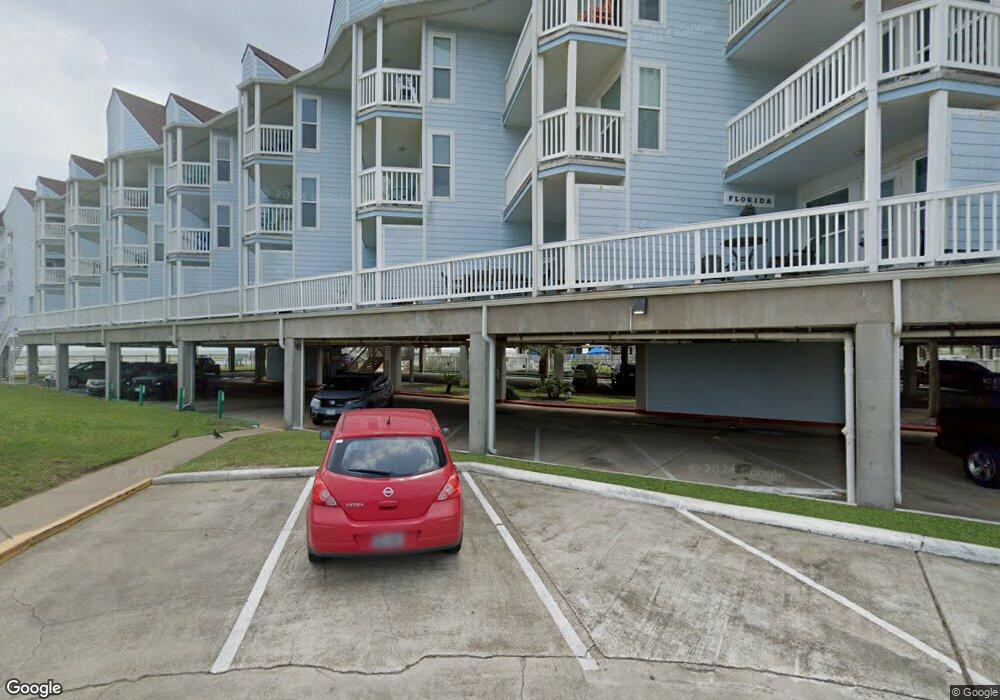

Seascape Resort Beachfront Condos 10811 Termini San Luis Pass Rd Unit 2301 Galveston, TX 77554

Spanish Grant-Beachside Village-Evia NeighborhoodEstimated Value: $445,000 - $460,000

2

Beds

2

Baths

759

Sq Ft

$598/Sq Ft

Est. Value

About This Home

This home is located at 10811 Termini San Luis Pass Rd Unit 2301, Galveston, TX 77554 and is currently estimated at $454,209, approximately $598 per square foot. 10811 Termini San Luis Pass Rd Unit 2301 is a home located in Galveston County with nearby schools including Oppe Elementary School, Parker Elementary School, and Burnet STREAM Magnet School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2012

Sold by

Bailey Ronald M and Bailey Waverly D

Bought by

Caldwell D L

Current Estimated Value

Purchase Details

Closed on

Apr 13, 2007

Sold by

Volk Kenneth J and Volk Monica C

Bought by

Bailey Ronald M and Bailey Waverly D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,500

Interest Rate

6.19%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 22, 2003

Sold by

Best Anthony J and Best Gloria J

Bought by

Volk Kenneth J and Volk Monica C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Caldwell D L | -- | Chicago Title | |

| Bailey Ronald M | -- | Chicago Title | |

| Volk Kenneth J | -- | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bailey Ronald M | $184,500 | |

| Previous Owner | Volk Kenneth J | $85,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,265 | $381,250 | $19,660 | $361,590 |

| 2024 | $6,265 | $410,930 | $19,660 | $391,270 |

| 2023 | $6,265 | $371,540 | $19,660 | $351,880 |

| 2022 | $6,628 | $250,000 | $19,660 | $230,340 |

| 2021 | $6,075 | $273,470 | $19,660 | $253,810 |

| 2020 | $5,347 | $227,308 | $19,660 | $207,648 |

| 2019 | $5,550 | $229,040 | $19,660 | $209,380 |

| 2018 | $4,761 | $195,580 | $19,660 | $175,920 |

| 2017 | $4,700 | $195,580 | $19,660 | $175,920 |

| 2016 | $4,701 | $195,595 | $19,655 | $175,940 |

| 2015 | $4,332 | $178,285 | $19,655 | $158,630 |

| 2014 | $4,387 | $103,005 | $19,655 | $83,350 |

Source: Public Records

About Seascape Resort Beachfront Condos

Map

Nearby Homes

- 10811 Termini San Luis Pass Rd

- 10811 Termini San Luis Pass Rd Unit 2112

- 10811 Termini-San Luis Pass Rd Unit 1314

- 10811 San Luis Pass Rd Unit 1118

- 10811 San Luis Pass Rd Unit 1318

- 10811 San Luis Pass Rd Unit 1121

- 10811 San Luis Pass Rd Unit 2320

- 10811 San Luis Pass Rd Unit 1216

- 10811 San Luis Pass Rd Unit 1201

- 10811 San Luis Pass Rd Unit 1213

- 10811 Termini-San Luis Pass Rd Unit 2303

- 10811 San Luis Pass Rd Unit 2301

- 10811 San Luis Pass Rd Unit 1315

- 10811 Termini San Luis Pass Rd Unit 1101

- 10811 Termini San Luis Pass Rd Unit 2123

- 10525 Termini-San Luis Pass Rd Unit 1001

- 11010 1/2 Termini-San Luis Pass Rd

- 10327 San Luis Pass Rd Unit 413

- 10327 Termini San Luis Pass Rd Unit 611

- 10327 Termini San Luis Pass Rd Unit 517

- 10811 Termini-San Luis Pass Rd

- 10811 Termini San Luis Pass Rd Unit Sea Villa

- 10811 San Luis Pass Rd Unit 2319

- 10811 Termini San Luis Pass Rd Unit 2120

- 10811 Termini San Luis Pass Rd Unit 1312

- 10811 Termini San Luis Pass Rd Unit 1108

- 10811 Termini San Luis Pass Rd Unit 2213

- 10811 San Luis Pass Rd Unit 1117

- 10811 Termini-San Luis Pass Rd Unit 2119

- 10811 San Luis Pass Rd Unit 2213

- 10811 Termini San Luis Pass Rd Unit 2303

- 10811 Termini-San Luis Pass Rd Unit 1213

- 10811 San Luis Pass Rd Unit 2101

- 10811 San Luis Pass Rd Unit 1307

- 10811 Termini-San Luis Pass Rd Unit 2117

- 10811 Fm 3005 Rd Unit 2321

- 10811 San Luis Pass Rd Unit 1319

- 10811 San Luis Pass Rd Unit 2322

- 10811 San Luis Pass Rd Unit 2203

- 10811 San Luis Pass Rd Unit 2323