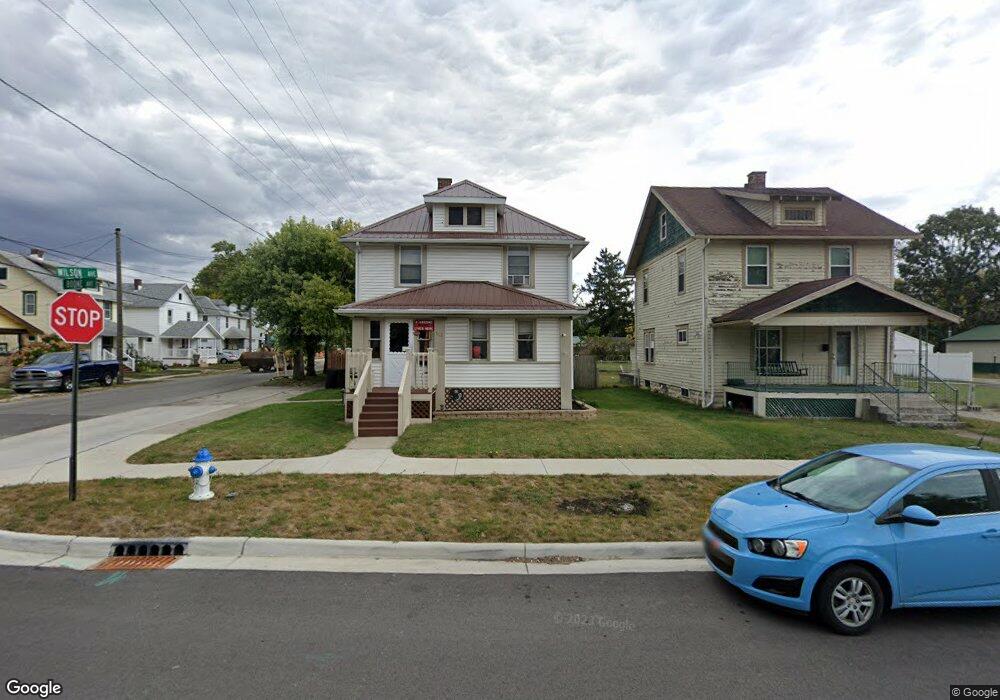

1079 Wilson Ave Marion, OH 43302

Estimated Value: $115,000 - $157,000

2

Beds

1

Bath

832

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 1079 Wilson Ave, Marion, OH 43302 and is currently estimated at $130,602, approximately $156 per square foot. 1079 Wilson Ave is a home located in Marion County with nearby schools including George Washington Elementary School, Ulysses S. Grant Middle School, and Harding High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2009

Sold by

Keeran Heather D and Harris Heather D

Bought by

Wells Fargo Bank Na

Current Estimated Value

Purchase Details

Closed on

Jun 16, 2009

Sold by

Wells Fargo Bank Na

Bought by

Guesman Donald D and Guesman Mary S

Purchase Details

Closed on

Nov 10, 2005

Sold by

Darby Josephine L

Bought by

Keeran Heather D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,900

Interest Rate

8.12%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jan 11, 1999

Bought by

Guseman Donald D and Surv Mary S

Purchase Details

Closed on

Mar 25, 1996

Bought by

Guseman Donald D and Surv Mary S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wells Fargo Bank Na | $43,334 | Prism Title | |

| Guesman Donald D | $32,000 | Prism Title & Closing Servic | |

| Keeran Heather D | $74,900 | 21St Century Title Agency In | |

| Guseman Donald D | -- | -- | |

| Guseman Donald D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Keeran Heather D | $74,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,112 | $29,030 | $6,420 | $22,610 |

| 2023 | $1,112 | $29,030 | $6,420 | $22,610 |

| 2022 | $1,032 | $29,030 | $6,420 | $22,610 |

| 2021 | $910 | $23,040 | $5,580 | $17,460 |

| 2020 | $912 | $23,040 | $5,580 | $17,460 |

| 2019 | $911 | $23,040 | $5,580 | $17,460 |

| 2018 | $784 | $19,810 | $5,590 | $14,220 |

| 2017 | $794 | $19,810 | $5,590 | $14,220 |

| 2016 | $791 | $19,810 | $5,590 | $14,220 |

| 2015 | $786 | $19,250 | $5,320 | $13,930 |

| 2014 | $785 | $19,250 | $5,320 | $13,930 |

| 2012 | $794 | $19,290 | $3,220 | $16,070 |

Source: Public Records

Map

Nearby Homes

- 1185 E Center St

- 164 Clover Ave

- 1090 E Church St

- 174 Barnhart St

- 1225 Ackerman Ave

- 144 Spencer St

- 357 Franconia Ave

- 145 Sara Ave

- 851 E Center St

- 310 Denning Ave

- 921 Adams St

- 0 Denning Ave

- 222 Uhler Ave

- 1195 Indiana Ave

- 126 S Seffner Ave

- 250 N Grand Ave

- 699 Wilson Ave

- 224 Jefferson St

- 400 Forest Lawn Blvd

- 381 Forest Lawn Blvd