- 2851 S Wilson Rd

- 158 Donna Ave

- 209 S Wilson Rd Unit lots 2 & 3 Atcher Di

- 219 Meadowlake Dr

- 2670 S Wilson Rd

- 115 Gateway Crossings Blvd

- 3013 S Woodland Dr

- 2634 Lake Rd N

- 2630 Lake Rd N

- 2320 S Dixie Blvd

- DUPONT Plan at Shelton Woods

- ESSEX Plan at Shelton Woods

- 2671 Lake Rd N

- 121 Danbrook Ct

- 116 Danbrook Ct

- HENLEY Plan at Meadows at Cowley Crossings