108 Mallard Glen Dr Unit 1081082 Dayton, OH 45458

Estimated Value: $131,000 - $147,000

2

Beds

2

Baths

987

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 108 Mallard Glen Dr Unit 1081082, Dayton, OH 45458 and is currently estimated at $139,642, approximately $141 per square foot. 108 Mallard Glen Dr Unit 1081082 is a home located in Montgomery County with nearby schools including Primary Village South, Cline Elementary, and Magsig Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2016

Sold by

Walters Michelle L and Salvina Michelle L

Bought by

Jacobs Manuel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,050

Outstanding Balance

$29,869

Interest Rate

3.42%

Mortgage Type

New Conventional

Estimated Equity

$109,773

Purchase Details

Closed on

May 28, 2009

Sold by

Brandenburg Rebecca E and Brandenburg Joshua A

Bought by

Salvina Michelle L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,569

Interest Rate

4.84%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 15, 2004

Sold by

Thomas Vernon

Bought by

Holmes Rebecca E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,300

Interest Rate

5.91%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 22, 1997

Sold by

Huey Anthony and Huey Debora K

Bought by

Thomas Vernon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jacobs Manuel | $65,000 | Hallmark Title | |

| Salvina Michelle L | $79,000 | Attorney | |

| Holmes Rebecca E | $75,000 | -- | |

| Thomas Vernon | $68,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jacobs Manuel | $63,050 | |

| Previous Owner | Salvina Michelle L | $77,569 | |

| Previous Owner | Holmes Rebecca E | $70,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,160 | $36,960 | $8,740 | $28,220 |

| 2023 | $2,160 | $36,960 | $8,740 | $28,220 |

| 2022 | $1,799 | $24,370 | $5,750 | $18,620 |

| 2021 | $1,804 | $24,370 | $5,750 | $18,620 |

| 2020 | $1,801 | $24,370 | $5,750 | $18,620 |

| 2019 | $1,582 | $19,070 | $5,750 | $13,320 |

| 2018 | $1,404 | $19,070 | $5,750 | $13,320 |

| 2017 | $1,388 | $19,070 | $5,750 | $13,320 |

| 2016 | $1,679 | $21,830 | $5,750 | $16,080 |

| 2015 | $1,682 | $21,830 | $5,750 | $16,080 |

| 2014 | $1,662 | $21,830 | $5,750 | $16,080 |

| 2012 | -- | $22,450 | $5,750 | $16,700 |

Source: Public Records

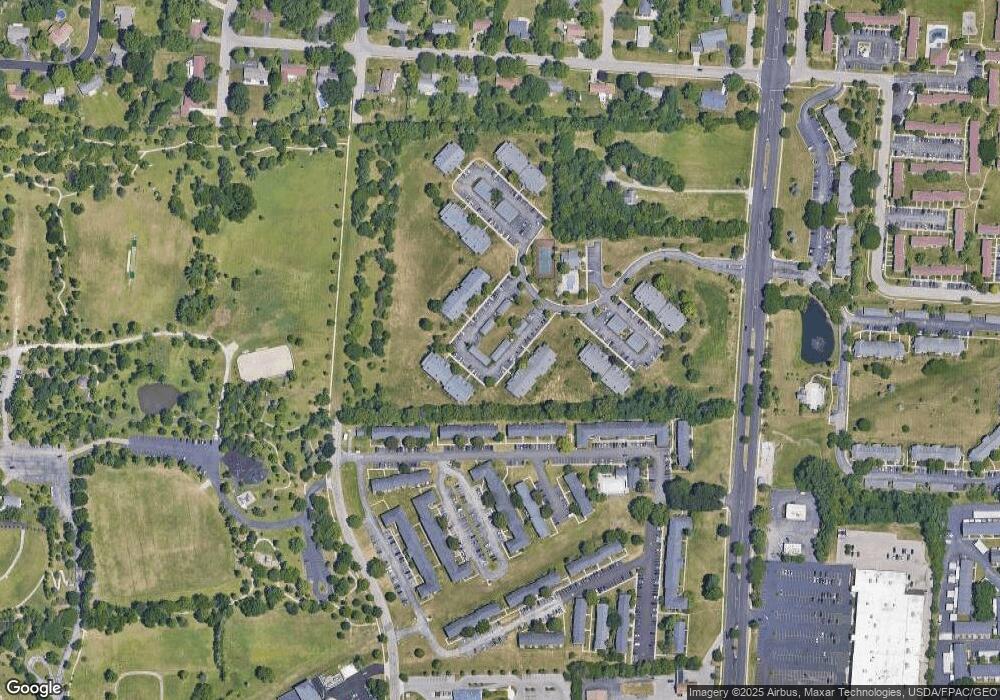

Map

Nearby Homes

- 325 Annette Dr

- 843 Clareridge Ln Unit 843

- 9095 Heather Dr

- 694 Spring Ridge Place

- 284 Tauber Dr

- 210 Anton Ct

- 255 Gershwin Dr

- 170 S Main St Unit C

- 9183 Mary Haynes Dr

- 479 Beth Page Cir Unit 74797

- 35 Bywood Ct

- 8823 Birkdale Hills Cir Unit 108823

- 508 Peachcreek Rd

- 51 Winchester (#E) Place

- 9375 Shawhan Dr

- 20 Gershwin Dr

- 8749 Shadycreek Dr Unit 8751

- 1071 Star Valley Ct

- 8836 Washington Colony Dr Unit 16

- 565 Pine Needles Dr Unit 29147

- 108 Mallard Glen Dr Unit 1081087

- 108 Mallard Glen Dr Unit 1081086

- 108 Mallard Glen Dr Unit 1081085

- 108 Mallard Glen Dr Unit 1081084

- 108 Mallard Glen Dr Unit 1081083

- 108 Mallard Glen Dr Unit 108108

- 108 Mallard Glen Dr

- 108 Mallard Glen Dr Unit 3

- 108 Mallard Glen Dr Unit 2

- 108 Mallard Glen Dr Unit 6

- 108 Mallard Glen Dr Unit 1081088

- 108 Mallard Glen Dr Unit 8

- 108 Mallard Glen Dr Unit 5

- 116 Mallard Glen Dr Unit 1161167

- 116 Mallard Glen Dr Unit 1161166

- 116 Mallard Glen Dr Unit 1161165

- 116 Mallard Glen Dr Unit 1161164

- 116 Mallard Glen Dr Unit 1161163

- 116 Mallard Glen Dr Unit 1161161

- 116 Mallard Glen Dr