107 Matador Ct Fort Worth, TX 76108

Far West Fort Worth NeighborhoodEstimated Value: $1,041,000 - $1,644,391

4

Beds

7

Baths

6,685

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 107 Matador Ct, Fort Worth, TX 76108 and is currently estimated at $1,439,130, approximately $215 per square foot. 107 Matador Ct is a home located in Parker County with nearby schools including Silver Creek Elementary School, Azle Elementary School, and Azle Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2011

Sold by

Eades Quinn L and Eades Maria K

Bought by

Pardue William E and Pardue Agnieszka M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 2, 2011

Sold by

Scogins Darrell and Scogins Kellie

Bought by

Pardue William E and Pardue Agnieszka M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,000

Interest Rate

4.86%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 8, 2005

Sold by

Richardson Joe A and Richardson Cynthia

Bought by

Pardue William E and Pardue Agnieszka M

Purchase Details

Closed on

Oct 25, 2001

Sold by

Strickland John and Strickland Staci

Bought by

Pardue William E and Pardue Agnieszka M

Purchase Details

Closed on

Jan 1, 1901

Bought by

Pardue William E and Pardue Agnieszka M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pardue William E | -- | Fnt | |

| Pardue William E | -- | -- | |

| Eades Quinn L | -- | Hexter Fair Title Company | |

| Pardue William E | -- | -- | |

| Scogins Darrell | -- | None Available | |

| Pardue William E | -- | -- | |

| Pardue William E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Pardue William E | $417,000 | |

| Previous Owner | Eades Quinn L | $294,000 | |

| Previous Owner | Eades Quinn L | $417,000 | |

| Previous Owner | Pardue William E | $294,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,783 | $1,254,601 | -- | -- |

| 2024 | $6,783 | $1,140,546 | -- | -- |

| 2023 | $6,783 | $1,036,860 | $0 | $0 |

| 2022 | $17,442 | $942,600 | $135,500 | $807,100 |

| 2021 | $18,275 | $942,600 | $135,500 | $807,100 |

| 2020 | $17,209 | $892,460 | $75,000 | $817,460 |

| 2019 | $16,764 | $892,460 | $75,000 | $817,460 |

| 2018 | $15,288 | $745,670 | $75,000 | $670,670 |

| 2017 | $14,568 | $745,670 | $75,000 | $670,670 |

| 2016 | $15,104 | $773,100 | $75,000 | $698,100 |

| 2015 | $5,513 | $773,100 | $75,000 | $698,100 |

| 2014 | $13,359 | $695,260 | $75,000 | $620,260 |

Source: Public Records

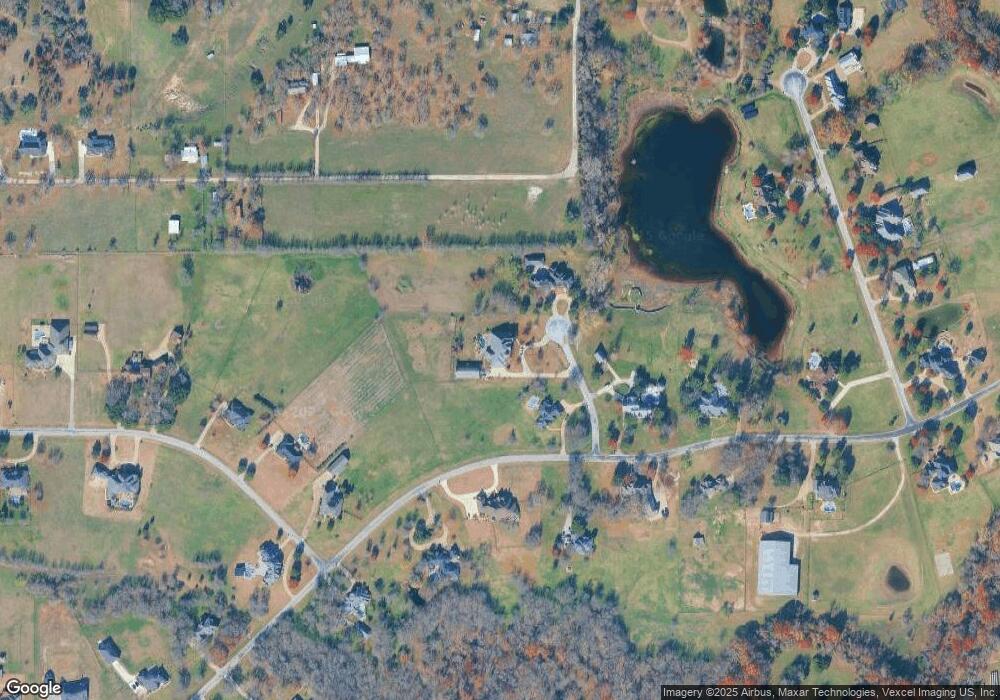

Map

Nearby Homes

- 420 Cattlebaron Parc Dr

- 694 Boling Ranch Rd

- 813 Remuda Dr

- 741 Remuda Dr

- 142 Crown Ridge Ct

- 742 Boling Ranch Rd

- 108 Stone Canyon Cir

- 100 Stone Canyon Cir

- 145 Ranch Creek Dr

- 175 N Boyce Ln

- 101 Deer Crossing Way

- 104 Woodview Creek Trail

- 1144 Rd

- 1144 Boling Ranch Rd N

- 301 Silver Canyon Dr

- 313 Silver Canyon Dr

- 129 Lariat Ct

- 900 Reese Ln

- 101 E Bozeman Ln

- 200 W Bozeman Ln

- 101 Matador Ct

- 115 Matador Ct

- 224 Cattlebaron Parc Dr

- 323 Cattlebaron Parc Dr

- 225 Cattlebaron Parc Dr

- 301 Cattlebaron Parc Dr

- 301 Cattlebaron Parc Dr

- 212 Cattlebaron Parc Dr

- 337 Cattlebaron Parc Dr

- 106 King Ranch Ct

- 213 Cattlebaron Parc Dr

- 136 King Ranch Ct

- 650 Lewis Deas Rd

- 351 Cattlebaron Parc Dr

- 761 Lewis Deas Rd

- 133 Waggoner Ct

- 117 King Ranch Ct

- 200 Cattlebaron Parc Dr

- 769 Lewis Deas Rd

- 207 Cattlebaron Parc Dr