Estimated Value: $459,048 - $504,000

3

Beds

3

Baths

1,579

Sq Ft

$310/Sq Ft

Est. Value

About This Home

This home is located at 10706 Spring Mountain Place, Tampa, FL 33626 and is currently estimated at $488,762, approximately $309 per square foot. 10706 Spring Mountain Place is a home located in Hillsborough County with nearby schools including Westchase Elementary School, Davidsen Middle School, and Alonso High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2008

Sold by

Westchase Community Association Inc

Bought by

Overstreet Donald K and Overstreet Marcia

Current Estimated Value

Purchase Details

Closed on

Oct 21, 2008

Sold by

Amtrust Bank

Bought by

Overstreet Donald K and Overstreet Marcia

Purchase Details

Closed on

Sep 11, 2008

Sold by

Stockmore Kimberly

Bought by

Ohio Savings Bank

Purchase Details

Closed on

Jun 3, 2008

Sold by

Stockamore Kimberly

Bought by

Westchase Community Assn Inc

Purchase Details

Closed on

May 18, 2005

Sold by

Rose Francis R and Rose Julie L

Bought by

Stockmore Kimberly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,500

Interest Rate

6.87%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Overstreet Donald K | -- | Commerce Title | |

| Overstreet Donald K | $170,000 | Cornerstone Title | |

| Ohio Savings Bank | -- | None Available | |

| Westchase Community Assn Inc | -- | Attorney | |

| Stockmore Kimberly | $255,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stockmore Kimberly | $229,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,301 | $359,563 | $95,200 | $264,363 |

| 2023 | $6,633 | $318,516 | $64,400 | $254,116 |

| 2022 | $6,310 | $340,796 | $64,400 | $276,396 |

| 2021 | $5,946 | $256,276 | $25,200 | $231,076 |

| 2020 | $5,483 | $229,021 | $8,400 | $220,621 |

| 2019 | $5,850 | $229,537 | $8,400 | $221,137 |

| 2018 | $6,349 | $242,965 | $0 | $0 |

| 2017 | $6,019 | $222,879 | $0 | $0 |

| 2016 | $5,994 | $211,121 | $0 | $0 |

| 2015 | $5,717 | $191,928 | $0 | $0 |

| 2014 | -- | $174,480 | $0 | $0 |

| 2013 | -- | $158,618 | $0 | $0 |

Source: Public Records

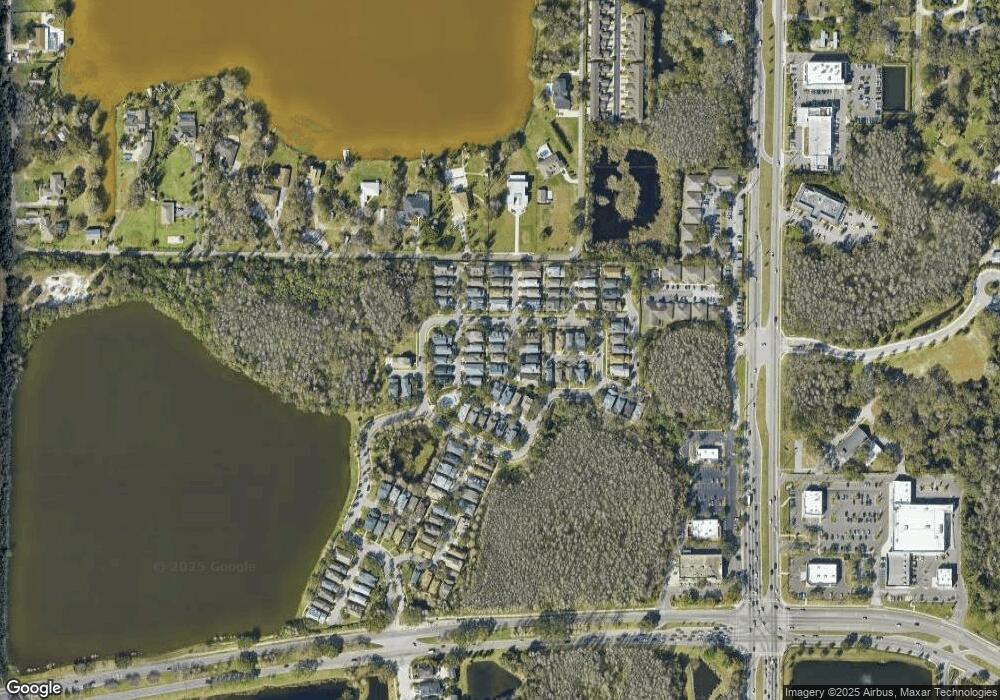

Map

Nearby Homes

- 8907 Ashford Gables Ct

- 9002 Spring Garden Way

- 11004 Kitty Hawk Dr

- 8805 Casablanca Way

- 8840 Cameron Crest Dr

- 8836 Cameron Crest Dr

- 9428 Cavendish Dr

- 8531 Acorn Ridge Ct

- 9420 Georgian Park Ln Unit 106

- 8562 Acorn Ridge Ct

- 11613 Sweet Tangerine Ln

- 9589 Cavendish Dr

- 11612 Navel Orange Way

- 11638 Sweet Tangerine Ln

- 10717 Ashford Oaks Dr

- 11424 Crowned Sparrow Ln

- 9248 Fox Sparrow Rd

- 9237 Fox Sparrow Rd

- 9115 Otter Pass

- 11506 Crowned Sparrow Ln

- 10704 Spring Mountain Place

- 10708 Spring Mountain Place

- 10702 Spring Mountain Place

- 10707 Sierra Vista Place

- 10705 Sierra Vista Place

- 10709 Sierra Vista Place

- 10707 Spring Mountain Place

- 10705 Spring Mountain Place

- 10709 Spring Mountain Place

- 10703 Sierra Vista Place

- 10703 Spring Mountain Place

- 10701 Sierra Vista Place

- 10802 Spring Mountain Place

- 10701 Spring Mountain Place

- 9007 Spring Garden Way

- 9005 Spring Garden Way

- 10801 Sierra Vista Place

- 10801 Spring Mountain Place

- 8908 Ashford Gables Ct

- 10804 Spring Mountain Place