10785 E Grant Rd Franktown, CO 80116

Estimated Value: $1,154,844 - $1,427,000

3

Beds

3

Baths

2,282

Sq Ft

$548/Sq Ft

Est. Value

About This Home

This home is located at 10785 E Grant Rd, Franktown, CO 80116 and is currently estimated at $1,249,961, approximately $547 per square foot. 10785 E Grant Rd is a home located in Douglas County with nearby schools including Franktown Elementary School, Sagewood Middle School, and Ponderosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 17, 2006

Sold by

Meyer Jerome M and Sharman Meyer L

Bought by

Shell William R and Shell Raewyn D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$536,000

Outstanding Balance

$306,629

Interest Rate

6.87%

Mortgage Type

Unknown

Estimated Equity

$943,332

Purchase Details

Closed on

Jan 17, 2002

Sold by

Potter William Grear and Nawrocki Doreen A

Bought by

Boodell Barbara A

Purchase Details

Closed on

Jun 20, 1990

Sold by

Millette Sheila Weiss and Weiss Sheila A

Bought by

Potter William Grear and Nawrocki Doreen A

Purchase Details

Closed on

Dec 10, 1977

Sold by

Unavailable

Bought by

Unavailable

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shell William R | $670,000 | Security Title | |

| Boodell Barbara A | $184,000 | -- | |

| Potter William Grear | $41,000 | -- | |

| Unavailable | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shell William R | $536,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,887 | $68,040 | $21,790 | $46,250 |

| 2024 | $6,887 | $83,590 | $27,490 | $56,100 |

| 2023 | $6,964 | $83,590 | $27,490 | $56,100 |

| 2022 | $4,852 | $57,950 | $15,670 | $42,280 |

| 2021 | $5,028 | $57,950 | $15,670 | $42,280 |

| 2020 | $4,872 | $57,460 | $13,570 | $43,890 |

| 2019 | $4,895 | $57,460 | $13,570 | $43,890 |

| 2018 | $4,423 | $51,000 | $9,910 | $41,090 |

| 2017 | $4,118 | $51,000 | $9,910 | $41,090 |

| 2016 | $4,212 | $51,150 | $11,810 | $39,340 |

| 2015 | $4,308 | $51,150 | $11,810 | $39,340 |

| 2014 | $4,180 | $46,390 | $7,030 | $39,360 |

Source: Public Records

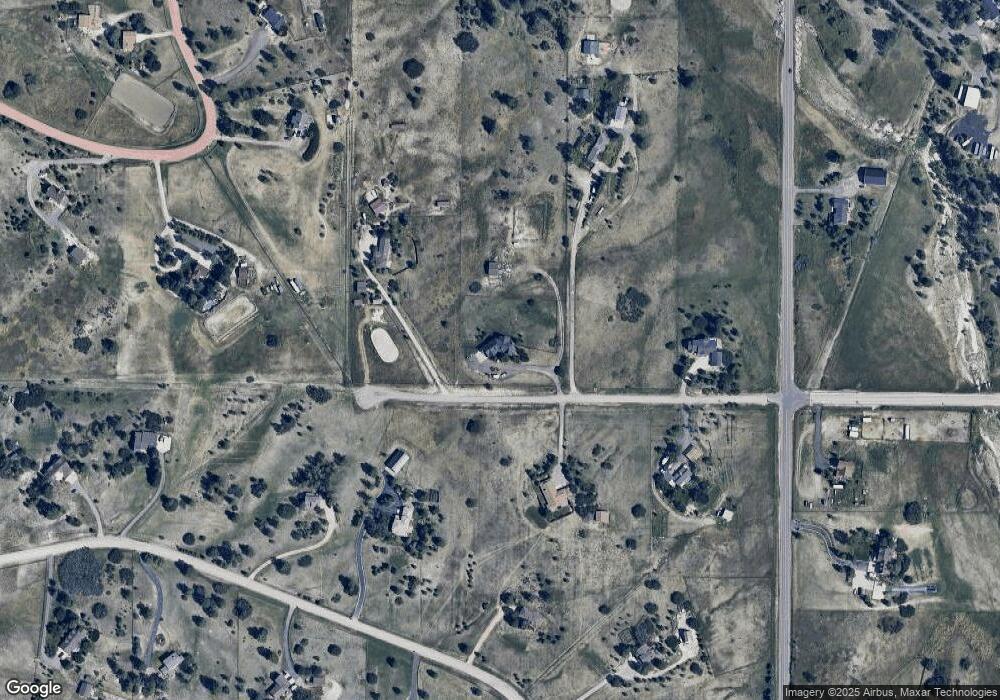

Map

Nearby Homes

- 2130 Frontier Ln

- 75 Evening Hunt Rd

- 11491 Evening Hunt Rd

- 2379 Fox View Trail

- 2705 Fox View Trail

- 1579 Deerpath Rd

- 2218 Deerpath Rd

- 2741 Morning Run Ct

- 2622 Fox View Trail

- 87 Evening Hunt Rd

- 2568 Fox View Trail

- 2568 Fox View Trail Unit 38

- 2937 Hidden Den Ct

- 11218 Ponderosa Ln

- 3125 Red Kit Rd

- 11011 Sunset Oaks

- 11008 Sunset Oaks Place

- 11012 Sunset Oaks Place

- 121 County Road 146

- 8788 E Tanglewood Rd

- 10750 E Grant Rd

- 10880 E Grant Rd

- 10515 Holden Cir

- 10969 E Grant Rd

- 10909 E Grant Rd

- 10960 E Grant Rd

- 10481 Holden Cir

- 10555 Holden Cir

- 2266 Frontier Ln

- 2252 Frontier Ln

- 10579 Holden Cir

- 10445 Holden Cir

- 2080 Flintwood Rd

- 11056 E Grant Rd

- 10500 Holden Cir

- 2314 Frontier Ln

- 1870 Flintwood Rd

- 10456 Holden Cir

- 10411 Holden Cir

- 2210 Frontier Ln

Your Personal Tour Guide

Ask me questions while you tour the home.