10655 SW 7th St Unit 1803 Pembroke Pines, FL 33025

Pembroke Lakes South NeighborhoodEstimated Value: $303,467 - $373,000

2

Beds

3

Baths

1,100

Sq Ft

$319/Sq Ft

Est. Value

About This Home

This home is located at 10655 SW 7th St Unit 1803, Pembroke Pines, FL 33025 and is currently estimated at $351,117, approximately $319 per square foot. 10655 SW 7th St Unit 1803 is a home located in Broward County with nearby schools including Pines Lakes Elementary School, Pines Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 22, 2011

Sold by

The Bank Of New York Mellon

Bought by

Huang Huan Sen and Deng Qing Mei

Current Estimated Value

Purchase Details

Closed on

Sep 21, 2010

Sold by

Bustos Diana Carolina

Bought by

The Bank Of New York Mellon and The Bank Of New York

Purchase Details

Closed on

Aug 16, 2003

Sold by

Quantum Homes Llc

Bought by

Bustos Diana Carolina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Interest Rate

7.75%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Huang Huan Sen | $94,300 | Attorney | |

| The Bank Of New York Mellon | $66,700 | None Available | |

| Bustos Diana Carolina | $180,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bustos Diana Carolina | $144,000 | |

| Closed | Bustos Diana Carolina | $36,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,638 | $107,880 | -- | -- |

| 2024 | $1,553 | $104,840 | -- | -- |

| 2023 | $1,553 | $101,790 | $0 | $0 |

| 2022 | $1,442 | $98,830 | $0 | $0 |

| 2021 | $1,376 | $95,960 | $0 | $0 |

| 2020 | $1,356 | $94,640 | $0 | $0 |

| 2019 | $1,302 | $92,520 | $0 | $0 |

| 2018 | $1,238 | $90,800 | $0 | $0 |

| 2017 | $1,214 | $88,940 | $0 | $0 |

| 2016 | $1,191 | $87,120 | $0 | $0 |

| 2015 | $1,204 | $86,520 | $0 | $0 |

| 2014 | $1,193 | $85,840 | $0 | $0 |

| 2013 | -- | $93,020 | $9,300 | $83,720 |

Source: Public Records

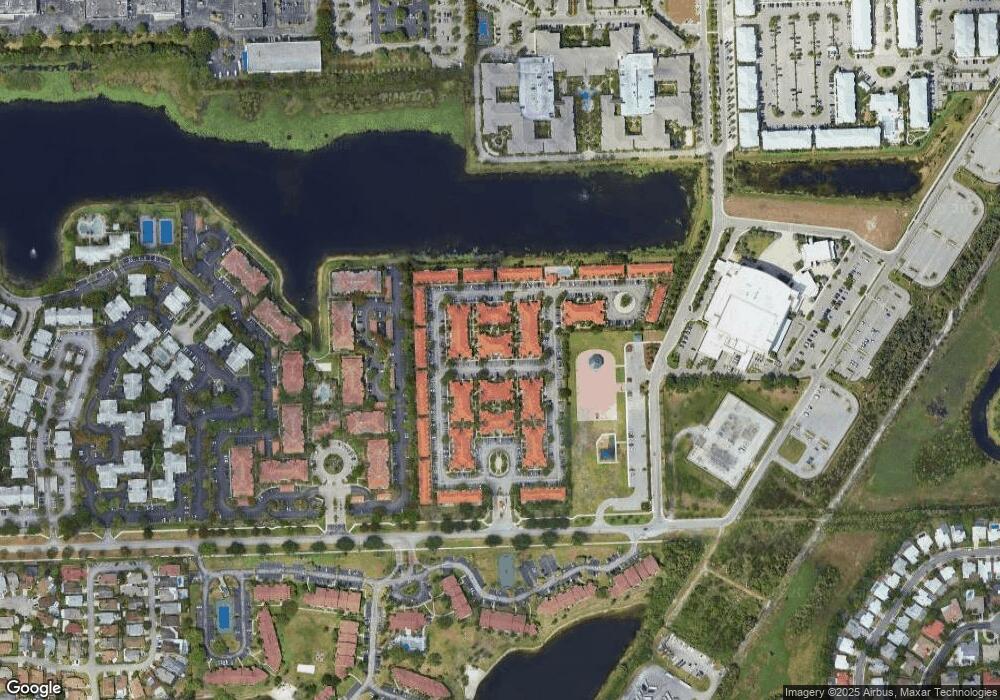

Map

Nearby Homes

- 10653 SW 8th St Unit 2407

- 603 SW 107th Ave Unit 1701

- 11133 SW 8th St Unit 1029

- 655 SW 111th Way Unit 2016

- 620 SW 111th Ave Unit 104

- 711 SW 111th Way Unit 3017

- 720 SW 111th Ave Unit 307

- 677 SW 111th Ave Unit 303

- 11185 SW 6th St Unit 3032

- 655 SW 111th Way Unit 3086

- 777 SW 111th Way Unit 1018

- 10921 SW 10th Ct

- 10372 SW 9th Ln

- 1160 SW 110th Ave

- 11225 SW 9th Ct Unit 11225

- 1013 SW 112th Terrace Unit 1013

- 640 SW 113th Terrace

- 810 SW 113th Terrace

- 949 SW 113th Terrace

- 1025 SW 113th Terrace Unit O

- 10647 SW 7th St Unit 1804

- 10659 SW 7th St

- 10663 SW 7th St Unit 1802

- 10667 SW 7th St Unit 1809

- 10651 SW 7th St Unit 1807

- 10639 SW 7th St Unit 1805

- 10671 SW 7th St

- 10643 SW 7th St Unit 1806

- 10675 SW 7th St Unit 1810

- 661 SW 107th Ave Unit 1709

- 658 SW 106th Ave Unit 1516

- 10652 SW 6th St Unit 1608

- 10660 SW 6th St Unit 1607

- 10668 SW 6th St

- 10636 SW 6th St Unit 1610

- 10644 SW 6th St Unit 1609

- 642 SW 106th Ave