Estimated Value: $644,069 - $745,000

4

Beds

3

Baths

3,727

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 10625 Oakview Pointe Terrace, Gotha, FL 34734 and is currently estimated at $696,517, approximately $186 per square foot. 10625 Oakview Pointe Terrace is a home located in Orange County with nearby schools including Thornebrooke Elementary School, Gotha Middle School, and Olympia High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2016

Sold by

Bell Joe and Bell Carole

Bought by

Stermen David L and Stermen Debra L

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2005

Sold by

Comment Daniel and Comment Joan

Bought by

Bell Joe and Bell Carole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$343,200

Interest Rate

5.54%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 22, 2002

Sold by

Glen E Andrew M and Brenda S Andrew M

Bought by

Comment Daniel and Comment Joan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.98%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 10, 2001

Sold by

Morrison Hms Inc C

Bought by

Andrew Glen E and Andrew Brenda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Interest Rate

7.17%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stermen David L | $410,000 | Equitable Title Of West O | |

| Bell Joe | $429,000 | Jordan Title | |

| Comment Daniel | $320,000 | -- | |

| Andrew Glen E | $305,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bell Joe | $343,200 | |

| Previous Owner | Andrew Glen E | $200,000 | |

| Previous Owner | Andrew Glen E | $244,000 | |

| Closed | Bell Joe | $64,350 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,066 | $404,007 | -- | -- |

| 2024 | $5,404 | $392,621 | -- | -- |

| 2023 | $5,404 | $370,443 | $0 | $0 |

| 2022 | $5,226 | $359,653 | $0 | $0 |

| 2021 | $5,149 | $349,178 | $0 | $0 |

| 2020 | $4,905 | $344,357 | $0 | $0 |

| 2019 | $5,053 | $336,615 | $0 | $0 |

| 2018 | $5,014 | $330,339 | $0 | $0 |

| 2017 | $4,948 | $339,914 | $85,000 | $254,914 |

| 2016 | $4,127 | $332,230 | $85,000 | $247,230 |

| 2015 | $4,197 | $311,716 | $75,000 | $236,716 |

| 2014 | $4,260 | $280,548 | $75,000 | $205,548 |

Source: Public Records

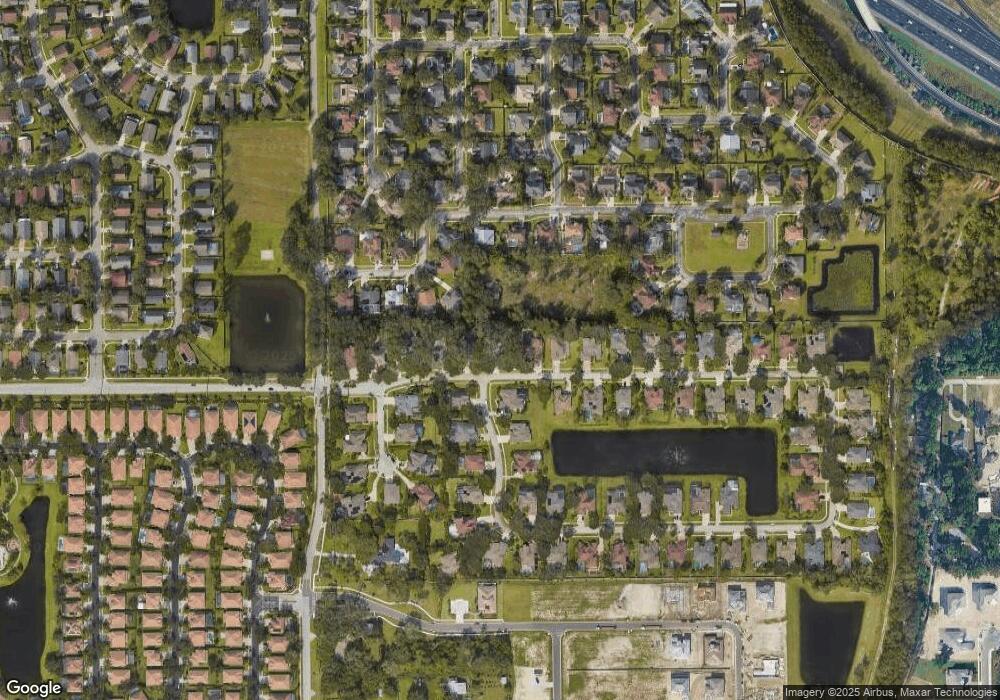

Map

Nearby Homes

- 10600 Oakview Pointe Terrace

- 10193 Brocksport Cir

- 10199 Brocksport Cir

- 475 Douglas Edward Dr

- 524 Douglas Edward Dr

- 438 Drexel Ridge Cir

- 2437 Cliffdale St

- 1206 Sutter Ave

- 608 Bridge Creek Blvd

- 430 Winding Hollow Ave

- 9802 6th St

- 1804 Maple Leaf Dr

- 84 Braelock Dr

- 1516 Hempel Ave

- 3352 Beazer Dr

- 9648 Weatherstone Ct

- 10442 Birch Tree Ln

- 1882 Lake Pearl Dr

- 0 Quail Cove Ct

- 814 Windergrove Ct

- 10619 Oakview Pointe Terrace

- 10631 Oakview Pointe Terrace

- 933 7th Ave

- 933 7th Ave Unit Land

- 10300 Oakview Pointe Terrace

- 10637 Oakview Pointe Terrace

- 10613 Oakview Pointe Terrace

- 10301 Oakview Pointe Terrace

- 10454 Windermere Chase Blvd

- 10612 Oakview Pointe Terrace

- 10460 Windermere Chase Blvd

- 10306 Oakview Pointe Terrace

- 10643 Oakview Pointe Terrace

- 10607 Oakview Pointe Terrace

- 10307 Oakview Pointe Terrace

- 10448 Windermere Chase Blvd

- 1007 Parkwood Cove Ct

- 10436 Windermere Chase Blvd

- 10606 Oakview Pointe Terrace

- 10430 Windermere Chase Blvd