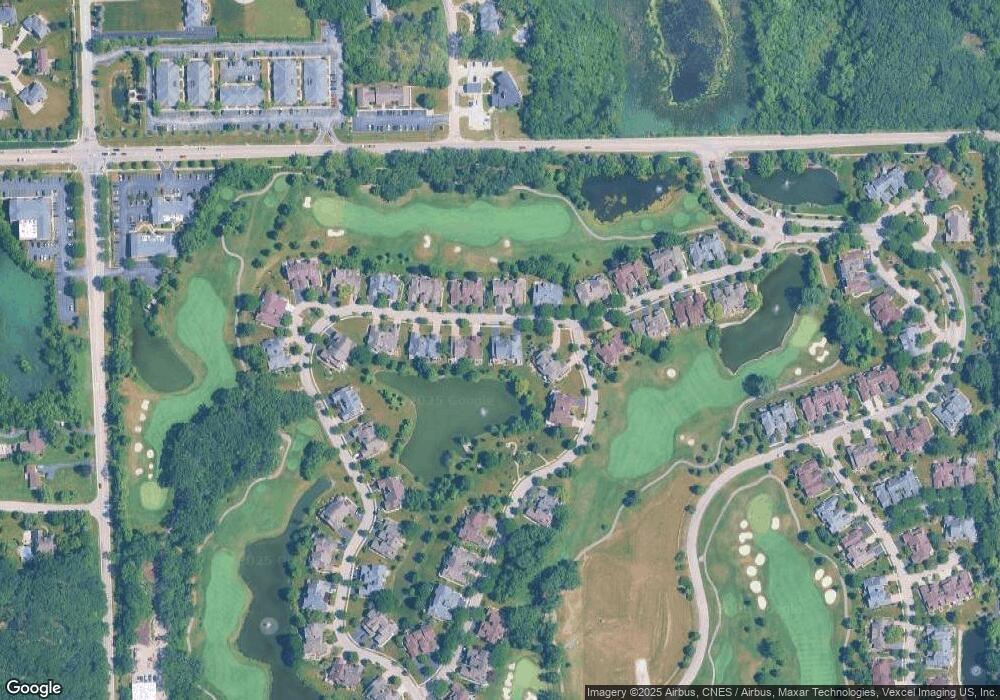

10607 Golf Rd Orland Park, IL 60462

Orland Grove NeighborhoodEstimated Value: $526,944 - $744,000

3

Beds

3

Baths

3,300

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 10607 Golf Rd, Orland Park, IL 60462 and is currently estimated at $612,736, approximately $185 per square foot. 10607 Golf Rd is a home located in Cook County with nearby schools including Orland Park Elementary School, High Point Elementary School, and Orland Jr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2012

Sold by

Cashman Peter J and Cashman Margaret C

Bought by

Cashman Peter J and Cashman Margaret C

Current Estimated Value

Purchase Details

Closed on

Jun 20, 2011

Sold by

Kreger Mark A

Bought by

Cashman Peter J and Cashman Margaret C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Outstanding Balance

$75,832

Interest Rate

4.63%

Mortgage Type

New Conventional

Estimated Equity

$536,904

Purchase Details

Closed on

Feb 14, 2009

Sold by

Kreger Joan

Bought by

Kreger Joan H and J H Kreger Trust #409

Purchase Details

Closed on

Nov 19, 2004

Sold by

Motl Robert J

Bought by

Motl Robert J and Kreger Joan

Purchase Details

Closed on

Nov 14, 2003

Sold by

Benhart Louis S and Benhart Mary J

Bought by

Robert J Motl Trust #129

Purchase Details

Closed on

Jun 11, 1997

Sold by

Benhart Louis S and Benhart Mary J

Bought by

Benhart Louis S and Benhart Mary J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cashman Peter J | -- | None Available | |

| Cashman Peter J | $365,000 | Cti | |

| Kreger Joan H | -- | None Available | |

| Motl Robert J | -- | -- | |

| Robert J Motl Trust #129 | $398,000 | Cti | |

| Benhart Louis S | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cashman Peter J | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,016 | $38,001 | $12,597 | $25,404 |

| 2023 | $7,986 | $38,001 | $12,597 | $25,404 |

| 2022 | $7,986 | $32,817 | $11,022 | $21,795 |

| 2021 | $7,760 | $32,817 | $11,022 | $21,795 |

| 2020 | $7,583 | $32,817 | $11,022 | $21,795 |

| 2019 | $7,032 | $29,048 | $10,038 | $19,010 |

| 2018 | $7,260 | $30,629 | $10,038 | $20,591 |

| 2017 | $7,111 | $30,629 | $10,038 | $20,591 |

| 2016 | $6,850 | $27,047 | $9,053 | $17,994 |

| 2015 | $6,750 | $27,047 | $9,053 | $17,994 |

| 2014 | $6,664 | $27,047 | $9,053 | $17,994 |

| 2013 | $6,331 | $27,330 | $9,053 | $18,277 |

Source: Public Records

Map

Nearby Homes

- 10534 Golf Rd

- 10666 Golf Rd

- 14340 108th Ave

- 14137 108th Ave

- 10801 Doyle Ct

- 14701 Crystal Tree Dr

- 14700 108th Ave

- 14000 108th Ave

- 14061 Persimmon Dr

- 14405 Greenland Ave

- 11132 Alexis Ln

- 10639 Misty Hill Rd

- 10956 Persimmon Ct

- 10158 Huntington Ct

- 10924 Crystal Springs Ln

- 14031 Norwich Ln Unit 301

- 11257 Melrose Ct

- 14813 Holly Ct

- 9750 Ravinia Ln Unit 303

- 15060 Hale Dr

- 10613 Golf Rd

- 10601 Golf Rd

- 10619 Golf Rd

- 14352 Lake Ridge Rd

- 10608 Golf Rd

- 10604 Golf Rd

- 10612 Golf Rd

- 10600 Golf Rd

- 10625 Golf Rd

- 10616 Golf Rd

- 10620 Golf Rd

- 10620 Golf Rd

- 10554 Golf Rd

- 14358 Lake Ridge Rd

- 10550 Golf Rd

- 10626 Golf Rd

- 10631 Golf Rd

- 14400 Lake Ridge Rd

- 10630 Golf Rd

- 14406 Lake Ridge Rd