10615 Sugar Crest Ave Unit 2A Duluth, GA 30097

Estimated Value: $735,000 - $817,000

4

Beds

4

Baths

3,155

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 10615 Sugar Crest Ave Unit 2A, Duluth, GA 30097 and is currently estimated at $782,623, approximately $248 per square foot. 10615 Sugar Crest Ave Unit 2A is a home located in Fulton County with nearby schools including Wilson Creek Elementary School, River Trail Middle School, and Northview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2006

Sold by

Edwards Richard B and Edwards Linda M

Bought by

Mcareavey Dermont

Current Estimated Value

Purchase Details

Closed on

Jan 24, 2002

Sold by

Pechman Tamsen E and Pechman Bruce D

Bought by

Edwards Linda M and Edwards Richard B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$287,000

Interest Rate

7.12%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 21, 1994

Sold by

Hooper James Bldrs Inc

Bought by

Pechman Tamsen E Bruce D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,000

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcareavey Dermont | $422,500 | -- | |

| Edwards Linda M | $359,000 | -- | |

| Pechman Tamsen E Bruce D | $292,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Edwards Linda M | $287,000 | |

| Previous Owner | Pechman Tamsen E Bruce D | $234,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,897 | $248,000 | $64,640 | $183,360 |

| 2023 | $8,226 | $248,000 | $64,640 | $183,360 |

| 2022 | $5,682 | $248,760 | $56,120 | $192,640 |

| 2021 | $5,623 | $205,920 | $45,800 | $160,120 |

| 2020 | $5,559 | $188,800 | $46,360 | $142,440 |

| 2019 | $691 | $188,800 | $46,360 | $142,440 |

| 2018 | $5,363 | $212,720 | $46,360 | $166,360 |

| 2017 | $5,603 | $182,000 | $44,560 | $137,440 |

| 2016 | $5,396 | $203,840 | $44,560 | $159,280 |

| 2015 | $5,467 | $211,320 | $44,560 | $166,760 |

| 2014 | $5,663 | $173,600 | $45,080 | $128,520 |

Source: Public Records

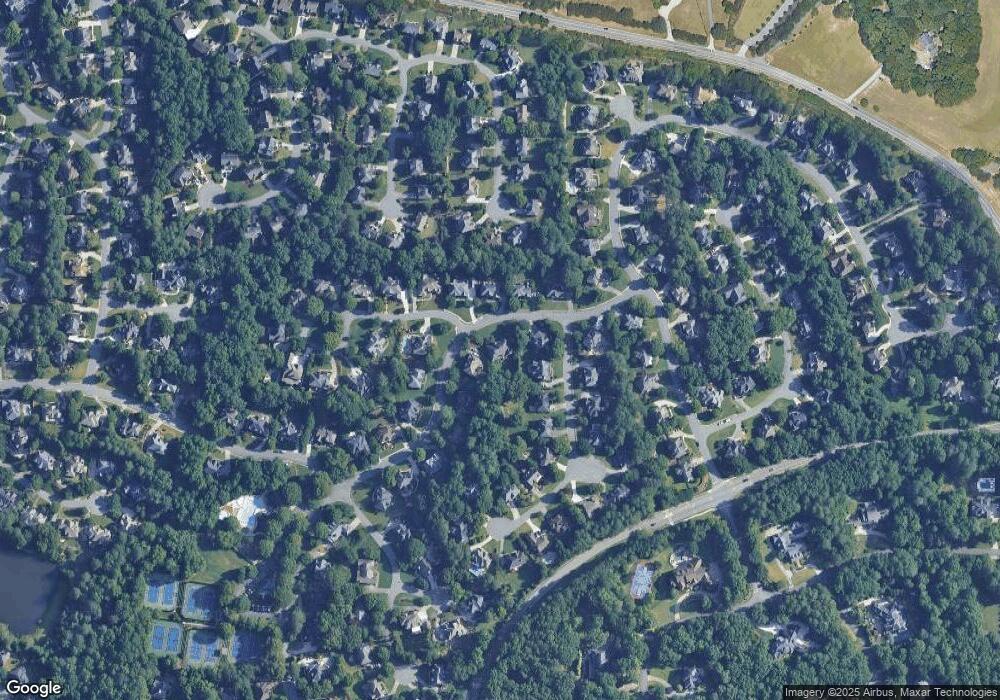

Map

Nearby Homes

- 10723 Glenleigh Dr

- 740 Creek Wind Ct

- 10635 N Edgewater Place

- 445 Stedford Ln

- 120 Wood River Ct

- 225 Lazy Shade Ct Unit 1B

- 1001 Shurcliff Ln

- 330 Longvue Ct

- 1305 Simonds Way

- 951 Olmsted Ln

- 828 Olmsted Ln

- 6273 Clapham Ln

- 260 Ketton Downs

- 755 Abbotts Mill Ct Unit 69

- 320 Brookhaven Walk

- 540 Abbotts Mill Dr

- 11100 Brookhavenclub Dr

- 6126 Narcissa Place

- 345 Wiman Park Ln

- 10605 Sugar Crest Ave

- 10635 Sugar Crest Ave Unit 82

- 215 Selkirk Ln

- 225 Selkirk Ln

- 10595 Sugar Crest Ave

- 10620 Sugar Crest Ave Unit 2A

- 10630 Sugar Crest Ave Unit 2A6

- 10610 Sugar Crest Ave

- 10590 Sugar Crest Ave

- 10640 Sugar Crest Ave

- 235 Selkirk Ln Unit 5B1

- 0 Selkirk Ln Unit 7457951

- 0 Selkirk Ln Unit 7416527

- 0 Selkirk Ln Unit 8881761

- 0 Selkirk Ln Unit 8758011

- 0 Selkirk Ln Unit 8658988

- 0 Selkirk Ln Unit 7355726

- 10580 Sugar Crest Ave Unit 2A

- 10655 Sugar Crest Ave

- 10585 Sugar Crest Ave