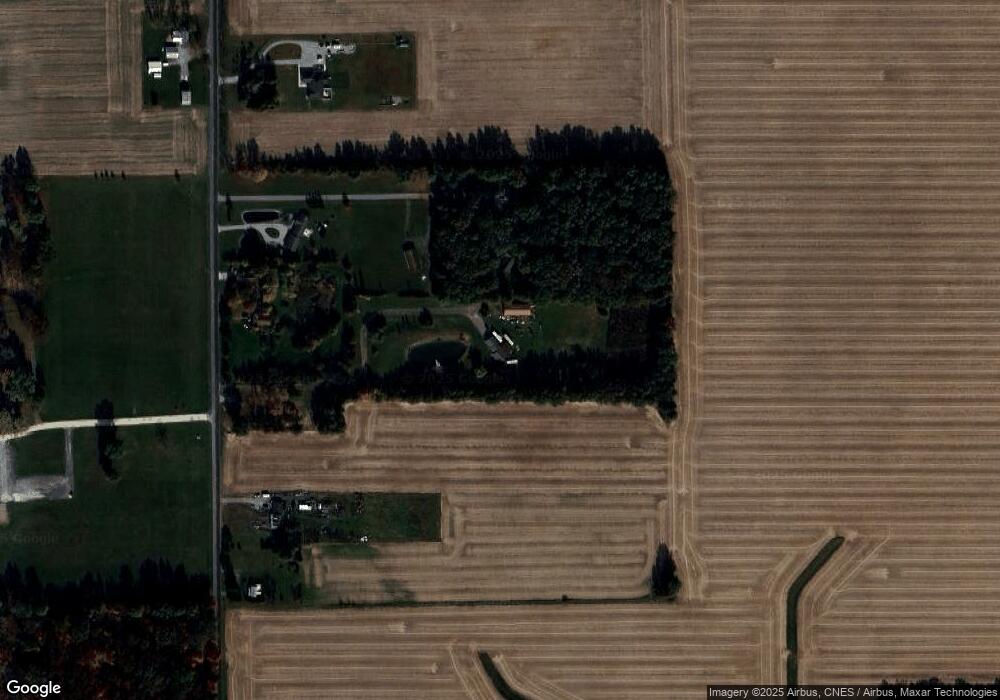

1077 S Conant Rd Spencerville, OH 45887

Estimated Value: $279,000 - $353,720

3

Beds

2

Baths

1,248

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 1077 S Conant Rd, Spencerville, OH 45887 and is currently estimated at $312,930, approximately $250 per square foot. 1077 S Conant Rd is a home located in Allen County with nearby schools including Spencerville Elementary School, Spencerville Middle School, and Spencerville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2006

Sold by

Steele Kevin E and Steele Stacy I

Bought by

Newland Mark E and Newland Kelly R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Outstanding Balance

$92,322

Interest Rate

6.88%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$220,608

Purchase Details

Closed on

Mar 15, 1995

Sold by

Jakubowski Olivia

Bought by

Steele Kevin and Sterling Stacy

Purchase Details

Closed on

Aug 10, 1993

Sold by

Morton Cherilea

Bought by

Jakubowski Olivia

Purchase Details

Closed on

Oct 15, 1990

Bought by

Morton Cherilea

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newland Mark E | $160,000 | None Available | |

| Steele Kevin | $8,000 | -- | |

| Jakubowski Olivia | -- | -- | |

| Morton Cherilea | $15,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newland Mark E | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,039 | $95,800 | $28,910 | $66,890 |

| 2023 | $2,492 | $73,680 | $22,230 | $51,450 |

| 2022 | $2,593 | $73,680 | $22,230 | $51,450 |

| 2021 | $2,576 | $73,680 | $22,230 | $51,450 |

| 2020 | $2,528 | $68,400 | $23,070 | $45,330 |

| 2019 | $2,528 | $68,400 | $23,070 | $45,330 |

| 2018 | $2,420 | $68,400 | $23,070 | $45,330 |

| 2017 | $2,339 | $64,270 | $23,070 | $41,200 |

| 2016 | $2,305 | $64,270 | $23,070 | $41,200 |

| 2015 | $2,266 | $64,270 | $23,070 | $41,200 |

| 2014 | $2,266 | $64,020 | $23,520 | $40,500 |

| 2013 | $2,290 | $64,020 | $23,520 | $40,500 |

Source: Public Records

Map

Nearby Homes

- 1069 S Kemp Rd

- 7470 Fort Amanda Rd

- 22284 Ohio 198

- 714 Briggs Ave Unit 1

- 123 Oakland Ave

- 316 E 4th St

- 213 N Pearl St

- 425 N Main St

- 408 N Mulberry St

- 5825 Poling Rd

- 845 Atalan Trail

- 1734 Woodberry Creek Dr

- 4875 Wenatchi Trail

- 200 Fraunfelter Rd S

- 1784 Woodberry Creek Dr

- 4803 Kitamat Trail

- 251 Timberfield Dr N

- 521 S Broadway St

- 336 W 4th St

- 406 S Mulberry St