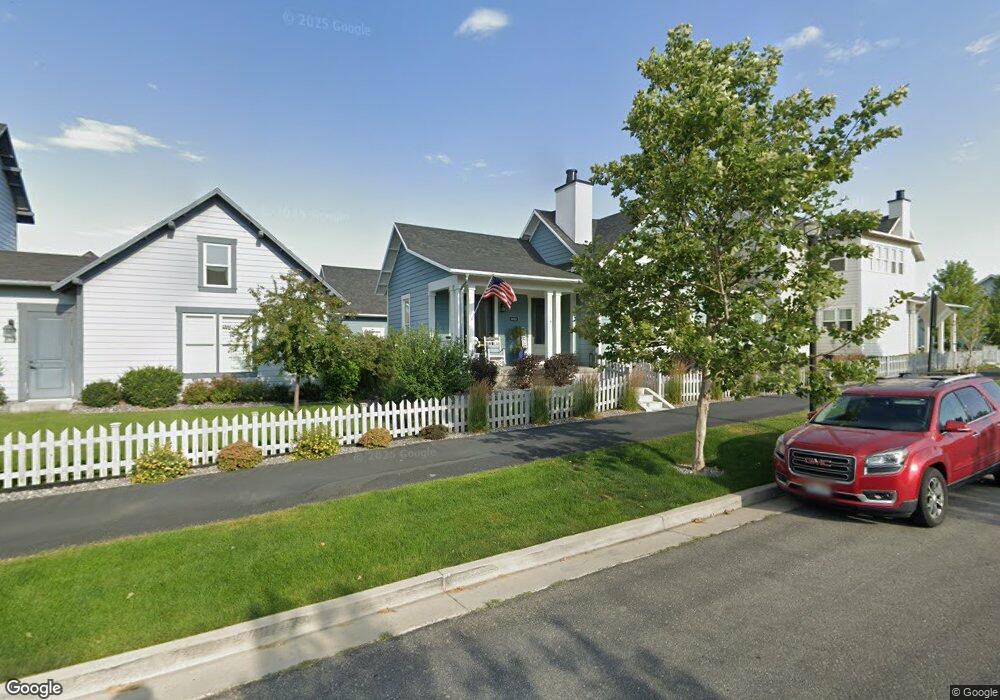

10761 S Rippling Bay Unit 136 South Jordan, UT 84095

Daybreak NeighborhoodEstimated Value: $986,000 - $1,144,000

6

Beds

4

Baths

4,731

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 10761 S Rippling Bay Unit 136, South Jordan, UT 84095 and is currently estimated at $1,066,129, approximately $225 per square foot. 10761 S Rippling Bay Unit 136 is a home located in Salt Lake County with nearby schools including Eastlake Elementary School, Mountain Creek Middle School, and Herriman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2024

Sold by

Harris Nirla and Harris Shane

Bought by

Shane And Nirla Harris Revocable Trust and Harris

Current Estimated Value

Purchase Details

Closed on

Aug 14, 2019

Sold by

Marshall Andrew and Marshall Kati A

Bought by

Harris Nirla and Harris Shane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$591,120

Interest Rate

3.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 22, 2017

Sold by

Dbse Llc

Bought by

Marshall Andrew and Marshall Kati A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$538,400

Interest Rate

4.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 16, 2016

Sold by

Vp Daybreak Operations Llc

Bought by

Holmes Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,500

Interest Rate

3.43%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shane And Nirla Harris Revocable Trust | -- | None Listed On Document | |

| Harris Nirla | -- | Meridian Title | |

| Marshall Andrew | -- | Meridian Title | |

| Dbsf Llc | -- | Meridian Title | |

| Holmes Homes Inc | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Harris Nirla | $591,120 | |

| Previous Owner | Marshall Andrew | $538,400 | |

| Previous Owner | Holmes Homes Inc | $340,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,207 | $1,011,400 | $107,800 | $903,600 |

| 2024 | $5,207 | $988,600 | $104,600 | $884,000 |

| 2023 | $5,400 | $967,400 | $101,600 | $865,800 |

| 2022 | $5,551 | $974,600 | $99,600 | $875,000 |

| 2021 | $4,531 | $729,900 | $76,800 | $653,100 |

| 2020 | $4,443 | $670,900 | $72,300 | $598,600 |

| 2019 | $3,992 | $592,600 | $72,300 | $520,300 |

| 2018 | $3,856 | $569,500 | $71,200 | $498,300 |

| 2017 | $2,935 | $424,900 | $71,200 | $353,700 |

| 2016 | $944 | $71,200 | $71,200 | $0 |

| 2015 | $971 | $71,200 | $71,200 | $0 |

| 2014 | $1,113 | $80,200 | $80,200 | $0 |

Source: Public Records

Map

Nearby Homes

- 4518 W Cave Run Ln

- 10934 Coralville Way

- 4652 W Isla Daybreak Rd Unit 128

- 10924 Paddle Board Way

- 10566 S Oquirrh Lake Rd

- 10991 Lake Island Dr Unit 311

- 10993 Lake Island Dr Unit 310

- 11037 S Lake Island Dr Unit 3-378

- Ashland Plan at Cascade Village - Augustine

- Avenel Plan at Cascade Village - Augustine

- Camden Plan at Cascade Village - Augustine

- Sonoma Plan at Cascade Village - Augustine

- 11043 S Lake Island Dr Unit 3-377

- 10843 S Lake Ave Unit 257

- 10819 S Indigo Sky Way

- 11048 S Paddle Board Way Unit 3-332

- 10762 S Beach Comber Way

- 10566 S Lake Ave

- 4523 W South Jordan Pkwy

- 11064 S Paddle Board Way

- 10761 S Rippling Bay

- 10753 S Rippling Bay Unit 137

- 10769 S Rippling Bay Unit 4E-135

- 10771 S Rippling Bay Unit 4-134

- 10762 S Rippling Bay Unit 132

- 10771 S Lake Ave Unit 238

- 10754 S Rippling Bay Unit 3131

- 10754 S Rippling Bay Unit 131

- 10768 S Rippling Bay Unit 4-133

- 4553 W Talquin Ln

- 4552 W Sebago Way

- 10734 S Oquirrh Lake Rd Unit 4-104

- 10734 S Oquirrh Lake Rd

- 10733 S Wistful Way

- 10724 S Oquirrh Lake Rd

- 10763 S Felicity Ct Unit 10-128

- 10757 S Felicity Ct

- 4541 W Talquin Ln

- 4541 W Talquin Ln

- 4538 W Sebago Way