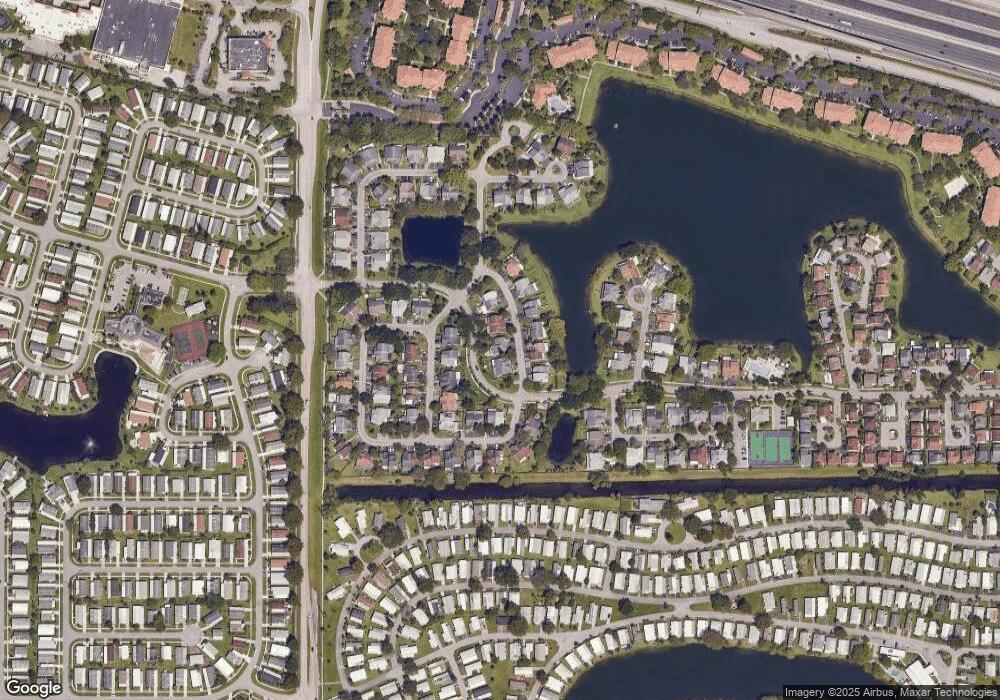

1071 SW 110th Terrace Davie, FL 33324

Scarborough NeighborhoodEstimated Value: $444,000 - $491,000

3

Beds

2

Baths

1,550

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 1071 SW 110th Terrace, Davie, FL 33324 and is currently estimated at $468,755, approximately $302 per square foot. 1071 SW 110th Terrace is a home located in Broward County with nearby schools including Fox Trail Elementary School, Indian Ridge Middle School, and Western High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 15, 2018

Sold by

Fortunato Pietro and Fortunato Ignazia

Bought by

Fortunato Giovanni

Current Estimated Value

Purchase Details

Closed on

Nov 12, 2015

Sold by

Fiorello John J and Fiorello Marilyn G

Bought by

Fortunato Giovanni and Fortunato Pietro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,000

Outstanding Balance

$81,124

Interest Rate

3.83%

Mortgage Type

New Conventional

Estimated Equity

$387,631

Purchase Details

Closed on

Mar 2, 2011

Sold by

Fiorello John J and Fiorello Marilyn G

Bought by

Mannellino Martha M and Zucaro Marlene A

Purchase Details

Closed on

Jan 1, 1988

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fortunato Giovanni | -- | None Available | |

| Fortunato Giovanni | $195,000 | American Title Services Inc | |

| Mannellino Martha M | -- | None Available | |

| Available Not | $65,214 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fortunato Giovanni | $103,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,596 | $244,130 | -- | -- |

| 2024 | $4,489 | $237,250 | -- | -- |

| 2023 | $4,489 | $230,340 | $0 | $0 |

| 2022 | $4,152 | $223,640 | $0 | $0 |

| 2021 | $4,010 | $217,130 | $0 | $0 |

| 2020 | $3,995 | $214,140 | $0 | $0 |

| 2019 | $3,832 | $209,330 | $0 | $0 |

| 2018 | $3,748 | $212,320 | $0 | $0 |

| 2017 | $3,499 | $193,830 | $0 | $0 |

| 2016 | $3,961 | $173,460 | $0 | $0 |

| 2015 | -- | $111,450 | $0 | $0 |

| 2014 | -- | $110,570 | $0 | $0 |

| 2013 | $19 | $114,040 | $27,280 | $86,760 |

Source: Public Records

Map

Nearby Homes

- 1060 SW 111th Way

- 1081 SW 110th Ln

- 1830 Meadows Dr

- 11248 SW 9th Manor

- 1765 Back Lot SW 112th Ave

- 979 SW 113th Way Unit 43/1-PL

- 1016 SW 114th Terrace Unit 14/6

- 1615 Hiatus Rd

- 1413 SW 109th Way

- 11390 SW 11th Ct Unit 4/5-PL

- 10550 W State Road 84 Unit 228

- 10550 W State Road 84

- 10550 W State Road 84 Unit 339

- 10550 W State Road 84 Unit 173

- 10550 W State Road 84 Unit 248

- 10550 W State Road 84 Unit 355

- 10550 W State Road 84 Unit 161

- 10550 W State Road 84 Unit 186

- 10550 W State Road 84 Unit 86

- 11101 SW 15th Manor

- 1061 SW 110th Terrace

- 1081 SW 110th Terrace

- 1051 SW 110th Terrace

- 1091 SW 110th Terrace

- 1041 SW 110th Terrace

- 1080 SW 110th Terrace Unit 154

- 1070 SW 110th Terrace

- 1090 SW 110th Terrace

- 1011 SW 110th Terrace Unit 1011

- 1011 SW 110th Terrace

- 1060 SW 110th Terrace

- 1060 SW 111th Terrace

- 1050 SW 111th Terrace Unit 133

- 1100 SW 110th Terrace

- 1070 SW 111th Terrace Unit 131

- 1040 SW 111th Terrace

- 1050 SW 110th Terrace

- 1100 SW 111th Terrace

- 1001 SW 110th Terrace