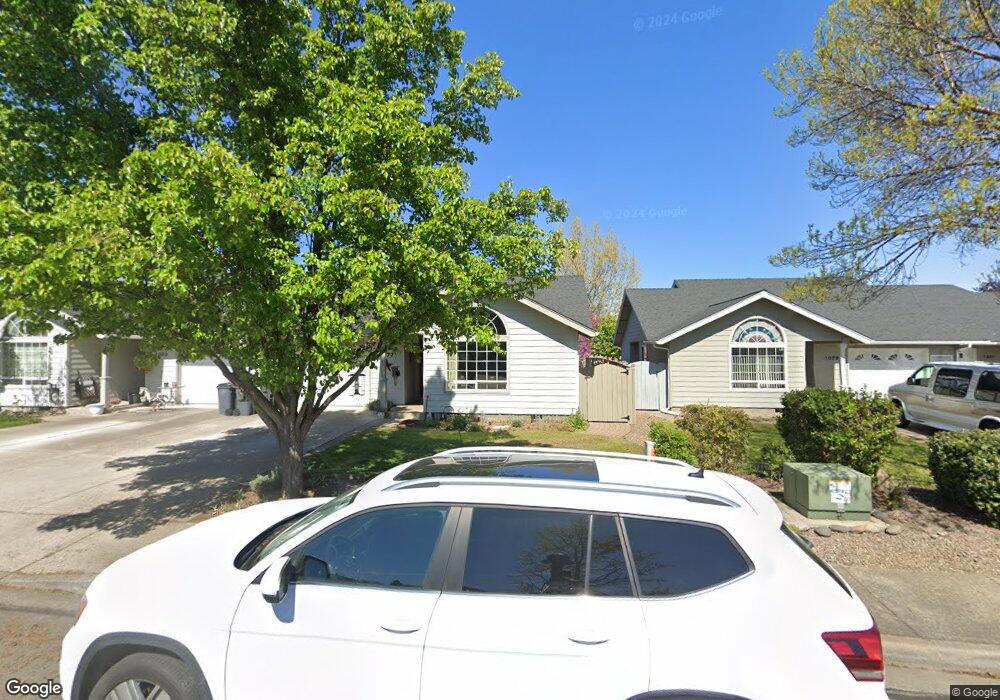

1077 Cherry St Central Point, OR 97502

Estimated Value: $297,000 - $336,000

3

Beds

2

Baths

1,243

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 1077 Cherry St, Central Point, OR 97502 and is currently estimated at $319,422, approximately $256 per square foot. 1077 Cherry St is a home located in Jackson County with nearby schools including Jewett Elementary School, Scenic Middle School, and Crater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2020

Sold by

Kosmatka Joshua

Bought by

Kosmatka Joshua and Kosmatka Melissa

Current Estimated Value

Purchase Details

Closed on

Feb 19, 2020

Sold by

Kosmatka Arnold L and Kosmatka Daniel A

Bought by

Kosmatka Joshua

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$175,948

Interest Rate

3.6%

Mortgage Type

VA

Estimated Equity

$143,474

Purchase Details

Closed on

May 12, 2014

Sold by

Puls Harriet J

Bought by

Kosmatka Arnold L and Kosmatka Daniel A

Purchase Details

Closed on

Oct 11, 2002

Sold by

Puls Harriet J

Bought by

Puls Harriet J and Kosmatka Daniel A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kosmatka Joshua | -- | Accommodation | |

| Kosmatka Joshua | $200,000 | Ticor Title | |

| Kosmatka Arnold L | -- | None Available | |

| Puls Harriet J | $132,900 | Multiple | |

| Puls Harriet J | $132,900 | Multiple | |

| East Cherry Estates Inc | $280,000 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kosmatka Joshua | $200,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,287 | $170,740 | -- | -- |

| 2025 | $2,231 | $165,770 | $72,500 | $93,270 |

| 2024 | $2,231 | $160,950 | $70,390 | $90,560 |

| 2023 | $2,160 | $156,270 | $68,350 | $87,920 |

| 2022 | $2,109 | $156,270 | $68,350 | $87,920 |

| 2021 | $2,049 | $151,720 | $66,360 | $85,360 |

| 2020 | $1,989 | $147,310 | $64,430 | $82,880 |

| 2019 | $2,397 | $138,860 | $60,750 | $78,110 |

| 2018 | $2,324 | $134,820 | $58,980 | $75,840 |

| 2017 | $2,265 | $134,820 | $58,980 | $75,840 |

| 2016 | $2,199 | $127,090 | $55,600 | $71,490 |

| 2015 | $2,107 | $127,090 | $55,600 | $71,490 |

| 2014 | $1,663 | $119,800 | $52,400 | $67,400 |

Source: Public Records

Map

Nearby Homes

- 833 Hazel St

- 331 N 8th St

- 731 Maple St

- 348 N 6th St

- 0 Peninger Rd

- 144 N 5th St

- 55 Crater Ln

- 342 Hazel St

- 350 Alder St

- 220 S 3rd St

- 4626 N Pacific Hwy

- 301 Freeman Rd Unit 30

- 301 Freeman Rd Unit 92

- 301 Freeman Rd Unit 91

- 4722 Gebhard Rd

- 4726 Gebhard Rd

- 1109 Annalise St

- 1113 Annalise St

- 1121 Annalise St

- 555 Freeman Rd Unit 73

Your Personal Tour Guide

Ask me questions while you tour the home.