10767 E Cetona Cir Scottsdale, AZ 85262

Estimated Value: $1,501,000 - $1,905,000

3

Beds

4

Baths

3,770

Sq Ft

$433/Sq Ft

Est. Value

About This Home

This home is located at 10767 E Cetona Cir, Scottsdale, AZ 85262 and is currently estimated at $1,631,543, approximately $432 per square foot. 10767 E Cetona Cir is a home located in Maricopa County with nearby schools including Black Mountain Elementary School, Cactus Shadows High School, and Sonoran Trails Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2024

Sold by

Ruckenbrod Richard and Gruett Sandra Lynn

Bought by

Richard Bruce Ruckenbrod And Sandra Lynn Grue and Ruckenbrod

Current Estimated Value

Purchase Details

Closed on

Mar 9, 2015

Sold by

Ruckenbrod Richard Bruce

Bought by

Ruckenbrod Richard

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Interest Rate

3.57%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 15, 2014

Sold by

Ruckenbrod Diane Lynn and Ruckenbrod Richard Bruce

Bought by

Ruckenbrod Richard Bruce

Purchase Details

Closed on

May 13, 2010

Sold by

Toll Brothers Az Limited Partnership

Bought by

Ruckenbrod R Bruce and Ruckenbrod Diane L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richard Bruce Ruckenbrod And Sandra Lynn Grue | -- | None Listed On Document | |

| Ruckenbrod Richard | -- | Grand Canyon Title Agency | |

| Ruckenbrod Richard Bruce | -- | None Available | |

| Ruckenbrod R Bruce | $700,054 | Westminster Title Agency Inc | |

| Toll Brothers Az Limited Partnership | -- | Westminster Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ruckenbrod Richard | $350,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,106 | $74,554 | -- | -- |

| 2024 | $3,927 | $71,004 | -- | -- |

| 2023 | $3,927 | $99,830 | $17,790 | $82,040 |

| 2022 | $3,783 | $70,000 | $12,470 | $57,530 |

| 2021 | $4,108 | $72,510 | $12,920 | $59,590 |

| 2020 | $4,035 | $70,480 | $12,560 | $57,920 |

| 2019 | $3,914 | $68,980 | $12,290 | $56,690 |

| 2018 | $3,806 | $64,770 | $11,540 | $53,230 |

| 2017 | $3,666 | $66,950 | $11,930 | $55,020 |

| 2016 | $3,650 | $66,770 | $11,900 | $54,870 |

| 2015 | $3,004 | $53,500 | $9,530 | $43,970 |

Source: Public Records

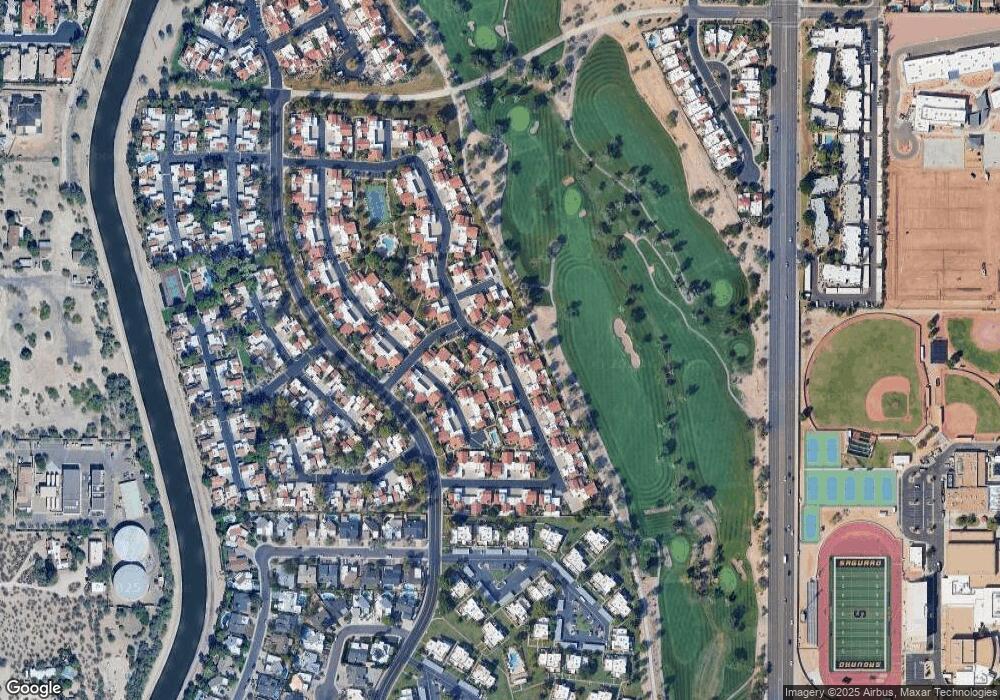

Map

Nearby Homes

- 36674 N Vasari Dr

- 36947 N Mirabel Club Dr Unit 186

- 36495 N Livorno Way

- 10934 E La Verna Way

- 36548 N 105th Place

- 36701 N Porta Nuova Rd

- 36511 N Porta Nuova Rd

- 37353 N 105th Place Unit 81

- 36352 N 105th Way Unit 238

- 36420 N 105th Place

- 36389 N 105th Place

- 37231 N 110th St

- 36482 N Boulder View Dr

- 37445 N 104th Place

- 37247 N Boulder View Dr

- 37247 N Boulder View Dr Unit 9

- 37995 N 109th St Unit 136

- 38152 N 109th St

- 10201 E Joy Ranch Rd Unit 387

- 10119 E Winter Sun Dr

- 10767 E Cetona Cir

- 10735 E Cetona Cir

- 36834 N Montalcino Rd

- 36835 N Montalcino Rd

- 10799 E Cetona Cir

- 10734 E Cetona Cir

- 10766 E Cetona Cir

- 36786 N Montalcino Rd

- 10798 E Cetona Cir

- 36787 N Montalcino Rd

- 36802 N Vasari Dr

- 36738 N Montalcino Rd

- 36739 N Montalcino Rd

- 36778 N Vasari Dr

- 36690 N Montalcino Rd

- 36691 N Montalcino Rd

- 36726 N 108th Place

- 36838 N 108th Place

- 36670 N 108th Place

- 36779 N Vasari Dr