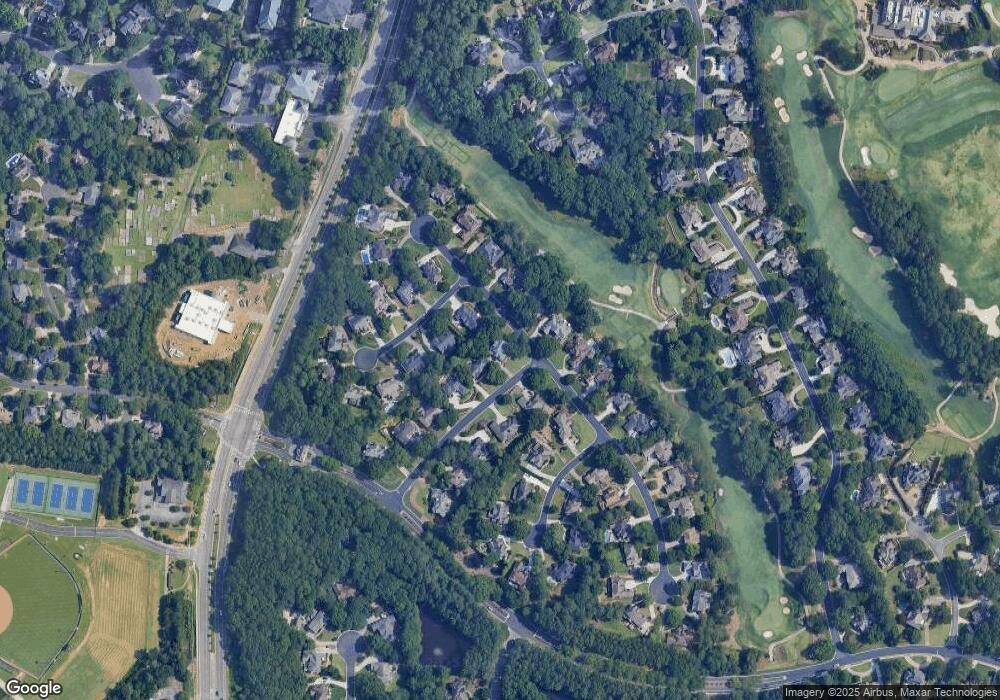

1060 Wild Dunes Way Duluth, GA 30097

Saint Ives Country Club NeighborhoodEstimated Value: $735,000 - $953,000

4

Beds

4

Baths

3,226

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 1060 Wild Dunes Way, Duluth, GA 30097 and is currently estimated at $848,449, approximately $263 per square foot. 1060 Wild Dunes Way is a home located in Fulton County with nearby schools including Wilson Creek Elementary School, Autrey Mill Middle School, and Johns Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2021

Sold by

Petrie Paul

Bought by

Mandrycky Nick S and Mandrycky Cathryn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Outstanding Balance

$113,172

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$735,277

Purchase Details

Closed on

Nov 16, 1993

Sold by

Staub Daniel E

Bought by

Petrie Paul Gail

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

7.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mandrycky Nick S | $525,000 | -- | |

| Petrie Paul Gail | $280,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mandrycky Nick S | $125,000 | |

| Previous Owner | Petrie Paul Gail | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,354 | $347,320 | $115,400 | $231,920 |

| 2023 | $7,881 | $279,200 | $77,080 | $202,120 |

| 2022 | $6,075 | $210,000 | $66,240 | $143,760 |

| 2021 | $5,451 | $209,720 | $66,000 | $143,720 |

| 2020 | $5,488 | $207,200 | $65,200 | $142,000 |

| 2019 | $0 | $203,560 | $64,040 | $139,520 |

| 2018 | $5,630 | $185,120 | $63,160 | $121,960 |

| 2017 | $5,646 | $178,040 | $60,760 | $117,280 |

| 2016 | $5,556 | $178,040 | $60,760 | $117,280 |

| 2015 | $5,617 | $178,040 | $60,760 | $117,280 |

| 2014 | $5,046 | $156,120 | $53,280 | $102,840 |

Source: Public Records

Map

Nearby Homes

- 1808 Ballybunion Dr

- 200 Southern Hill Dr

- 203 Southern Hill Dr

- 1135 Ascott Valley Dr

- 200 Wheatland Rd

- 606 Goldsmith Ct Unit 114

- 602 Goldsmith Ct Unit 116

- 3143 Saint Ives Country Club Pkwy

- 608 Goldsmith Ct Unit 113

- 153 Wards Crossing Way Unit 8

- 153 Wards Crossing Way

- 149 Wards Crossing Way Unit 10

- 149 Wards Crossing Way

- The Ellington Plan at Ward's Crossing

- The Jacobsen I Plan at Ward's Crossing

- The Jacobsen II Plan at Ward's Crossing

- The Benton III Plan at Ward's Crossing

- 1011 Crown Oak St Unit 47

- 1003 Crown Oak St Unit 43

- 1005 Crown Oak St Unit 44

- 1058 Wild Dunes Way

- 101 Oakland Hills Ct

- 1012 Quaker Ridge Way

- 1014 Quaker Ridge Way

- 103 Oakland Hills Ct

- 1059 Wild Dunes Way

- 1056 Wild Dunes Way

- 1010 Quaker Ridge Way

- 1016 Quaker Ridge Way

- 1057 Wild Dunes Way

- 105 Oakland Hills Ct

- 1054 Wild Dunes Way

- 1008 Quaker Ridge Way

- 1018 Quaker Ridge Way

- 1055 Wild Dunes Way

- 1013 Quaker Ridge Way

- 1005 Quaker Ridge Way

- 102 Oakland Hills Ct

- 114 Kennemer Ct

- 107 Oakland Hills Ct