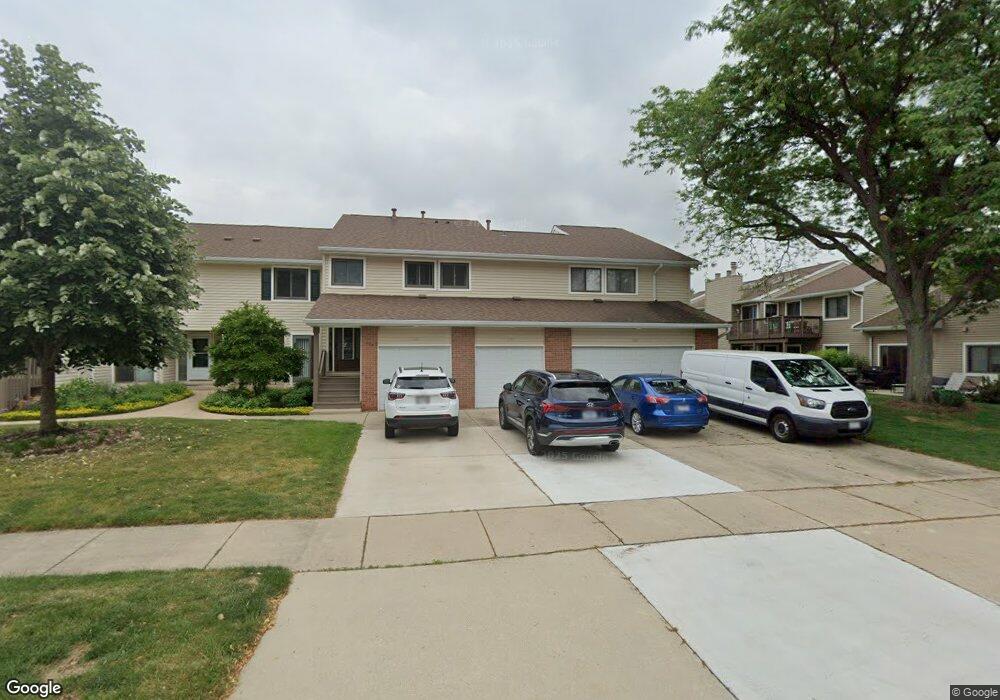

1061 Hidden Lake Dr Unit DR66040 Buffalo Grove, IL 60089

Estimated Value: $342,000 - $388,000

3

Beds

2

Baths

1,858

Sq Ft

$194/Sq Ft

Est. Value

About This Home

This home is located at 1061 Hidden Lake Dr Unit DR66040, Buffalo Grove, IL 60089 and is currently estimated at $360,210, approximately $193 per square foot. 1061 Hidden Lake Dr Unit DR66040 is a home located in Lake County with nearby schools including Meridian Middle School, Tripp Elementary School, and Aptakisic Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2004

Sold by

Joshi Vinayak D and Joshi Ujwala V

Bought by

Krzanowski Krzysztof and Krzanowski Jolanta

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,200

Outstanding Balance

$88,938

Interest Rate

5.25%

Mortgage Type

Unknown

Estimated Equity

$271,272

Purchase Details

Closed on

Apr 29, 1998

Sold by

Grossman Alan I and Grossman Rachel P

Bought by

Joshi Vinayak D and Joshi Ujwala

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,360

Interest Rate

7.22%

Mortgage Type

FHA

Purchase Details

Closed on

May 24, 1995

Sold by

Oirikh Michael and Orik Michael

Bought by

Grossman Alan I and Grossman Rachel P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,750

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Krzanowski Krzysztof | $249,000 | Ticor Title Insurance Co | |

| Joshi Vinayak D | $163,500 | -- | |

| Grossman Alan I | $157,500 | Attorneys Natl Title Network |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Krzanowski Krzysztof | $199,200 | |

| Previous Owner | Joshi Vinayak D | $152,360 | |

| Previous Owner | Grossman Alan I | $141,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,378 | $94,686 | $26,266 | $68,420 |

| 2023 | $7,177 | $89,343 | $24,784 | $64,559 |

| 2022 | $7,177 | $79,461 | $22,043 | $57,418 |

| 2021 | $6,920 | $78,604 | $21,805 | $56,799 |

| 2020 | $6,786 | $78,872 | $21,879 | $56,993 |

| 2019 | $6,609 | $78,581 | $21,798 | $56,783 |

| 2018 | $5,967 | $71,486 | $23,694 | $47,792 |

| 2017 | $5,886 | $69,817 | $23,141 | $46,676 |

| 2016 | $5,668 | $66,855 | $22,159 | $44,696 |

| 2015 | $5,536 | $62,522 | $20,723 | $41,799 |

| 2014 | $5,039 | $56,220 | $22,257 | $33,963 |

| 2012 | $4,828 | $56,333 | $22,302 | $34,031 |

Source: Public Records

Map

Nearby Homes

- 1012 Hobson Dr

- 938 Hidden Lake Dr

- 913 Hobson Dr

- 1113 Lockwood Dr

- 15 Thompson Ct

- 720 Dunhill Dr

- 1118 Larraway Dr

- 670 Dunhill Dr

- 46 Copperwood Dr

- 625 Marseilles Cir

- 437 Caren Dr

- 603 Cherbourg Ct N

- 711 Woodhollow Ln

- 620 Cobblestone Ln

- 931 Shady Grove Ln

- 538 Lasalle Ct

- 327 Lasalle Ln

- 276 Stanton Dr

- 1265 Devonshire Rd

- 1141 Devonshire Rd

- 181 Morningside Ln E Unit E66040L

- 1071 Hidden Lake Dr Unit DR66021

- 1063 Hidden Lake Dr Unit DR66032

- 1065 Hidden Lake Dr Unit DR66021

- 1066 Hidden Lake Dr Unit DR19801

- 1068 Hidden Lake Dr Unit DR19802

- 1051 Hidden Lake Dr Unit DR76040

- 134 Autumn Ct Unit CT76032

- 132 Autumn Ct Unit CT76021

- 173 Morningside Ln E Unit E56032R

- 1072 Hidden Lake Dr Unit DR19801

- 1074 Hidden Lake Dr Unit DR19802

- 126 Autumn Ct Unit CT76021

- 1076 Hidden Lake Dr Unit DR19803

- 124 Autumn Ct Unit CT76032

- 1078 Hidden Lake Dr Unit DR19803

- 1062 Hidden Lake Dr Unit DR19803

- 1064 Hidden Lake Dr Unit DR19803

- 1064 Hidden Lake Dr Unit 1064

- 1056 Hidden Lake Dr Unit DR18604