10748 S Autumn Wind Way Unit 9 South Jordan, UT 84009

Oquirrh Park NeighborhoodEstimated Value: $542,000 - $666,860

3

Beds

3

Baths

1,796

Sq Ft

$349/Sq Ft

Est. Value

About This Home

This home is located at 10748 S Autumn Wind Way Unit 9, South Jordan, UT 84009 and is currently estimated at $626,465, approximately $348 per square foot. 10748 S Autumn Wind Way Unit 9 is a home located in Salt Lake County with nearby schools including Welby Elementary School, Elk Ridge Middle School, and Mountain West Montessori Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2013

Sold by

South Jordan Real Estate Development Llc

Bought by

Larsen Thomas E and Larsen Marilyn J

Current Estimated Value

Purchase Details

Closed on

Apr 22, 2013

Sold by

Sma Enterprises Inc

Bought by

South Jordan Real Estate Development Llc

Purchase Details

Closed on

Jun 29, 2012

Sold by

South Jordon Real Estate Developme

Bought by

Sma Enterprises Inc and Elite Builders Grou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$41,000

Interest Rate

3.7%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 19, 2010

Sold by

Kgl Corporation

Bought by

South Jordan Real Estate Development Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Larsen Thomas E | -- | First American Title Company | |

| South Jordan Real Estate Development Llc | -- | None Available | |

| Sma Enterprises Inc | -- | Firat American Title Co Llc | |

| South Jordan Real Estate Development Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sma Enterprises Inc | $41,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,270 | $681,600 | $164,700 | $516,900 |

| 2024 | $3,270 | $620,800 | $152,900 | $467,900 |

| 2023 | $3,337 | $597,900 | $148,400 | $449,500 |

| 2022 | $3,471 | $609,500 | $145,500 | $464,000 |

| 2021 | $2,868 | $462,000 | $111,100 | $350,900 |

| 2020 | $2,773 | $418,800 | $107,600 | $311,200 |

| 2019 | $2,719 | $403,600 | $107,600 | $296,000 |

| 2018 | $2,601 | $384,200 | $107,600 | $276,600 |

| 2017 | $2,493 | $360,800 | $81,300 | $279,500 |

| 2016 | $2,553 | $350,200 | $81,300 | $268,900 |

| 2015 | $2,352 | $313,600 | $82,800 | $230,800 |

| 2014 | -- | $295,600 | $79,000 | $216,600 |

Source: Public Records

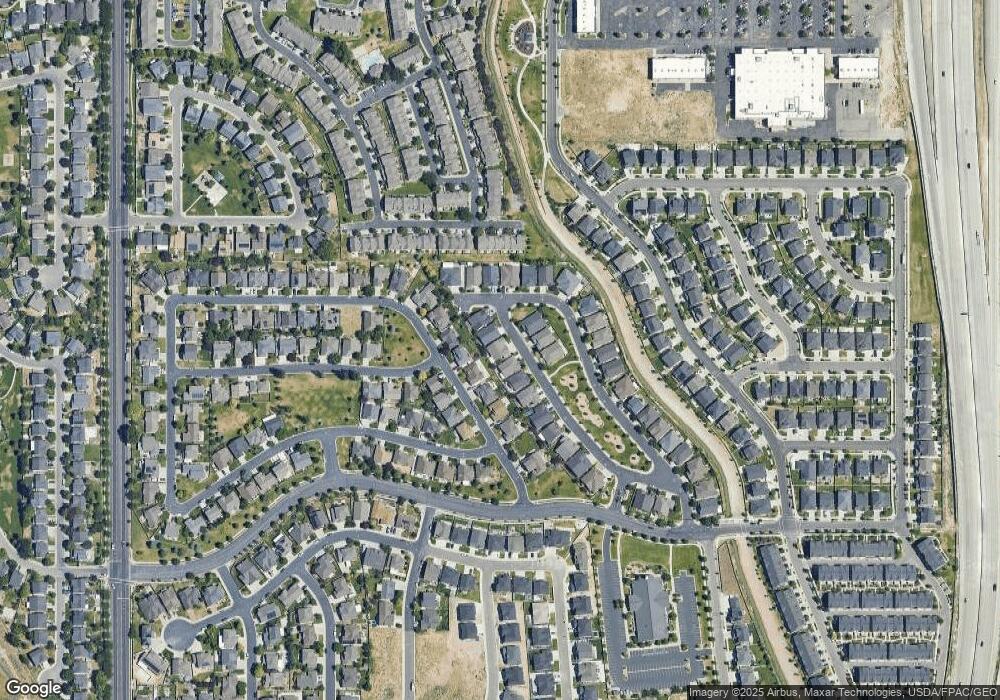

Map

Nearby Homes

- 3884 Coral Dune Dr Unit 222

- 3878 W Sage Willow Dr

- 10918 Little Sahara Dr Unit 1001

- 10931 S Glamis Dune Dr

- 10941 Little Sahara Dr

- 10934 Little Sahara Dr

- 10447 S Garden Sage Cir

- 3884 Sand Lake Dr

- Princeton Plan at High Pointe

- Sheridan Plan at High Pointe

- Dashell Plan at High Pointe

- Dakota Plan at High Pointe

- Olympus Plan at High Pointe

- Sweetwater Plan at High Pointe

- Roosevelt Plan at High Pointe

- Witzel Plan at High Pointe

- 3677 W Golden Sky Ln

- 10847 S Big Meadow Dr

- 11789 4000 W

- 10448 S Sage Vista Way

- 10748 S Autumn Wind Way

- 10742 S Autumn Wind Way Unit 10

- 10759 S Sienna Dune Dr

- 10759 Sienna Dune Dr

- 10736 S Autumn Wind Way

- 10736 S Autumn Wind Way Unit 11

- 10767 Sienna Dune Dr

- 10762 S Autumn Wind Way

- 10775 S Sienna Dune Dr

- 10739 S Autumn Wind Way

- 10747 Sienna Dune Dr Unit 319

- 10775 Sienna Dune Dr

- 10747 S Sienna Dune Dr

- 10751 S Autumn Wind Way

- 10768 S Autumn Wind Way Unit 6 AL

- 10783 Sienna Dune Dr

- 10737 S Sienna Dune Dr

- 10737 Sienna Dune Dr

- 10737 Sienna Dune Dr Unit 318

- 3824 W Autumn Sun Cove